How Yamaha’s Collaboration With POPS To Target Generation Alpha Has Changed Its Investment Story (TSE:7951)

Reviewed by Sasha Jovanovic

- Yamaha Music Innovations recently announced a collaboration with POPS, a content powerhouse with over 400 million users, to promote music education and events throughout Indonesia and Vietnam using influencer campaigns, school programs, and digital amplification.

- This partnership directly targets Generation Alpha, aiming to blend offline musical experiences with POPS’s extensive digital reach to boost awareness and engagement for Yamaha Music School in Southeast Asia.

- We’ll explore how tapping into POPS’s broad digital infrastructure could influence Yamaha’s investment narrative, especially in emerging markets.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Yamaha Investment Narrative Recap

To be a shareholder in Yamaha today, you need to believe that its strategic push into digital music education and partnerships in emerging markets, like the collaboration with POPS, can offset ongoing currency and trade headwinds. While this partnership shows promise for expanding reach among younger audiences, it is unlikely to have a material short-term impact on Yamaha’s biggest catalyst, meaningful improvement in core earnings, or mitigate its most pressing risk: persistent foreign exchange volatility and weak demand in key segments.

The June 2025 announcement of multiple partnerships to drive business improvement, including collaborations with firms like DataFalcon and Chartmetric, ties directly into Yamaha’s recent efforts in digital transformation and music education. These initiatives, together with the POPS collaboration, highlight Yamaha’s aim to accelerate growth in higher-margin and service-based revenue streams in emerging economies.

Yet, in contrast, investors should also be aware that even with these initiatives, ongoing foreign exchange risk remains a critical factor for earnings...

Read the full narrative on Yamaha (it's free!)

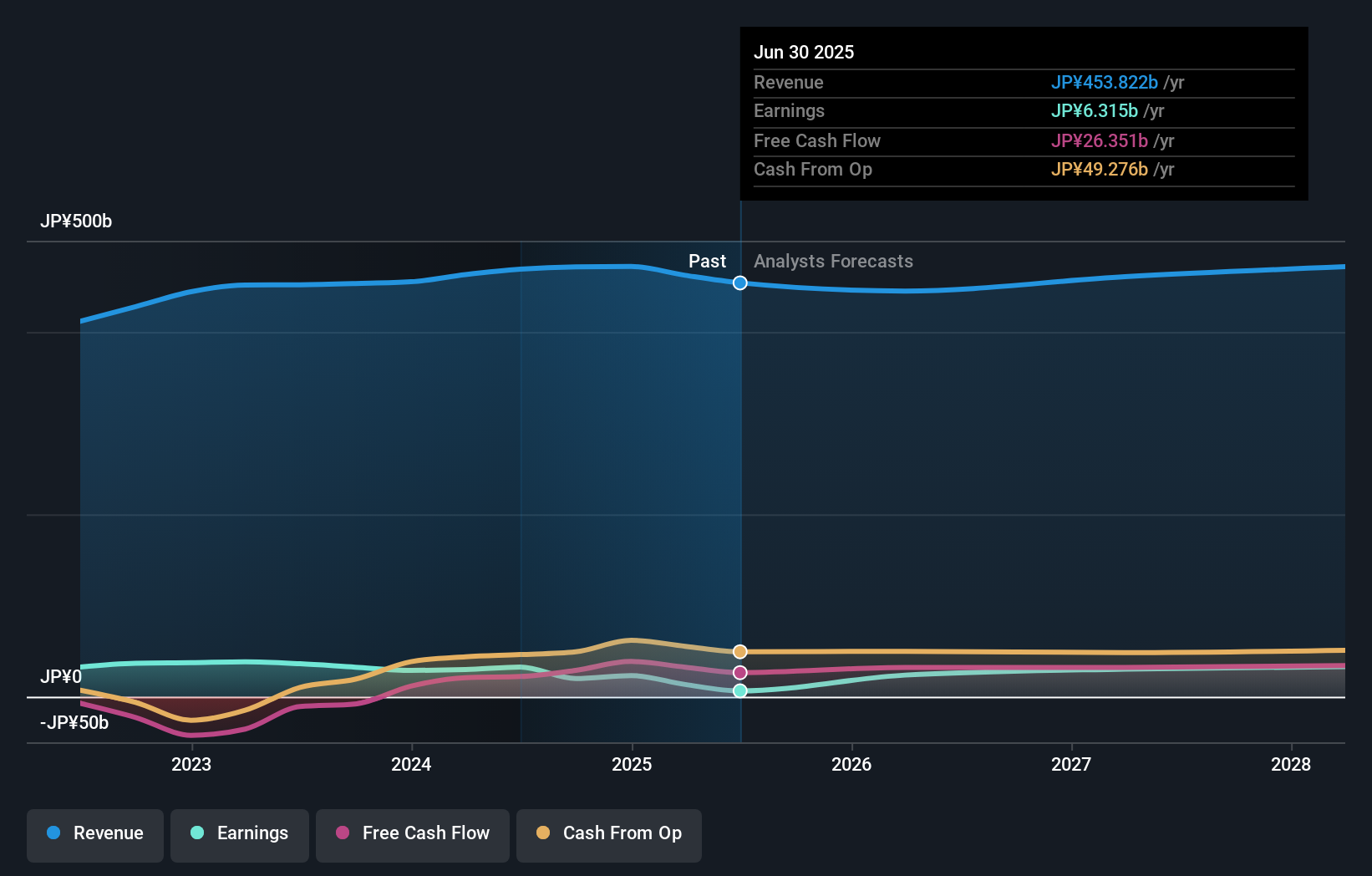

Yamaha's outlook suggests revenues of ¥477.9 billion and earnings of ¥34.8 billion by 2028. This reflects a 1.7% annual revenue growth rate and an increase in earnings of ¥28.5 billion from the current earnings of ¥6.3 billion.

Uncover how Yamaha's forecasts yield a ¥1132 fair value, a 12% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community fair value estimate for Yamaha comes in at ¥2,172.31, significantly above today’s share price. However, persistent foreign exchange headwinds continue to weigh on Yamaha’s earnings and outlook, reminding you that perspectives on value can vary widely.

Explore another fair value estimate on Yamaha - why the stock might be worth over 2x more than the current price!

Build Your Own Yamaha Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamaha research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Yamaha research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamaha's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives