- Japan

- /

- Food and Staples Retail

- /

- TSE:7649

Returns On Capital At Sugi HoldingsLtd (TSE:7649) Have Stalled

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So, when we ran our eye over Sugi HoldingsLtd's (TSE:7649) trend of ROCE, we liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Sugi HoldingsLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = JP¥46b ÷ (JP¥555b - JP¥252b) (Based on the trailing twelve months to August 2025).

So, Sugi HoldingsLtd has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 9.2% generated by the Consumer Retailing industry.

See our latest analysis for Sugi HoldingsLtd

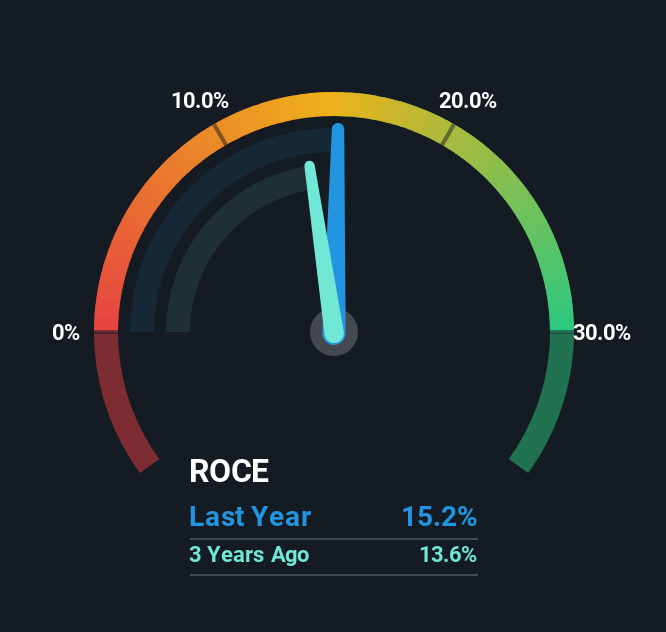

Above you can see how the current ROCE for Sugi HoldingsLtd compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Sugi HoldingsLtd .

How Are Returns Trending?

While the current returns on capital are decent, they haven't changed much. The company has consistently earned 15% for the last five years, and the capital employed within the business has risen 44% in that time. 15% is a pretty standard return, and it provides some comfort knowing that Sugi HoldingsLtd has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 45% of total assets, this reported ROCE would probably be less than15% because total capital employed would be higher.The 15% ROCE could be even lower if current liabilities weren't 45% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

Our Take On Sugi HoldingsLtd's ROCE

The main thing to remember is that Sugi HoldingsLtd has proven its ability to continually reinvest at respectable rates of return. And the stock has followed suit returning a meaningful 65% to shareholders over the last five years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

One more thing to note, we've identified 1 warning sign with Sugi HoldingsLtd and understanding it should be part of your investment process.

While Sugi HoldingsLtd isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7649

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026