- Italy

- /

- Auto Components

- /

- BIT:SGF

Top 3 Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have rallied to record highs, buoyed by expectations of economic growth and lower corporate taxes following a significant political shift. As markets adjust to these changes, investors are increasingly looking towards dividend stocks as a reliable source of income and stability in their portfolios. In light of current conditions, selecting dividend stocks with strong fundamentals can be an effective strategy for enhancing portfolio resilience and generating consistent returns amidst evolving economic landscapes.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sogefi (BIT:SGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogefi S.p.A. is a company that designs, develops, and produces filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry across Europe, South America, North America, and Asia with a market cap of €236.30 million.

Operations: Sogefi S.p.A. generates revenue from its core segments, including Suspensions (€546.31 million) and Air and Cooling (€479.15 million).

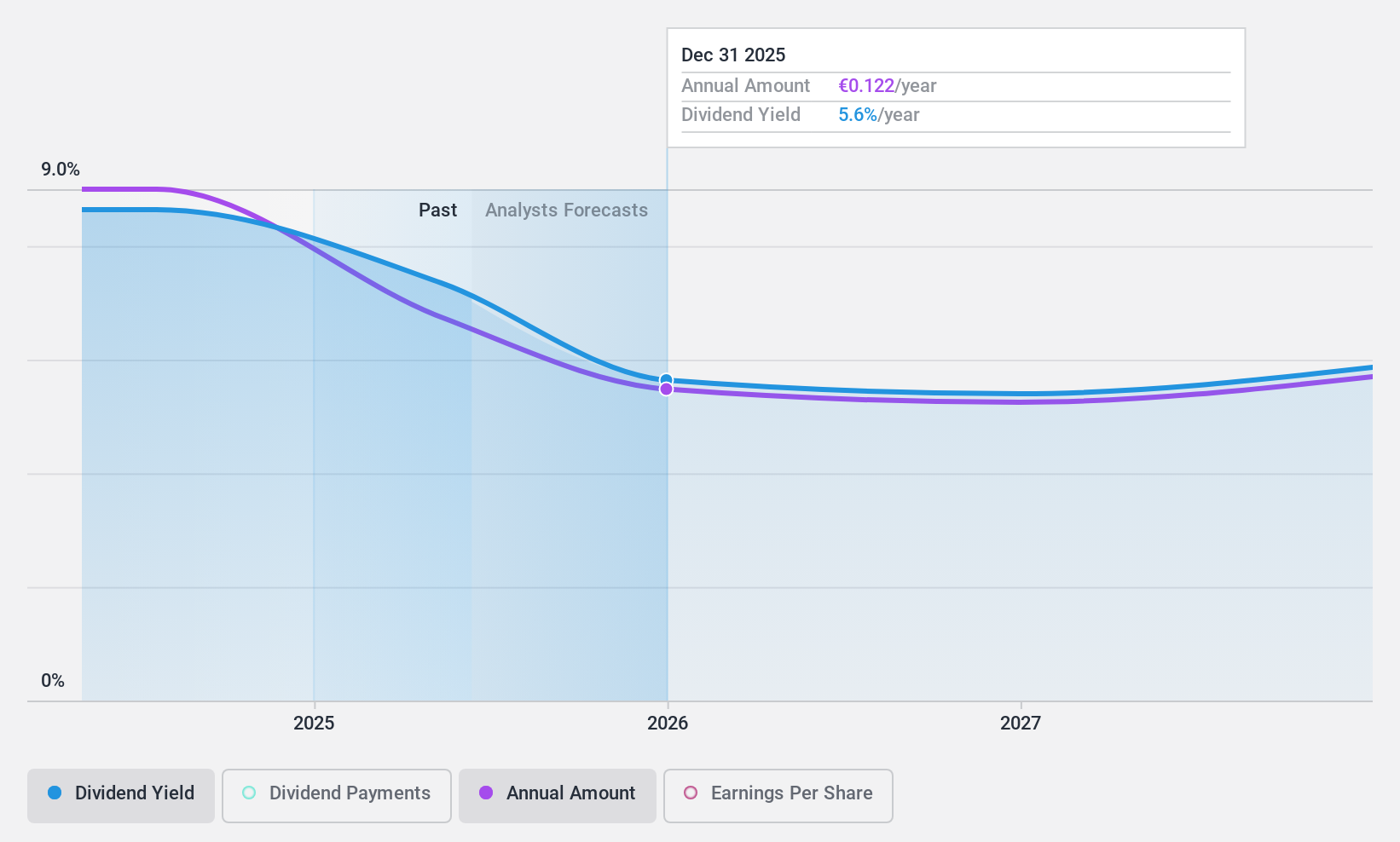

Dividend Yield: 9.8%

Sogefi's recent earnings report shows a decline in both sales and net income for the third quarter, with sales at €242.6 million and net income at €3.7 million, down from last year. Despite this, Sogefi offers a high dividend yield of 9.8%, ranking in the top 25% of Italian dividend payers. The dividends appear sustainable with low payout ratios—33.2% from earnings and 39.9% from cash flows—though it's too early to assess their reliability or growth potential due to the recent initiation of payments.

- Dive into the specifics of Sogefi here with our thorough dividend report.

- The valuation report we've compiled suggests that Sogefi's current price could be quite moderate.

Niterra (TSE:5334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Niterra Co., Ltd. manufactures and sells spark plugs and related products for internal-combustion engines, as well as technical ceramics, both in Japan and internationally, with a market cap of ¥962.43 billion.

Operations: Niterra Co., Ltd.'s revenue primarily comes from its Automobile Connection segment, generating ¥527.37 billion, and its Ceramic (Including Medical-Related) segment, contributing ¥97.70 billion.

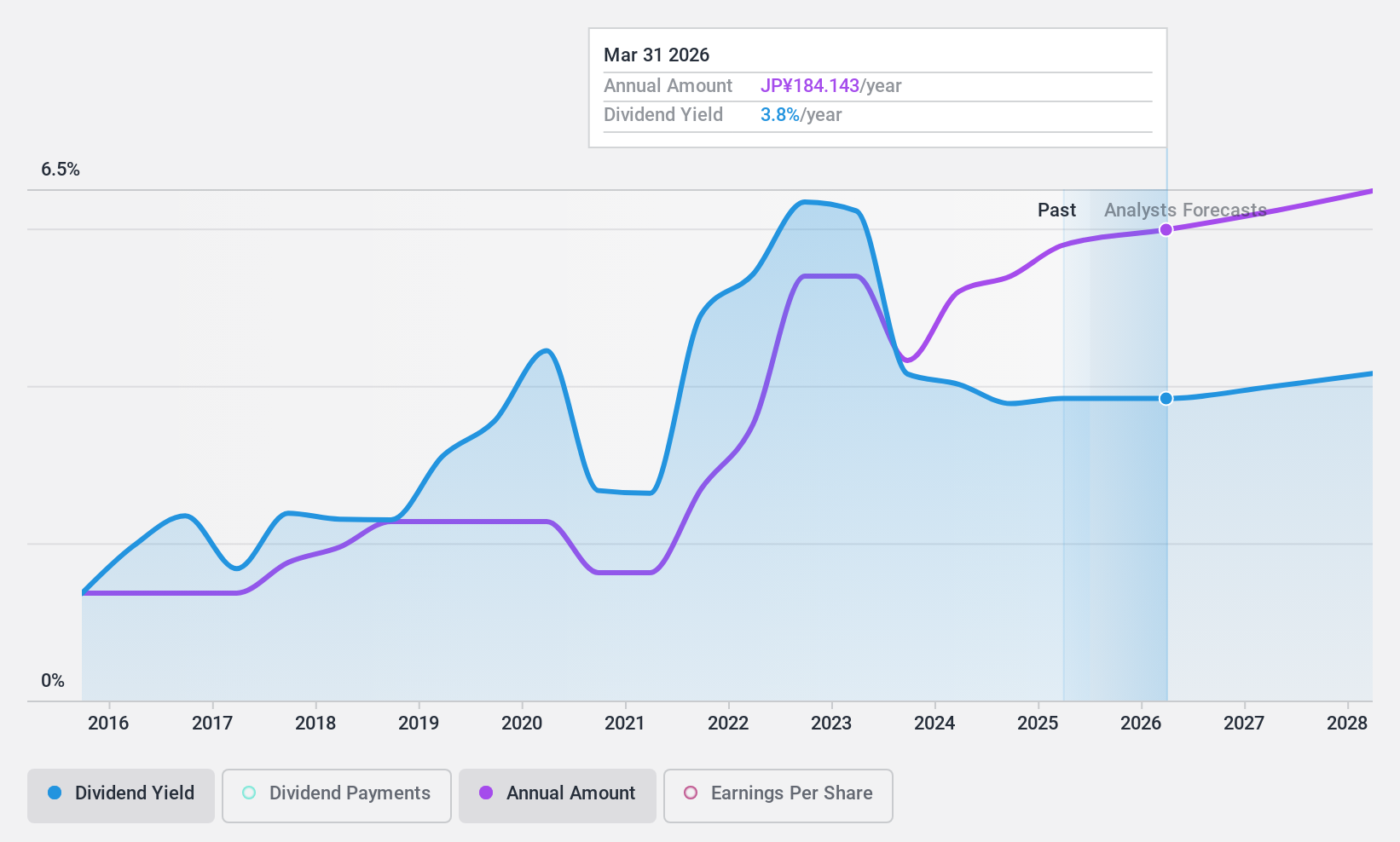

Dividend Yield: 3.7%

Niterra's dividend payments are well-supported by earnings and cash flows, with payout ratios of 39.6% and 35.8%, respectively. Despite a forecasted earnings growth of 6.22% annually, its dividend yield of 3.67% is slightly below the top quartile in Japan's market. The company's dividends have been volatile over the past decade but have shown growth during this period. Niterra trades at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

- Take a closer look at Niterra's potential here in our dividend report.

- Our valuation report unveils the possibility Niterra's shares may be trading at a discount.

Sankyo (TSE:6417)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sankyo Co., Ltd. is a Japanese company that manufactures and sells game machines and ball bearing supply systems, with a market cap of ¥464.61 billion.

Operations: Sankyo Co., Ltd.'s revenue is primarily derived from its Pachinko (Japanese Pinball)-Related Segment, which accounts for ¥102.92 billion, followed by the Pachislo (Slot Machine)-Related Segment contributing ¥49.66 billion.

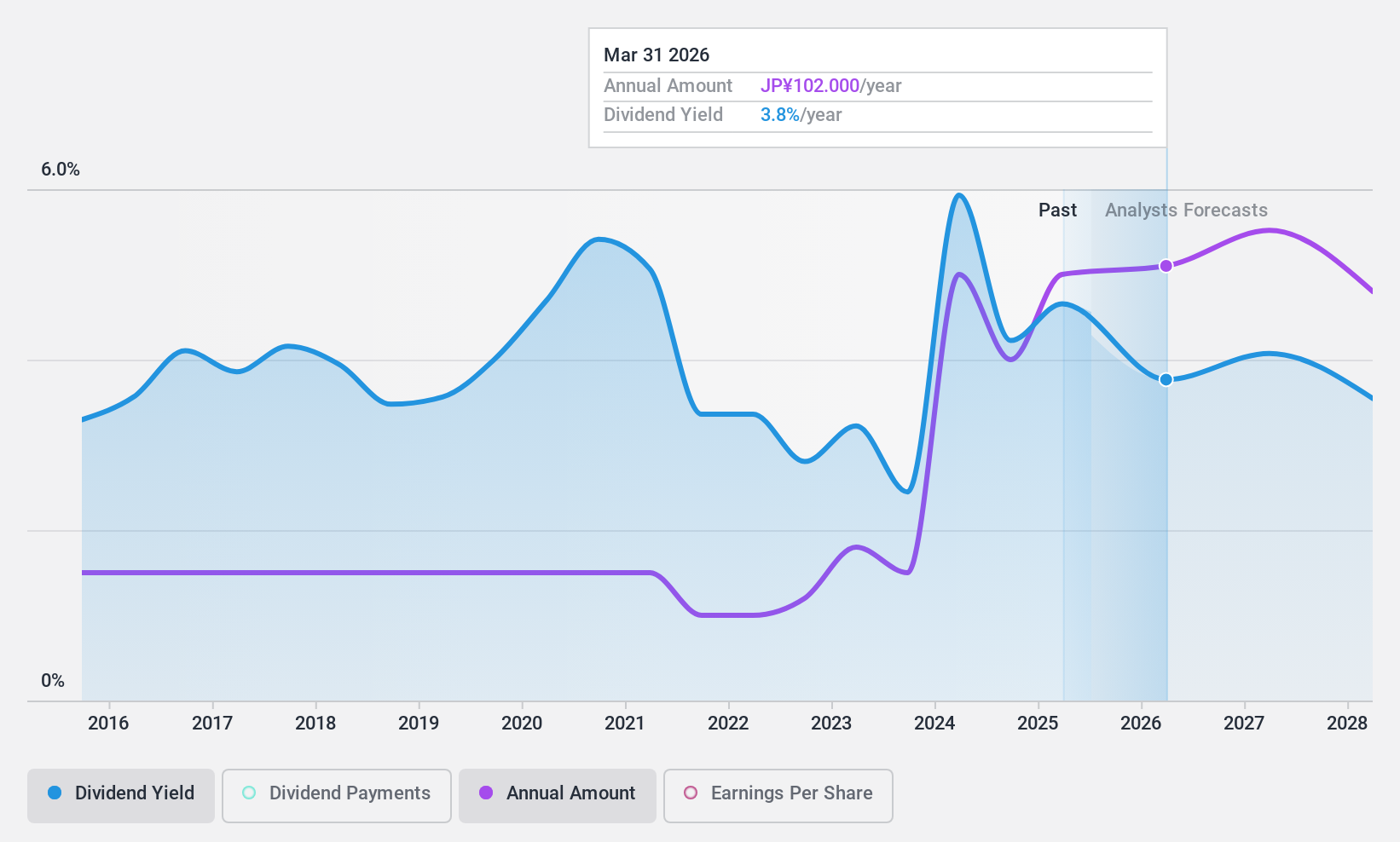

Dividend Yield: 3.8%

Sankyo Co., Ltd. announced a JPY 40.00 per share dividend for the second quarter, supported by earnings and cash flows with low payout ratios of 24.2% and 33.9%, respectively. Despite trading at a significant discount to its fair value, Sankyo's dividends have been unstable over the past decade, showing volatility rather than consistent growth. The dividend yield is relatively low compared to top-tier payers in Japan's market but remains covered by financial metrics.

- Click to explore a detailed breakdown of our findings in Sankyo's dividend report.

- In light of our recent valuation report, it seems possible that Sankyo is trading behind its estimated value.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1936 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry in Europe, South America, North America, and Asia.

Outstanding track record with flawless balance sheet and pays a dividend.