- Japan

- /

- Consumer Durables

- /

- TSE:6753

Sharp Corporation's (TSE:6753) Shares Climb 30% But Its Business Is Yet to Catch Up

Sharp Corporation (TSE:6753) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 4.7% isn't as impressive.

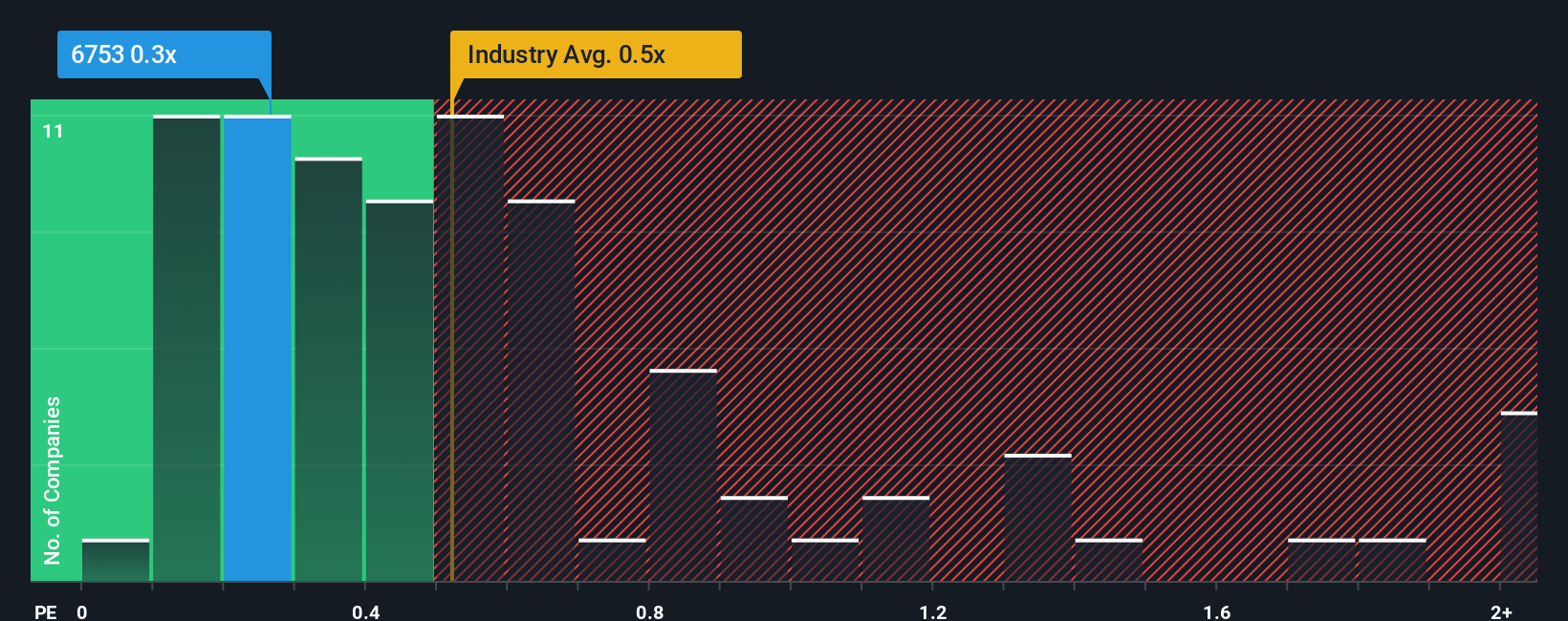

Although its price has surged higher, there still wouldn't be many who think Sharp's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Japan's Consumer Durables industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Sharp

What Does Sharp's Recent Performance Look Like?

Sharp could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Sharp's future stacks up against the industry? In that case, our free report is a great place to start.How Is Sharp's Revenue Growth Trending?

In order to justify its P/S ratio, Sharp would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.2%. The last three years don't look nice either as the company has shrunk revenue by 14% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 4.3% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 0.6% per annum, which paints a poor picture.

With this information, we find it concerning that Sharp is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Sharp's P/S?

Its shares have lifted substantially and now Sharp's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Sharp's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Sharp (at least 3 which shouldn't be ignored), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6753

Sharp

Manufactures and sells telecommunication equipment, electric and electronic application equipment, and electronic components in Japan, China, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026