Is ASICS’s Valuation Justified After Recent International Expansion News?

Reviewed by Bailey Pemberton

- Wondering if ASICS stock is truly worth its current price? You are not alone, as plenty of investors are asking whether the market is valuing it fairly right now.

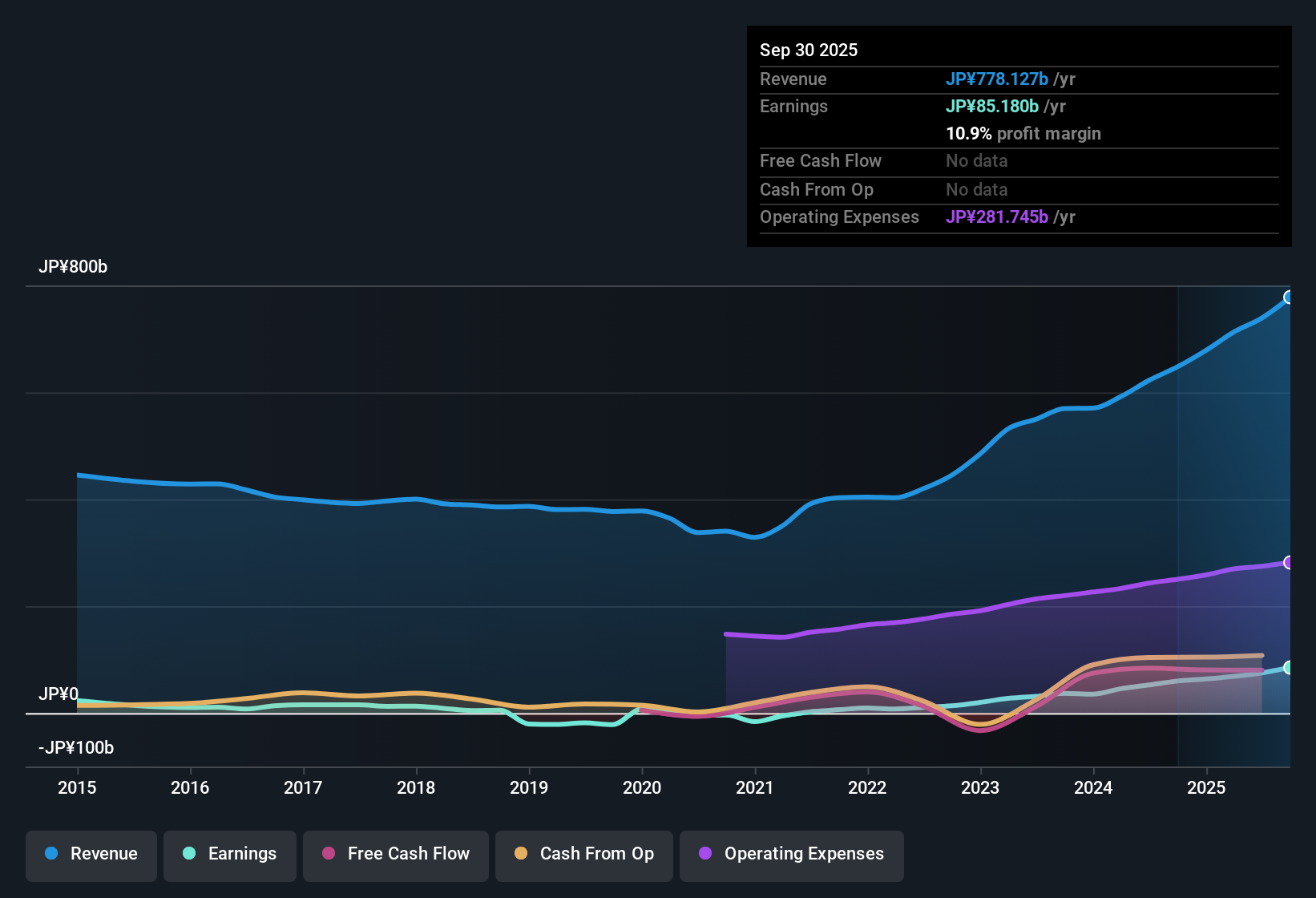

- While ASICS dipped slightly by 0.1% over the past week and 4.7% in the past month, it is still up an impressive 22.3% year-to-date and has gained 25.4% over the last year.

- Recent headlines have highlighted ASICS’s expanding international market presence, including new product launches and high-profile sponsorship deals. These developments have captured investor attention, and mergers and brand collaborations have played a role in shaping recent price movements, fueling optimism and presenting fresh growth opportunities.

- According to our checks, ASICS is undervalued in only 1 out of 6 valuation measures, which suggests there is a lot to consider beneath the surface. Let us take a look at how this score was determined and why there may be a more insightful way to think about what the company is truly worth.

ASICS scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASICS Discounted Cash Flow (DCF) Analysis

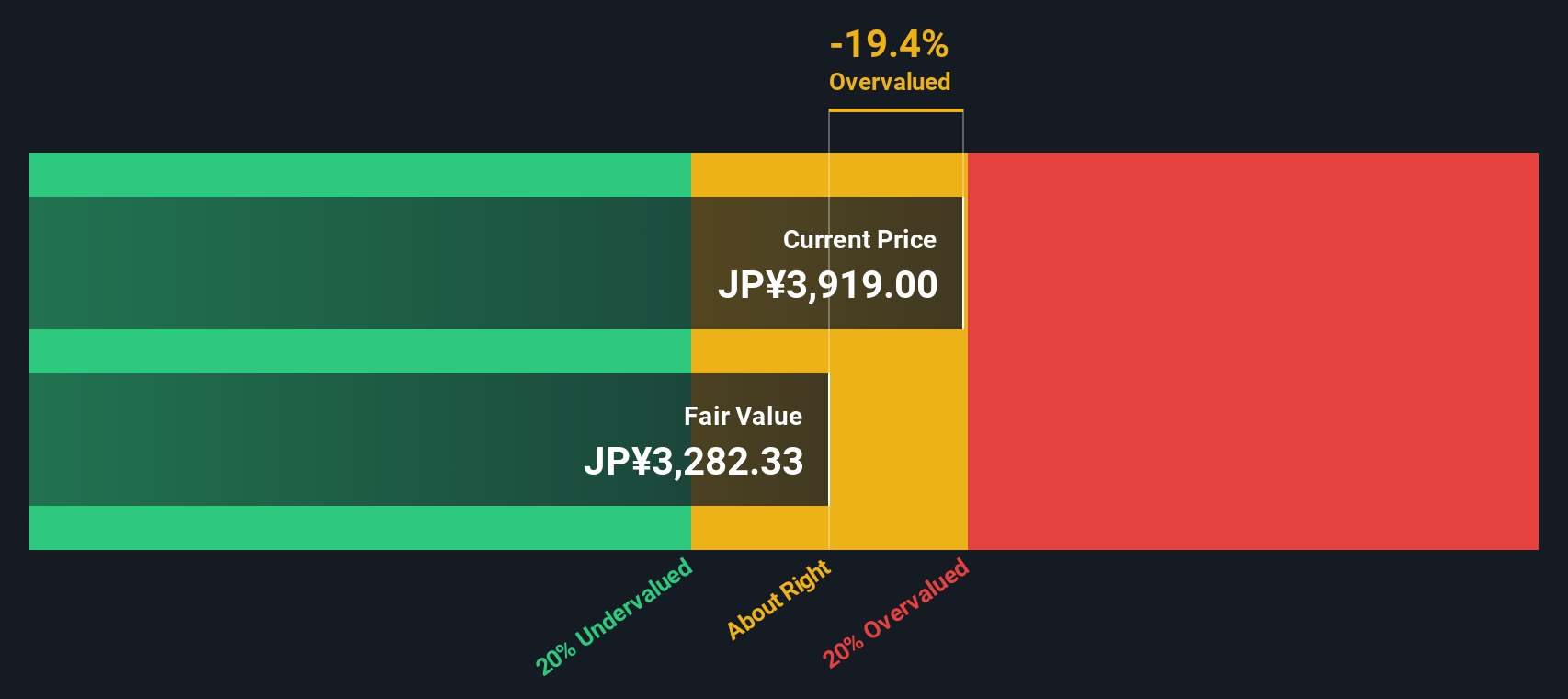

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting those projections back to today's value. For ASICS, this approach uses a two-stage Free Cash Flow to Equity model, taking into account analyst estimates for the first five years and extrapolated figures beyond that.

Currently, ASICS’s Free Cash Flow sits at around ¥85.5 billion. According to analyst consensus and systematic extrapolation, Free Cash Flow is projected to rise each year, reaching approximately ¥161.6 billion a decade from now. These projections rely on market expectations and recent company performance, reflecting incremental growth as ASICS expands.

Based on these estimates, the DCF model calculates an intrinsic value per share of ¥3,286. Despite this fundamental value, ASICS currently trades at a 13.8% premium compared to its DCF fair value. This suggests the share price is higher than fundamentals would justify at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASICS may be overvalued by 13.8%. Discover 922 undervalued stocks or create your own screener to find better value opportunities.

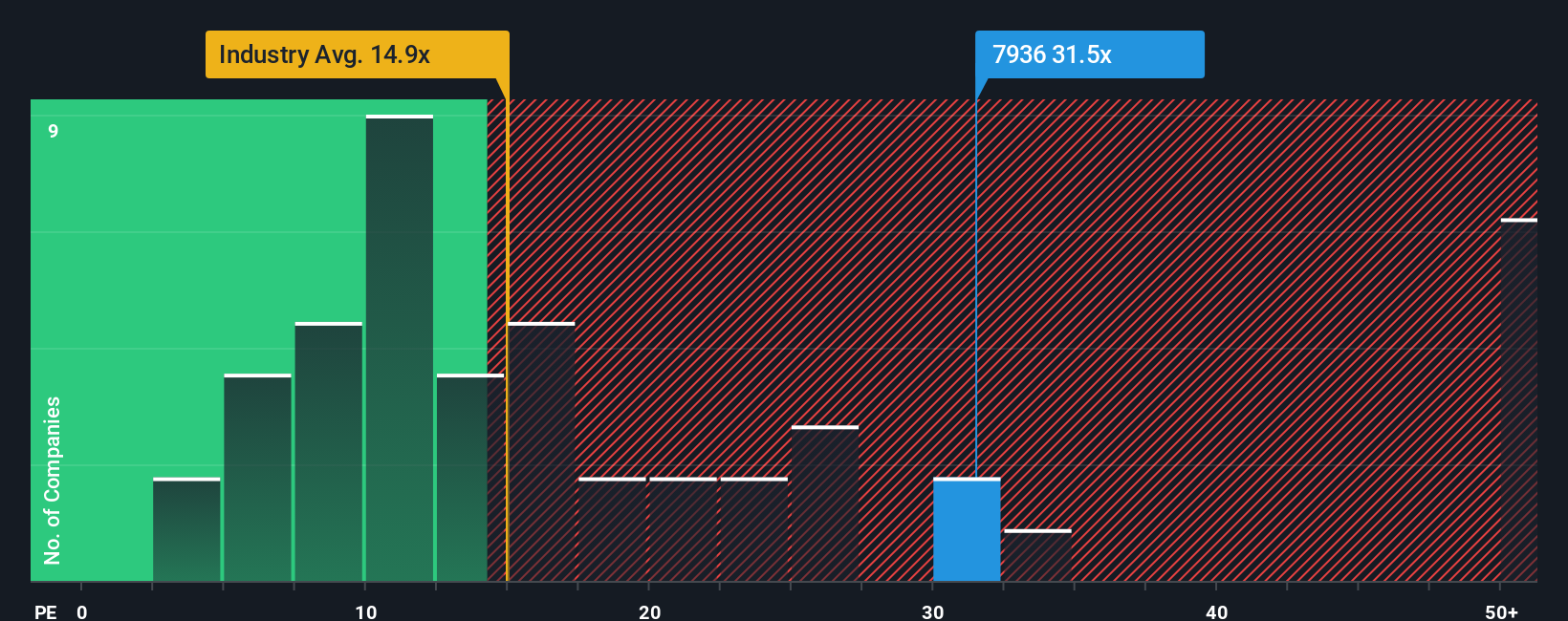

Approach 2: ASICS Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a widely used valuation metric, especially for profitable companies like ASICS. It helps investors gauge how much they are paying for each yen of earnings. A "normal" or "fair" P/E ratio is shaped by factors such as growth prospects and perceived business risk. Fast-growing companies or those with dependable earnings often command higher P/Es, while riskier or lower-growth companies tend to see lower multiples.

ASICS currently trades at a P/E ratio of 31.5x. For context, this is notably higher than the average for its luxury industry peers (14.8x), as well as the broader industry benchmark (14.8x). These comparisons might initially suggest ASICS is expensive relative to other companies in its sector.

However, Simply Wall St's “Fair Ratio” offers a deeper look, taking into account not just industry averages, but also factors like ASICS’s profitability, expected earnings growth, risk level, and market capitalization. In this case, the Fair Ratio for ASICS stands at 23.1x. By using a comprehensive view that goes beyond simple peer or industry comparisons, the Fair Ratio provides a more tailored benchmark for what ASICS’s P/E ratio should reasonably be.

Comparing ASICS’s current P/E of 31.5x with its Fair Ratio of 23.1x suggests the stock may be trading at a premium for its current fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASICS Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story, your perspective on a company, connecting the numbers (like fair value, estimated future revenue, earnings, and margins) to a real-world outlook.

Narratives make it easy to bridge a company’s unique story with financial forecasts and fair value estimations, making complex analysis accessible for everyone. Available right within Simply Wall St's Community page, Narratives are a tool that millions of investors use to evaluate whether a stock's current price is justified by its future prospects.

By creating or following a Narrative, investors can clearly see at a glance when a stock is potentially undervalued or overvalued by comparing their calculated Fair Value against today’s market Price. Narratives update automatically whenever new information such as earnings or news is released, ensuring your perspective stays current.

For example, among ASICS investors on the platform, some use the most optimistic revenue and margin forecasts for a higher fair value, while others take the most cautious estimates for a far lower one. This approach helps everyone find the Narrative that best fits their beliefs and strategy.

Do you think there's more to the story for ASICS? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7936

ASICS

Manufactures and sells sporting goods in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.