- Japan

- /

- Food and Staples Retail

- /

- TSE:3182

There's Reason For Concern Over Oisix ra daichi Inc.'s (TSE:3182) Price

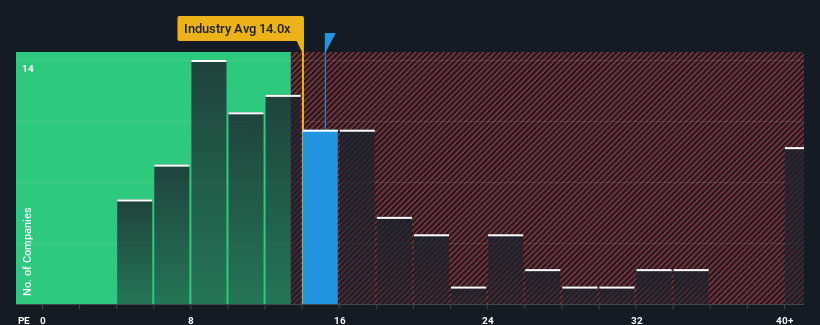

It's not a stretch to say that Oisix ra daichi Inc.'s (TSE:3182) price-to-earnings (or "P/E") ratio of 15.2x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Oisix ra daichi certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Oisix ra daichi

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Oisix ra daichi's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 109% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 27% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 7.3% over the next year. That's not great when the rest of the market is expected to grow by 11%.

In light of this, it's somewhat alarming that Oisix ra daichi's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Oisix ra daichi's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Oisix ra daichi.

If you're unsure about the strength of Oisix ra daichi's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Oisix ra daichi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3182

Oisix ra daichi

Engages in the online and catalogue sale of organic vegetables, agricultural products, additive free processed foods, and other food products and ingredients to general consumers in Japan.

Good value with adequate balance sheet.

Market Insights

Community Narratives