- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony Group (TSE:6758): Evaluating Valuation as Leadership Transition and Structural Changes Announced

Reviewed by Kshitija Bhandaru

Sony Group (TSE:6758) has named Kenji Tanaka as its next President and CEO, who is set to take the helm in April 2026. The announcement comes along with plans to shift Sony’s corporate structure.

See our latest analysis for Sony Group.

Momentum around Sony’s stock has been fairly muted, with recent events such as executive leadership changes and presentations at key industry conferences not sparking significant gains. Sony’s 1-year total shareholder return stands at just 0.6%, while its share price has only edged up over the past quarter. Investors seem to be waiting for clearer signals on the company’s long-term direction and growth potential as leadership transitions approach and corporate structure shifts take shape.

Inspired by Sony’s bold moves but want to cast a wider net? Explore opportunities in high-growth companies led by engaged insiders by checking out fast growing stocks with high insider ownership.

But with the stock hovering near analysts’ targets and a leadership shake-up on the horizon, investors may be wondering whether the current share price represents a rare value opportunity or if future growth is already reflected in the market.

Most Popular Narrative: 10.7% Undervalued

According to the most closely watched narrative, Sony’s fair value estimate sits above the recent share price, signaling room for further gains if expectations are met. This perspective draws on a wide range of factors, from shifting digital strategies to future earnings potential. Together, these support a higher valuation outlook than what the current market implies.

The accelerating monetization of proprietary content IP, including music catalogs, blockbuster anime (such as Demon Slayer), and cross-platform franchises, together with strategic partnerships (such as Bandai Namco), positions Sony to capitalize on global entertainment demand and improve both revenue growth and margin profile.

What’s fueling this robust valuation? The blueprint is built on Sony’s major entertainment franchises, optimistic earnings projections, and increasingly ambitious profit margins. If you’re curious where these bold projections land, the narrative’s deep dive reveals the key numbers analysts think could drive the next move.

Result: Fair Value of ¥4,709.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and rising competition in sensor markets could significantly affect Sony's growth outlook and valuation in the future.

Find out about the key risks to this Sony Group narrative.

Another View: Multiples Tell a Different Story

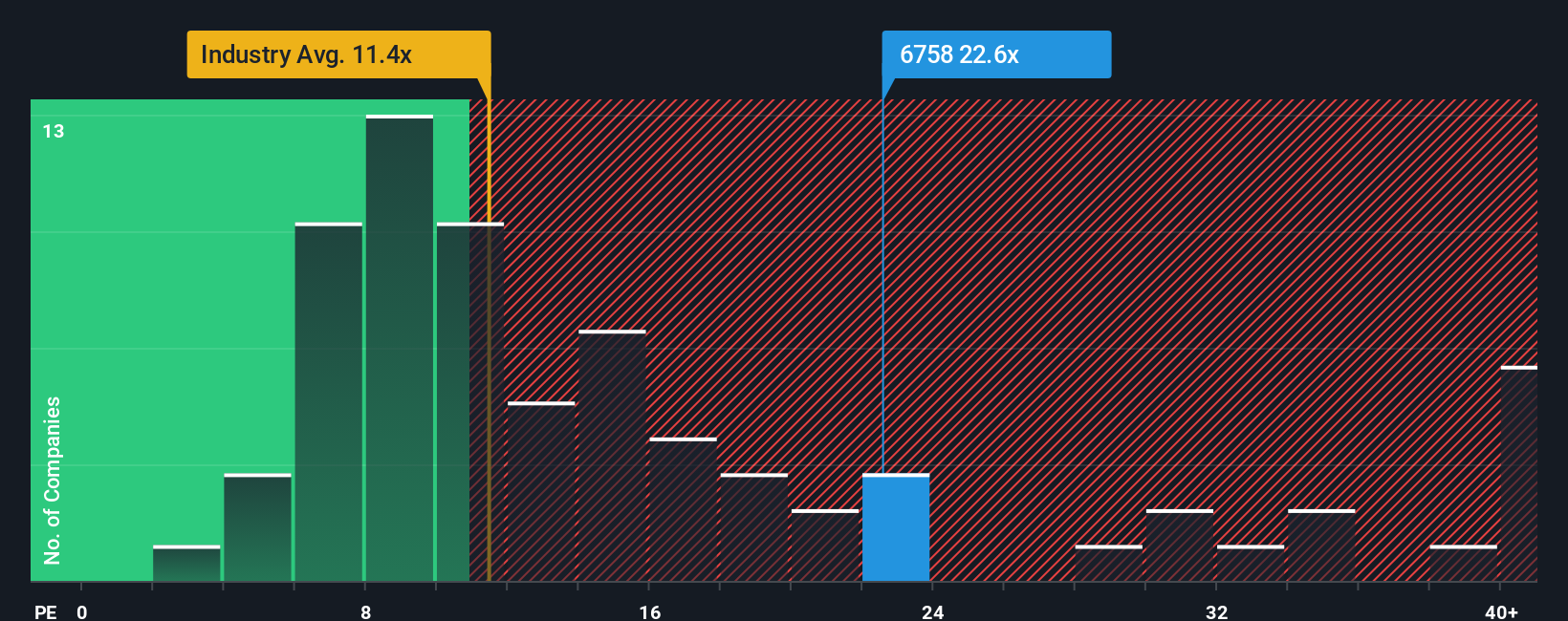

Switching focus to the market’s go-to benchmark, Sony trades at a price-to-earnings ratio of 21.1x. That is not only above the Japan Consumer Durables industry average of 11.3x, but also trails its peer group’s 28.3x. Compared to its fair ratio of 23.9x, this indicates Sony is valued a bit below where the broader market might eventually place it. Is the market missing out or rightfully cautious given the softer revenue outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sony Group Narrative

If these narratives do not align with your outlook, or you would rather dig into the details yourself, you can build your own narrative in just a few minutes and uncover your own perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sony Group.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh opportunities. If you want to stay ahead of the crowd, check out these handpicked themes before you miss the next move:

- Tap into tomorrow’s fintech leaders by analyzing these 78 cryptocurrency and blockchain stocks, which is changing the landscape of blockchain, payments, and digital assets.

- Lock in reliable, inflation-beating income streams as you review these 19 dividend stocks with yields > 3%, which is offering attractive yields and financial resilience.

- Benefit from rapid disruption in healthcare by tracking these 31 healthcare AI stocks, which is transforming diagnostics, patient care, and medical data with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives