- Japan

- /

- Food and Staples Retail

- /

- TSE:2687

Additional Considerations Required While Assessing CVS Bay Area's (TSE:2687) Strong Earnings

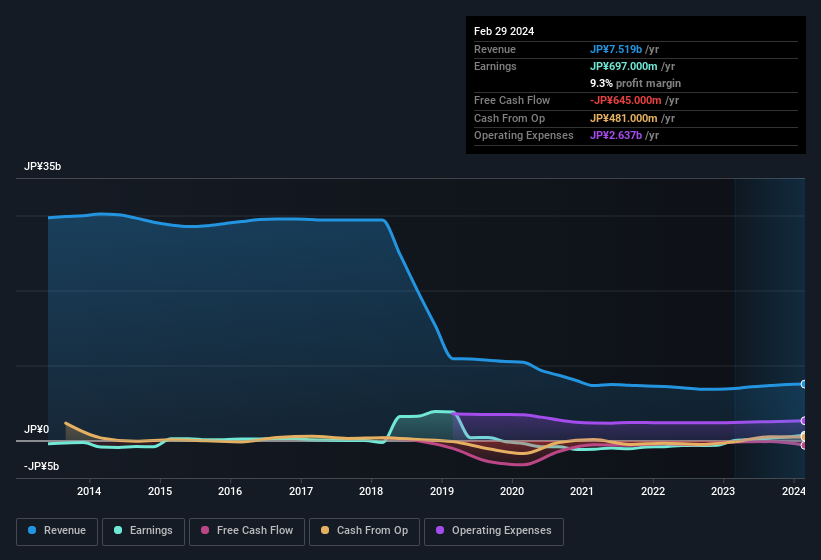

Despite announcing strong earnings, CVS Bay Area Inc.'s (TSE:2687) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for CVS Bay Area

Examining Cashflow Against CVS Bay Area's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

CVS Bay Area has an accrual ratio of 0.22 for the year to February 2024. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In the last twelve months it actually had negative free cash flow, with an outflow of JP¥645m despite its profit of JP¥697.0m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of JP¥645m, this year, indicates high risk. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation. This would partially explain why the accrual ratio was so poor.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of CVS Bay Area.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that CVS Bay Area received a tax benefit of JP¥270m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On CVS Bay Area's Profit Performance

CVS Bay Area's accrual ratio indicates weak cashflow relative to earnings, which perhaps arises in part from the tax benefit it received this year. On top of that, the unsustainable nature of tax benefits mean that there's a chance profit may be lower next year, certainly in the absence of strong growth. Considering all this we'd argue CVS Bay Area's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing CVS Bay Area at this point in time. When we did our research, we found 5 warning signs for CVS Bay Area (3 don't sit too well with us!) that we believe deserve your full attention.

Our examination of CVS Bay Area has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2687

Average dividend payer with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion