- Japan

- /

- Tech Hardware

- /

- TSE:6736

Discovering Suzhou Hailu Heavy IndustryLtd And 2 Other Promising Small Caps with Robust Potential

Reviewed by Simply Wall St

In the current landscape, Asian markets are navigating a complex environment marked by cautious optimism amid mixed economic data and geopolitical uncertainties. As investors seek opportunities in this fluctuating climate, small-cap stocks often stand out for their potential to capitalize on niche markets and innovative solutions. Identifying promising small caps like Suzhou Hailu Heavy Industry Ltd requires a keen eye for companies with strong fundamentals and the ability to adapt to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| AIC | 23.80% | 25.41% | 61.47% | ★★★★★★ |

| Xuelong GroupLtd | NA | -3.81% | -16.81% | ★★★★★★ |

| Taisun Enterprise | 0.14% | 7.43% | 19.72% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Aeolus Tyre | 35.14% | 0.01% | 17.84% | ★★★★★☆ |

| Unitech Printed Circuit Board | 50.12% | -1.25% | 11.55% | ★★★★★☆ |

| Kwang Dong Pharmaceutical | 44.94% | 6.47% | 3.58% | ★★★★☆☆ |

| Sichuan Dowell Science and Technology | 34.59% | 12.97% | -14.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Suzhou Hailu Heavy IndustryLtd (SZSE:002255)

Simply Wall St Value Rating: ★★★★★★

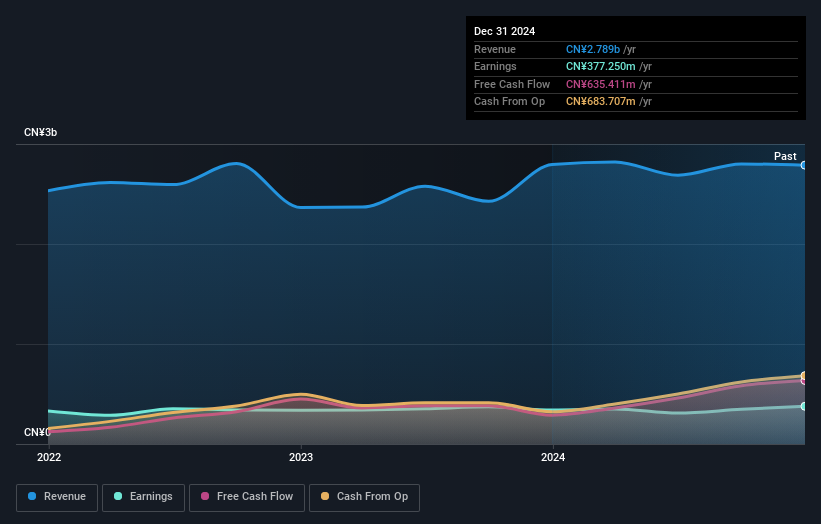

Overview: Suzhou Hailu Heavy Industry Co., Ltd specializes in the design, manufacture, and sale of industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment with a market cap of CN¥6.55 billion.

Operations: Suzhou Hailu Heavy Industry Co., Ltd generates revenue primarily from the sale of industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment. The company focuses on optimizing its cost structure to enhance profitability. Notably, it has shown variations in its net profit margin over recent periods.

Suzhou Hailu Heavy Industry, a notable player in the machinery sector, showcases impressive financial health with its debt to equity ratio dropping from 44.4% to 0.3% over five years, indicating strong balance sheet management. The company's earnings growth of 10.9% last year outpaced the industry average of 0.1%, reflecting robust operational performance and competitive edge in its field. Trading at about 61.5% below estimated fair value suggests potential undervaluation, making it an intriguing proposition for investors seeking opportunities in Asia's industrial landscape. With high-quality earnings and positive free cash flow, Suzhou Hailu seems well-positioned for future endeavors.

JVCKENWOOD (TSE:6632)

Simply Wall St Value Rating: ★★★★★★

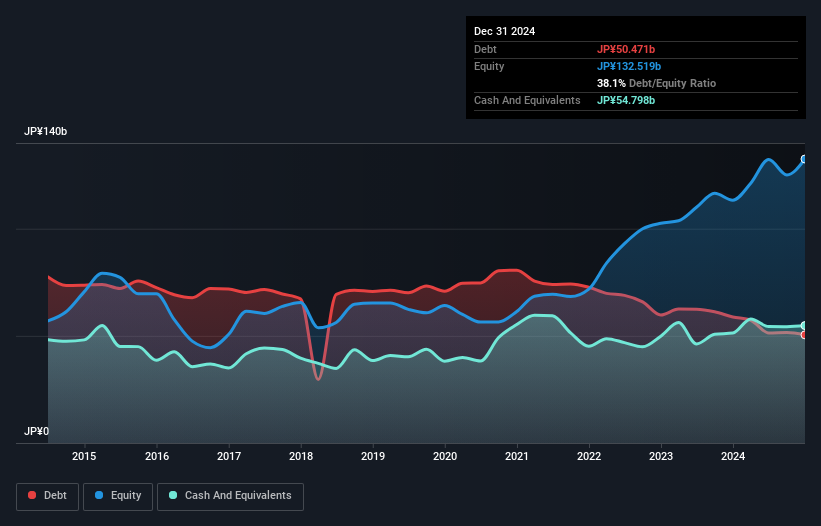

Overview: JVCKENWOOD Corporation is a global manufacturer and seller of products across the mobility and telematics services, public service, and media service sectors with a market cap of ¥205.92 billion.

Operations: The company generates revenue primarily from the Mobility & Telematics Services Area, contributing ¥199.43 billion, followed by the Public Service Field at ¥96.93 billion and Media Service Field at ¥55.44 billion.

JVCKENWOOD, a notable player in the Consumer Durables sector, has shown impressive earnings growth of 38.9% over the past year, outpacing the industry average of 9%. The company's debt management appears robust with a reduction in its debt-to-equity ratio from 110.4% to 38.1% over five years and interest payments well-covered by EBIT at a multiple of 163.5x. Recent strategic moves include completing share buybacks worth ¥4.50 billion, representing about 1.9% of shares, potentially signaling confidence in its valuation which trades at approximately 23.7% below estimated fair value.

Sun (TSE:6736)

Simply Wall St Value Rating: ★★★★☆☆

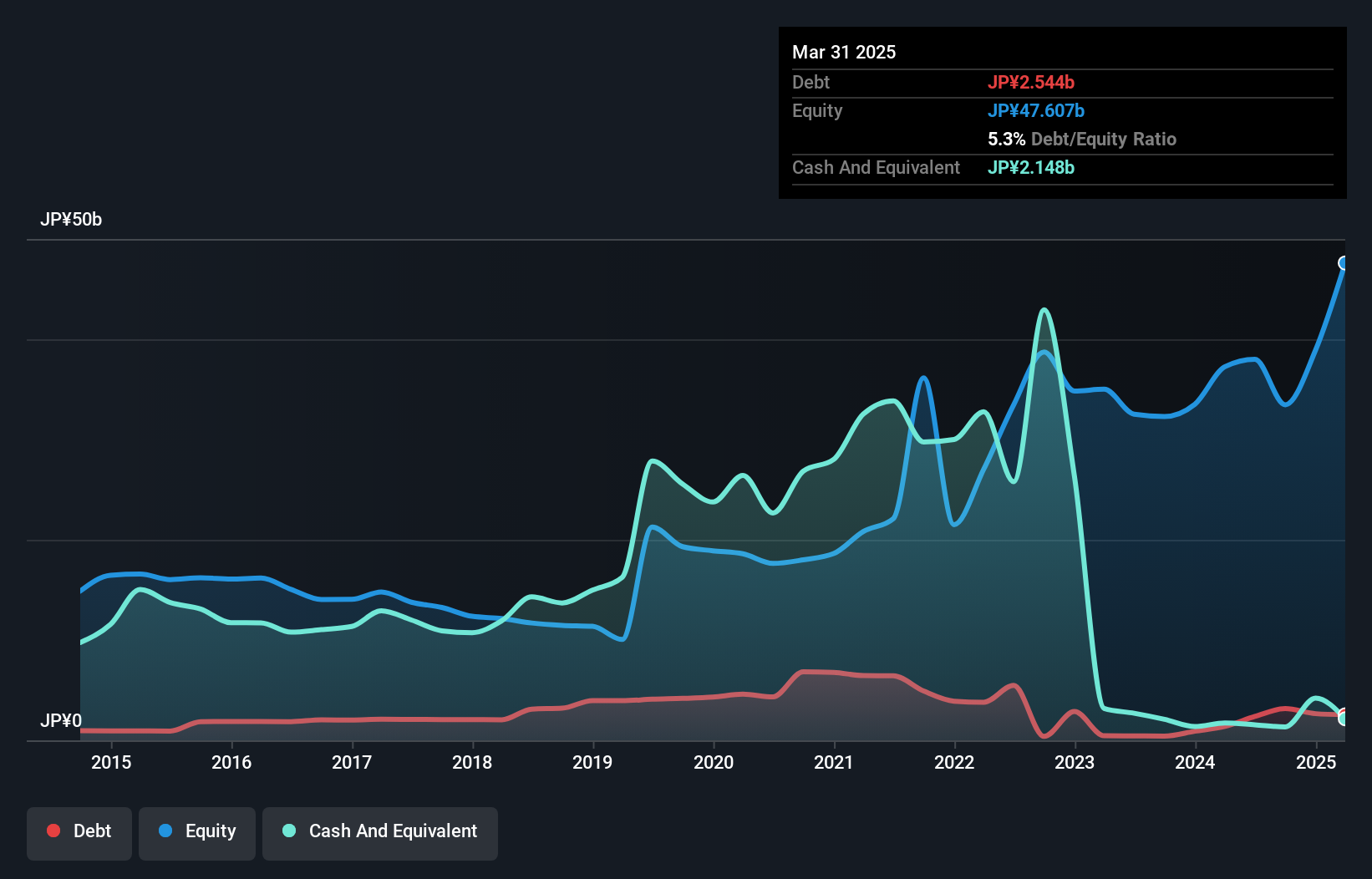

Overview: Sun Corporation operates in the mobile data solutions, entertainment, and information technology sectors in Japan with a market capitalization of ¥171.44 billion.

Operations: Sun Corporation generates revenue primarily from its Entertainment Related Business, which accounts for ¥5.99 billion, followed by the New IT Related Business at ¥3.41 billion. The Global Data Intelligence Business contributes ¥1.13 billion to the total revenue stream.

Sun, a dynamic player in the tech sector, has recently turned profitable, making it difficult to directly compare its growth with the industry average of 2.6%. The company boasts a debt-to-equity ratio that has impressively decreased from 22.8% to 6.8% over five years, indicating prudent financial management. However, a ¥12.9B one-off gain has significantly impacted its recent financial results, which might not reflect ongoing business operations accurately. Despite these fluctuations and high share price volatility over the past three months, Sun's price-to-earnings ratio of 13.4x suggests it remains an appealing option compared to industry standards (13.6x).

- Unlock comprehensive insights into our analysis of Sun stock in this health report.

Evaluate Sun's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 2652 Asian Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6736

Sun

Engages in the mobile data solutions, entertainment, information technology, and other businesses in Japan.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives