- Taiwan

- /

- Hospitality

- /

- TWSE:2731

Discover Hagihara Industries And 2 Other Top Dividend Stocks

Reviewed by Simply Wall St

As global markets approach record highs, investors are navigating a landscape marked by accelerating inflation and cautious optimism regarding international trade policies. With U.S. stocks climbing and European indices buoyed by hopes of geopolitical resolutions, dividend stocks offer a potentially attractive option for those seeking income in uncertain times. A good dividend stock typically combines a reliable payout history with the potential for growth, making it an appealing choice amidst fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

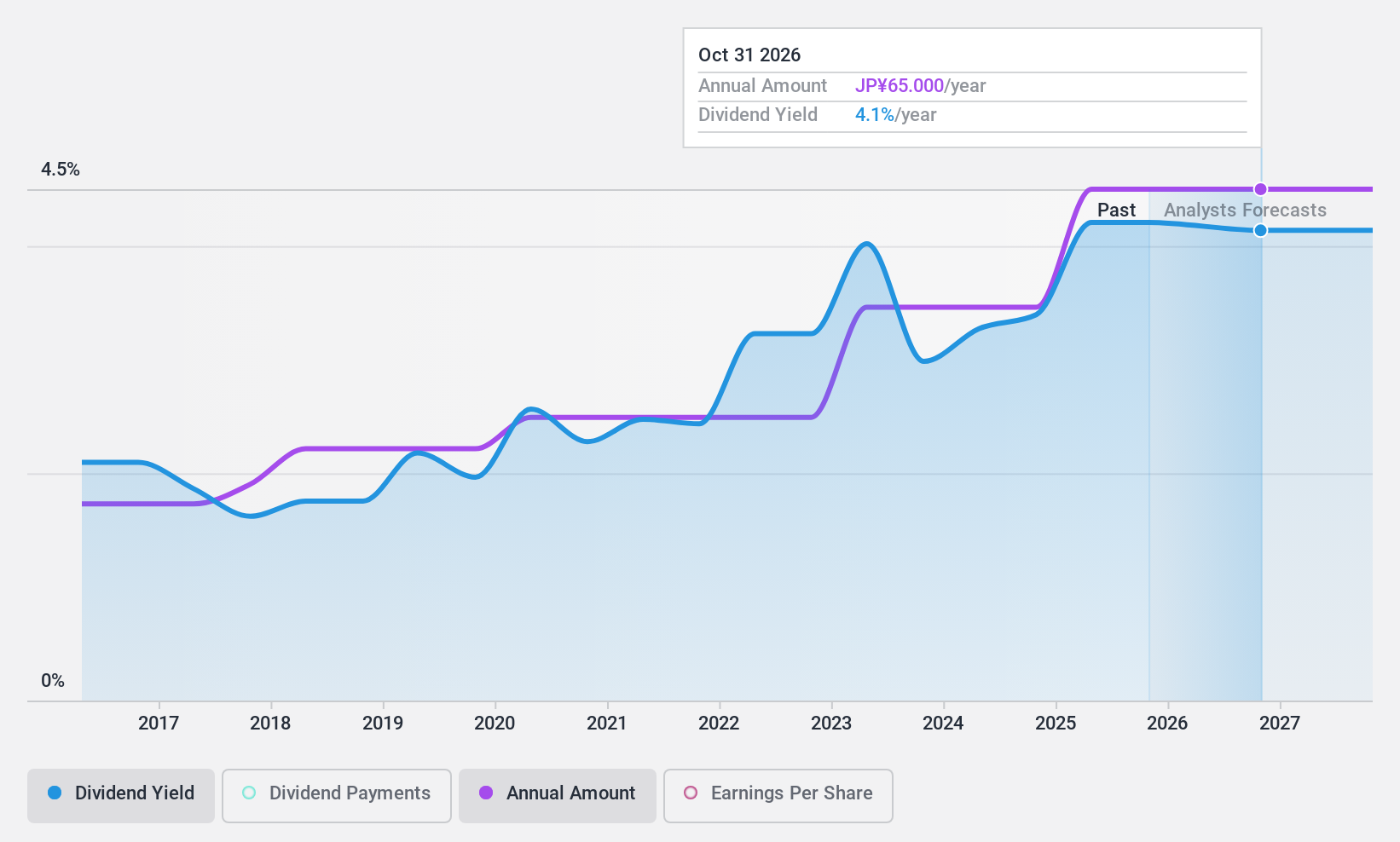

Hagihara Industries (TSE:7856)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Hagihara Industries Inc., with a market cap of ¥20.91 billion, operates through its subsidiaries to manufacture and sell flat yarns in Japan.

Operations: Hagihara Industries Inc. generates revenue primarily from its Synthetic Resin Processed Products Business, which accounts for ¥26.74 billion, and Machinery Products, contributing ¥6.70 billion.

Dividend Yield: 4.3%

Hagihara Industries offers an attractive dividend yield of 4.29%, ranking in the top 25% of Japanese dividend payers. The payout is sustainable, with a reasonable earnings payout ratio of 54.2% and cash flow coverage at 83.5%. Dividends have been stable and growing over the past decade, indicating reliability despite recent profit margin declines from 10% to 4.6%. Upcoming developments may be discussed at their Annual General Meeting on January 22, 2025.

- Unlock comprehensive insights into our analysis of Hagihara Industries stock in this dividend report.

- Our valuation report unveils the possibility Hagihara Industries' shares may be trading at a premium.

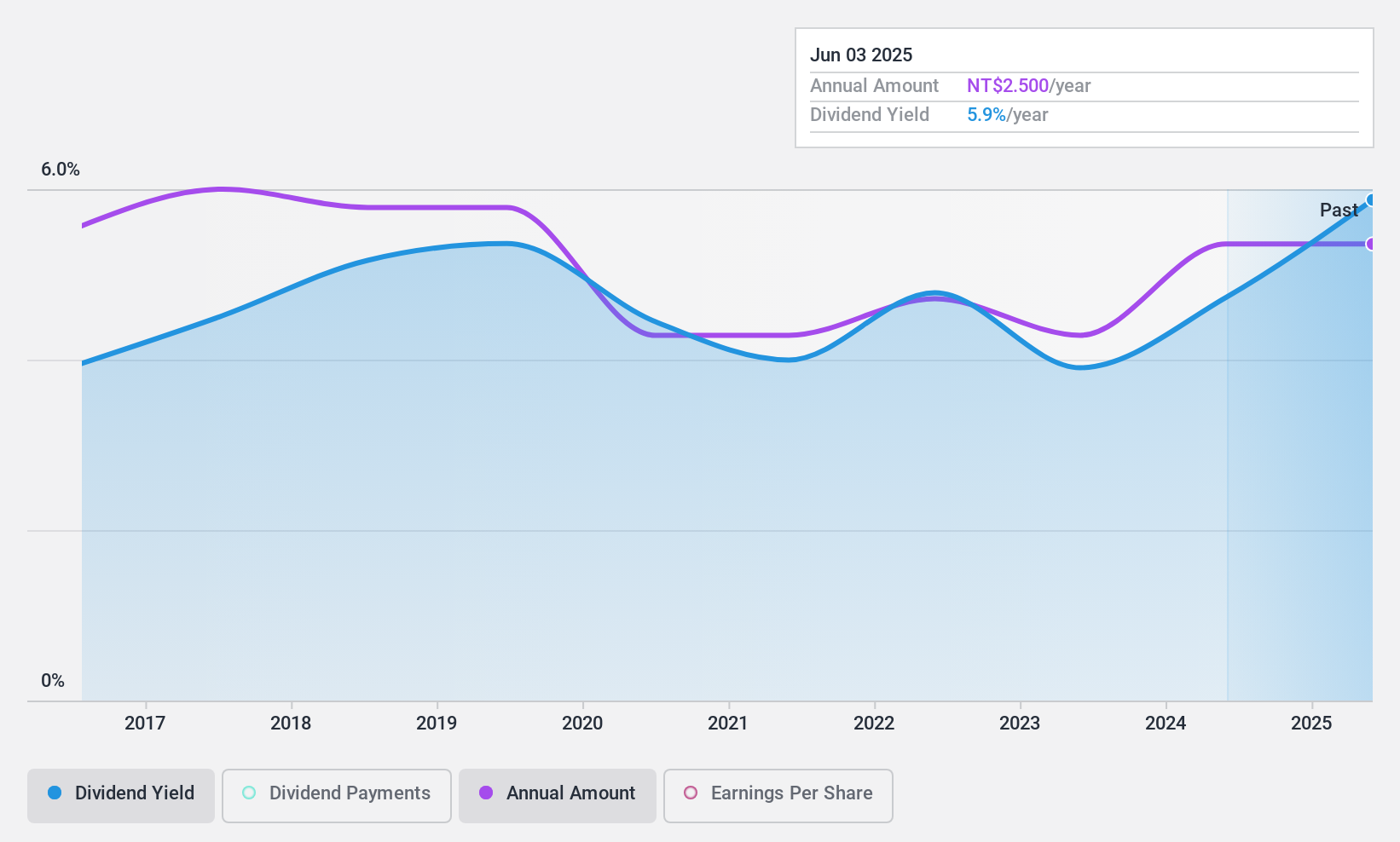

Namchow Holdings (TWSE:1702)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Namchow Holdings Co., Ltd. operates in Taiwan, China, and Thailand, focusing on the manufacture and sale of edible and non-edible oil, frozen dough, and dish and laundry liquid detergent products with a market cap of NT$12.60 billion.

Operations: Namchow Holdings Co., Ltd. generates revenue primarily from its Edible and Non-Edible Oil Detergent Products segment at NT$13.29 billion, followed by Food (Excl. Frozen Dough) at NT$4.47 billion, Frozen Dough at NT$2.39 billion, Ice Products at NT$2.09 billion, Cleaning Products at NT$479.49 million, and Catering services at NT$859.42 million.

Dividend Yield: 4.9%

Namchow Holdings' dividend yield of 4.87% ranks in the top 25% of Taiwan's market, with a sustainable payout ratio of 53.5% from earnings and 63.9% from cash flows. Despite this, dividends have been volatile over the past decade, lacking consistent growth or stability. The stock trades at a significant discount to its estimated fair value, but recent board discussions on portfolio changes may impact future dividend reliability.

- Navigate through the intricacies of Namchow Holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Namchow Holdings' share price might be too pessimistic.

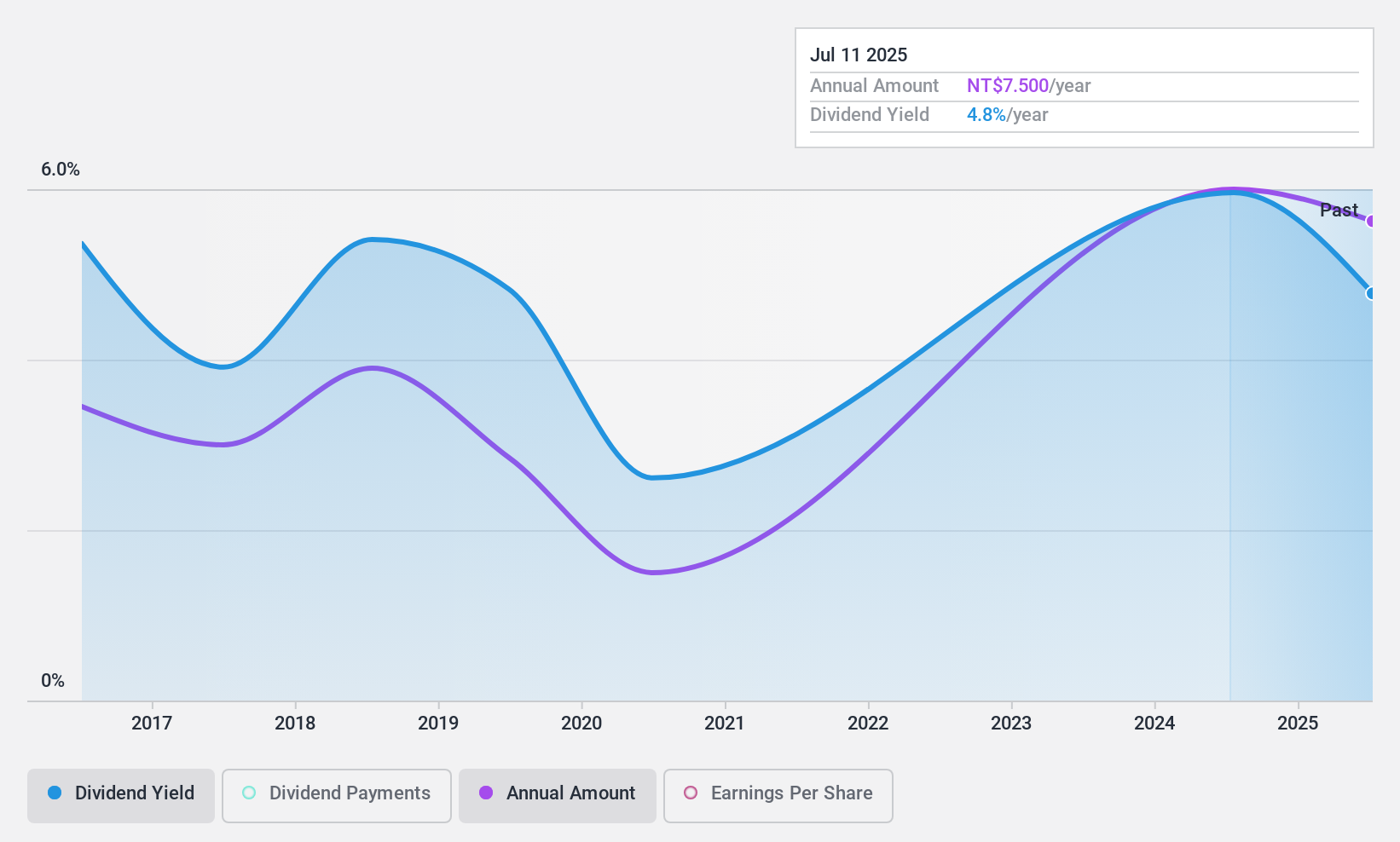

Lion Travel Service (TWSE:2731)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Travel Service Co., Ltd. offers travel services both in Taiwan and internationally, with a market cap of NT$11.61 billion.

Operations: Lion Travel Service Co., Ltd.'s revenue primarily comes from its Tour Department, which generated NT$28.15 billion.

Dividend Yield: 6.3%

Lion Travel Service offers a dividend yield of 6.32%, placing it among the top 25% of Taiwan's dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 49.3% and 32.3%, respectively, suggesting sustainability. However, the company's dividends have been volatile over the past decade, lacking reliability despite recent earnings growth of 223.5%. The stock trades significantly below its estimated fair value, presenting potential value opportunities for investors.

- Get an in-depth perspective on Lion Travel Service's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Lion Travel Service is priced lower than what may be justified by its financials.

Key Takeaways

- Unlock our comprehensive list of 1968 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2731

Lion Travel Service

Provides travel services in Taiwan and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives