- Japan

- /

- Consumer Durables

- /

- TSE:6952

The Bull Case For Casio ComputerLtd (TSE:6952) Could Change Following AI-Engineered Full-Metal G-SHOCK Launch

Reviewed by Sasha Jovanovic

- In December 2025, Casio America Inc. launched the GMWBZ5000 collection, a full-metal evolution of the iconic G-SHOCK 5000 series that uses AI-driven engineering, advanced shock absorption, and premium finishes, priced between US$660 and US$720 and rolling out broadly by February 2026.

- This blend of artificial intelligence, high-end materials, and heritage design could strengthen Casio’s positioning in premium, higher-margin watch segments and deepen brand appeal among design-conscious consumers.

- We’ll now explore how this AI-engineered, full-metal G-SHOCK launch could reshape Casio’s investment narrative across premium watches and innovation.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Casio ComputerLtd Investment Narrative Recap

To own Casio, you need to believe the company can turn its traditional strengths in durable watches and calculators into renewed growth, despite recent profit declines and uneven regional demand. The AI-engineered, full-metal GMWBZ5000 pushes deeper into premium G-SHOCK territory, but its near term impact on reversing margin pressure and exposure to U.S. tariffs is likely incremental rather than transformative.

The most relevant recent context is Casio’s steady dividend of ¥22.50 per share, reaffirmed multiple times through 2024 and 2025, even as earnings guidance has been revised down. That mix of income stability with pressure on profits frames the GMWBZ5000 launch as part of a broader effort to support higher margin timepieces while the company works through softer sales and higher cost headwinds.

Yet behind the excitement around AI-designed G-SHOCKs, investors should still be aware of...

Read the full narrative on Casio ComputerLtd (it's free!)

Casio ComputerLtd’s narrative projects ¥275.8 billion revenue and ¥20.2 billion earnings by 2028. This requires 2.2% yearly revenue growth and about a ¥14.6 billion earnings increase from ¥5.6 billion today.

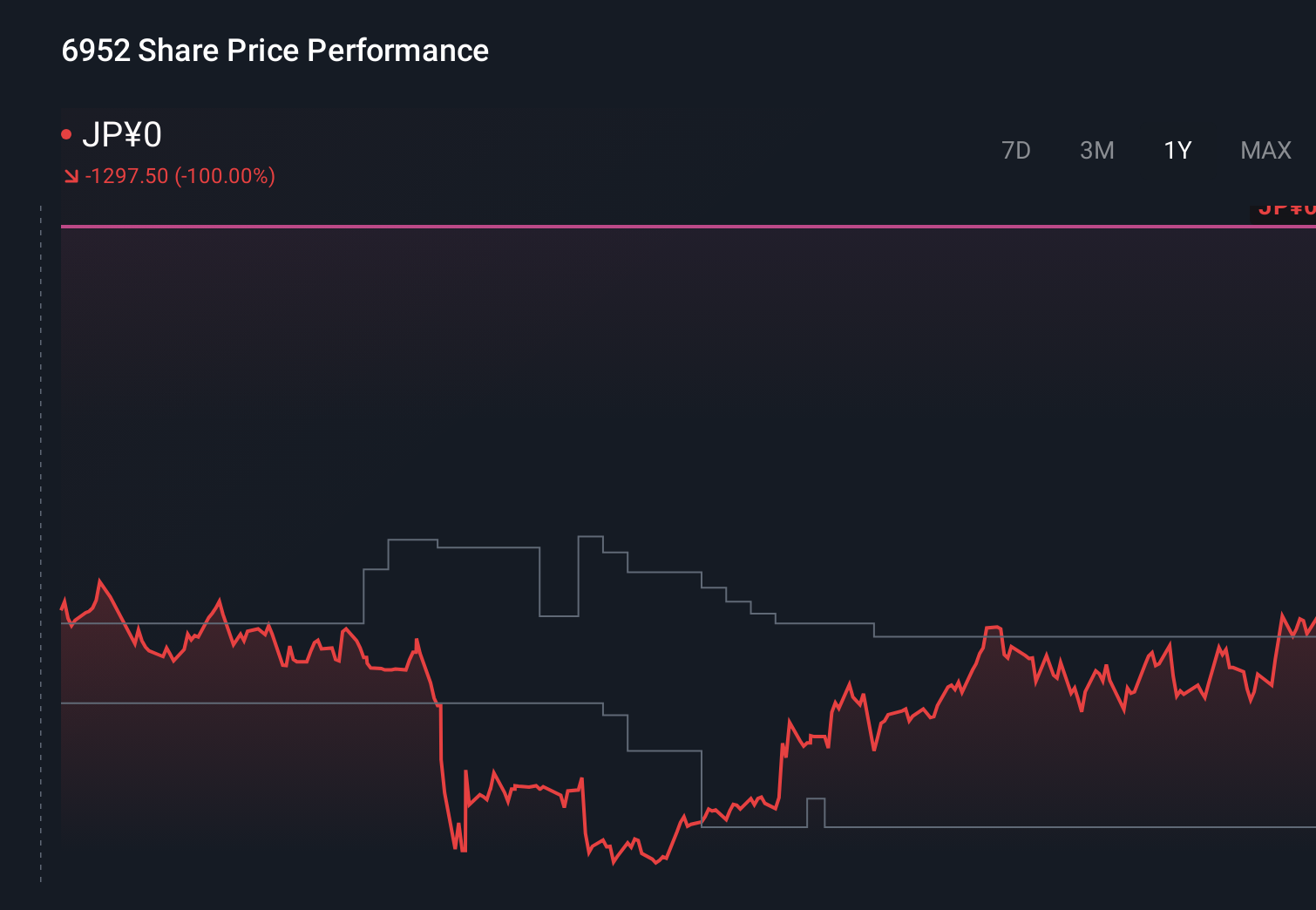

Uncover how Casio ComputerLtd's forecasts yield a ¥1291 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Casio range from ¥1,291 to ¥1,480, showing how far apart individual views can be. You will want to weigh those opinions against Casio’s recent profit declines and tariff exposure that could keep margins under pressure.

Explore 2 other fair value estimates on Casio ComputerLtd - why the stock might be worth just ¥1291!

Build Your Own Casio ComputerLtd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casio ComputerLtd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Casio ComputerLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casio ComputerLtd's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Engages in the development, production, sales, and services of watches, consumer products, systems, and other fields.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion