- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony (TSE:6758): Exploring Valuation After Three-Month 18% Climb and Flat Recent Performance

Reviewed by Simply Wall St

See our latest analysis for Sony Group.

Sony Group’s share price has been building momentum, with a steady 18% gain over the past three months and a robust 72% total shareholder return over the past year. While there have been a few headlines around Sony’s business segments in recent months, the real story is that recent performance reflects growing optimism about its long-term outlook.

If you’re curious which other tech leaders are riding a similar wave, check out our hand-picked selection in the See the full list for free..

The real question now is whether Sony Group’s shares are undervalued after this impressive run, or if the recent gains mean that future growth is already factored into the price. This may leave little room for new buyers.

Most Popular Narrative: 8.9% Undervalued

Sony Group's most widely followed narrative suggests a fair value that is nearly 9% higher than the latest closing price. This gap reflects optimism in the company's long-term business model and future profit margins.

Sony's leadership in advanced sensor technology is driving strong growth in the Imaging & Sensing Solutions segment. Higher unit prices from the adoption of larger, value-added sensors and demand in emerging applications (e.g., mobile, video) are expected to support topline growth and earnings resilience, particularly as connected and AI-enabled devices proliferate.

What’s behind this valuation? This narrative is fueled by bets on margin expansion, recurring digital revenues, and future device innovation. Want to see the financial assumptions and profit forecasts that power this price target? There are numbers here you don't want to miss.

Result: Fair Value of ¥4,819.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and intensifying competition in imaging technology could challenge Sony Group's margin growth and future earnings expectations.

Find out about the key risks to this Sony Group narrative.

Another View: DCF Approach Offers a Cautious Signal

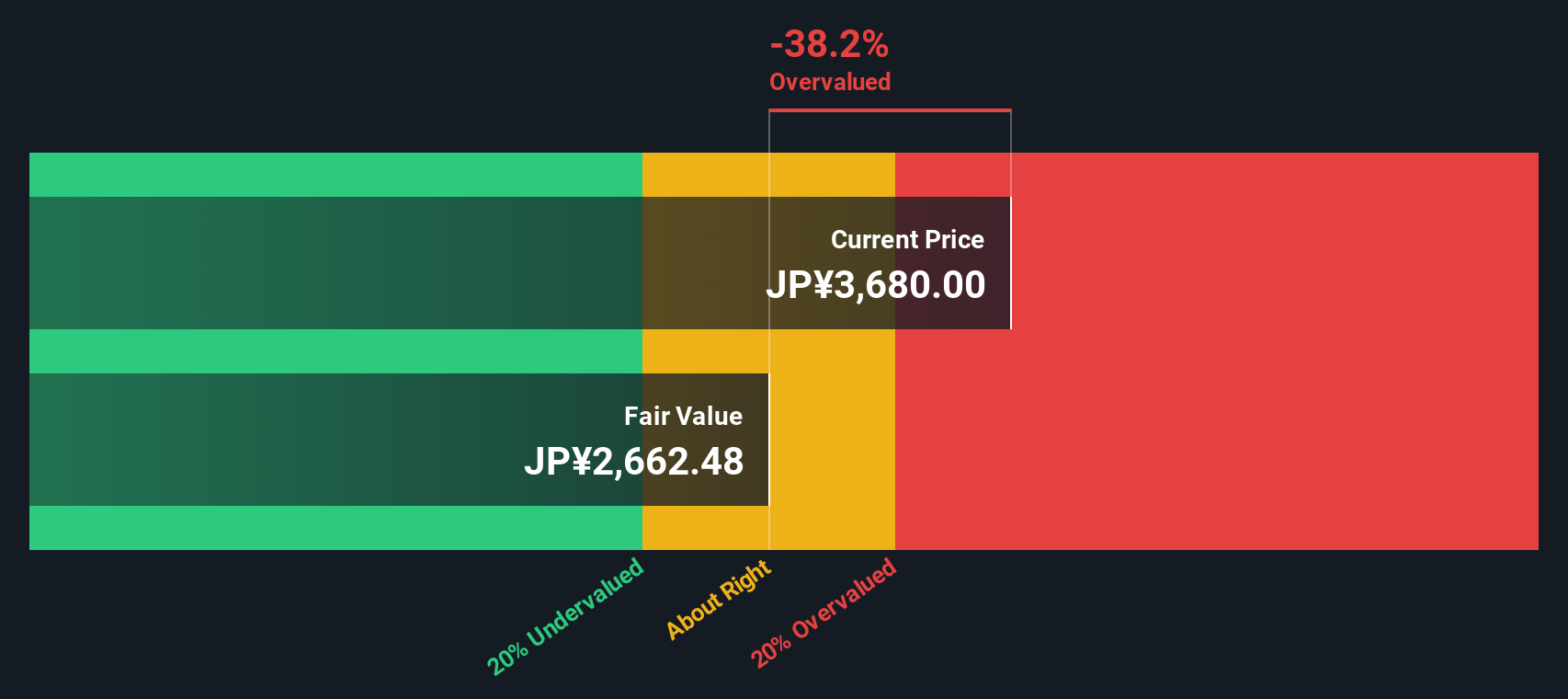

While the popular narrative values Sony Group at nearly 9% above its current price, our DCF model takes a more conservative stance. Based on discounted future cash flows, it pegs the fair value much lower, which suggests the shares may actually be overvalued at present. Does this mean the recent optimism is overdone?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sony Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sony Group Narrative

If you see things differently or want to dig into the details yourself, it takes just a few minutes to assemble your own take on Sony Group’s outlook with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sony Group.

Looking for more investment ideas?

Don't let opportunity pass you by. Use the Simply Wall Street Screener to unlock fresh ideas and stay one step ahead of other investors today.

- Uncover income potential by checking out these 17 dividend stocks with yields > 3%, which delivers yields above 3% and adds stability to your portfolio.

- Target tomorrow’s tech innovators through these 26 AI penny stocks, showcasing exciting companies shaping the artificial intelligence landscape.

- Ride powerful industry trends by searching for value in these 879 undervalued stocks based on cash flows, which could be positioned for substantial gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives