- Japan

- /

- Food and Staples Retail

- /

- TSE:8267

Why Aeon (TSE:8267) Is Up 14.4% After Dividend Hike and Strong First-Half Profit Announcement

Reviewed by Sasha Jovanovic

- Earlier this month, Aeon Co., Ltd. announced its half-year results for the period ended August 31, 2025, reporting sales of ¥4.76 trillion, revenue of ¥5.19 trillion, net income of ¥4.05 billion, and an increased interim dividend of ¥20 per share, with payment commencing on October 27, 2025.

- This combination of higher earnings and a dividend boost highlights management's confidence and could have a meaningful impact on investor sentiment.

- We'll explore how Aeon's stronger net income and new dividend announcement could shift the company's investment risk and growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aeon Investment Narrative Recap

To be a shareholder in Aeon, you need to believe that the company’s investments in digital transformation, private label growth, and international expansion can offset Japan’s aging demographics and rising competition. The recent half-year results show moderate earnings growth and a modest dividend increase, which support the near-term catalyst of improved profitability. However, these changes do not materially shift the biggest risk currently facing Aeon: persistently thin margins challenged by inflation and structural cost pressures. Of the recent announcements, the JPY 20 per share interim dividend is most relevant. While this higher payout may provide reassurance for income-focused shareholders and signals confidence, it does not directly address structural headwinds such as increased operating costs and demographic challenges that continue to weigh on Aeon's profitability outlook. Yet, investors should be aware that despite these confident signals, Aeon's exposure to prolonged margin pressures remains a concern...

Read the full narrative on Aeon (it's free!)

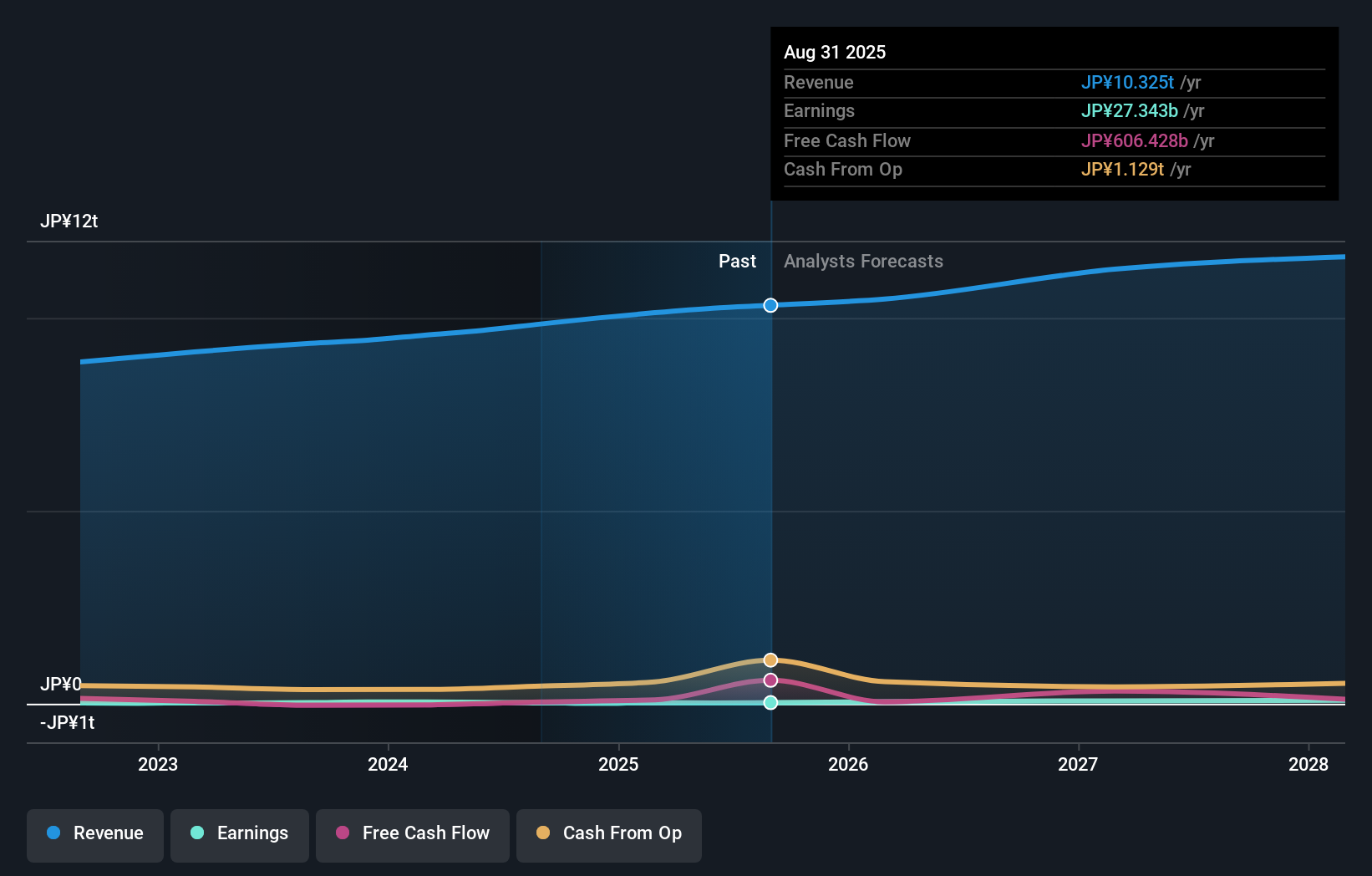

Aeon's narrative projects ¥11,895.5 billion revenue and ¥77.2 billion earnings by 2028. This requires 5.1% yearly revenue growth and a ¥58.3 billion increase in earnings from ¥18.9 billion today.

Uncover how Aeon's forecasts yield a ¥1331 fair value, a 43% downside to its current price.

Exploring Other Perspectives

Three community-sourced fair value estimates for Aeon range widely from ¥739.90 to ¥2,646.07. This diversity of perspectives in the Simply Wall St Community sits against ongoing concerns around Aeon’s ability to manage margin pressure amid inflation, encouraging readers to compare several possible outcomes.

Explore 3 other fair value estimates on Aeon - why the stock might be worth as much as 13% more than the current price!

Build Your Own Aeon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeon research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aeon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeon's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8267

Aeon

Operates in the retail industry in Japan, China, ASEAN countries, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives