- Japan

- /

- Consumer Durables

- /

- TSE:6755

A Piece Of The Puzzle Missing From Fujitsu General Limited's (TSE:6755) 33% Share Price Climb

The Fujitsu General Limited (TSE:6755) share price has done very well over the last month, posting an excellent gain of 33%. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

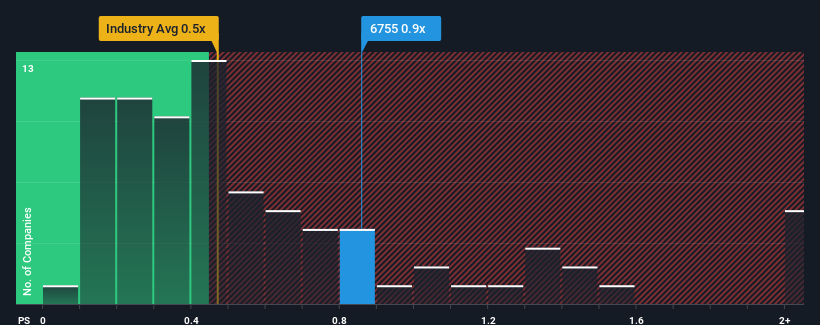

Even after such a large jump in price, there still wouldn't be many who think Fujitsu General's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in Japan's Consumer Durables industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Fujitsu General

How Has Fujitsu General Performed Recently?

Fujitsu General hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fujitsu General.Is There Some Revenue Growth Forecasted For Fujitsu General?

Fujitsu General's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.7% per year as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 1.0% per annum growth forecast for the broader industry.

With this information, we find it interesting that Fujitsu General is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Fujitsu General's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Fujitsu General's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Fujitsu General that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6755

Fujitsu General

Develops, manufactures, sells, and service of air conditioner and telecommunications products and components.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives