- Japan

- /

- Infrastructure

- /

- TSE:9301

3 Top Japanese Dividend Stocks Yielding Up To 3.7%

Reviewed by Simply Wall St

Japan's stock markets have experienced notable declines recently, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index losing 4.2%, driven by a sell-off in semiconductor stocks and a stronger yen impacting export-oriented companies. Amid these market conditions, investors may find stability in dividend stocks, which can offer consistent income even when market volatility is high. In this context, selecting dividend stocks with strong fundamentals and reliable payout histories becomes crucial for those seeking steady returns amid economic uncertainties.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.25% | ★★★★★★ |

| Globeride (TSE:7990) | 4.37% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.92% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.82% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.06% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.38% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

Click here to see the full list of 469 stocks from our Top Japanese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

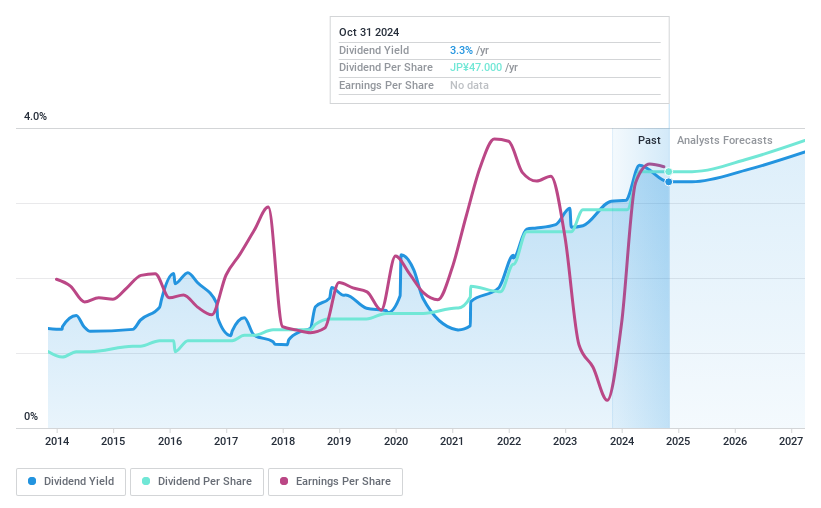

Zeon (TSE:4205)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zeon Corporation operates in the elastomers and specialty materials sectors with a market cap of ¥267.25 billion.

Operations: Zeon Corporation's revenue segments include ¥223.32 billion from the Elastomer Materials Business and ¥112.50 billion from the High-Performance Materials Business.

Dividend Yield: 3.7%

Zeon Corporation's dividend payments have been volatile over the past decade, with notable annual drops exceeding 20%. Despite this, the company's dividends are well covered by earnings (28.4% payout ratio) and cash flows (86.1% cash payout ratio). Recent earnings surged by 334.5%, though future earnings are forecasted to decline slightly. The company recently completed a buyback of 356,900 shares for ¥499.56 million, potentially indicating confidence in its financial stability and shareholder value enhancement strategies.

- Dive into the specifics of Zeon here with our thorough dividend report.

- According our valuation report, there's an indication that Zeon's share price might be on the cheaper side.

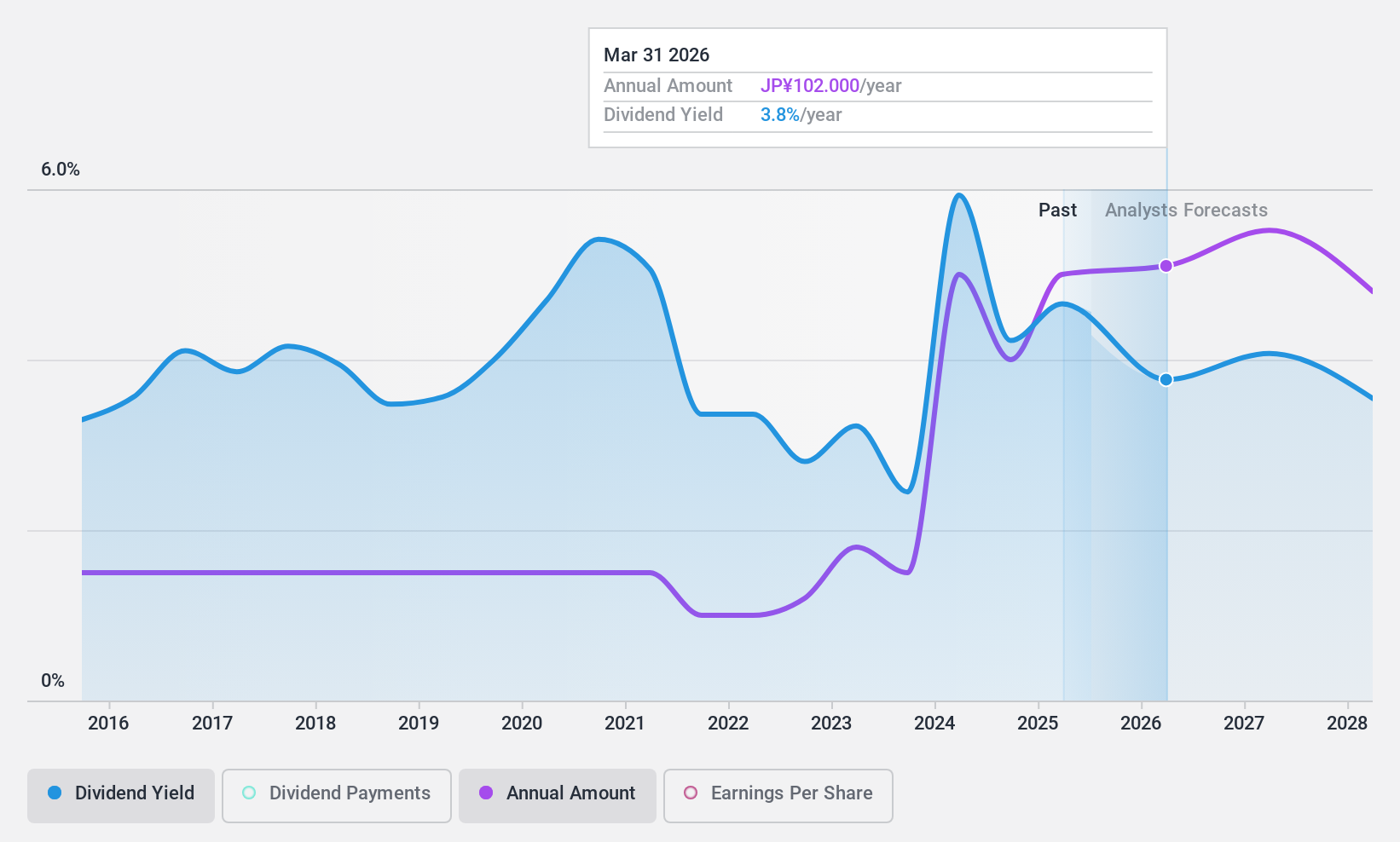

Sankyo (TSE:6417)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sankyo Co., Ltd. manufactures and sells game machines and ball bearing supply systems in Japan, with a market cap of ¥469.55 billion.

Operations: Sankyo Co., Ltd. generates revenue from its Pachinko-related segment (¥130.02 billion), Pachislo-related segment (¥39.70 billion), and Ball Bearing Supply Systems business (¥20.36 billion).

Dividend Yield: 3.7%

Sankyo Co., Ltd. offers a mixed dividend profile with dividends well covered by earnings (37.7% payout ratio) and cash flows (39.3% cash payout ratio). However, its dividend payments have been volatile over the past decade, experiencing significant drops at times. Despite this instability, Sankyo's dividends have grown over the last 10 years. Recent guidance for fiscal year ending March 31, 2025 projects net sales of ¥180 billion and operating income of ¥61 billion, reflecting solid financial health.

- Delve into the full analysis dividend report here for a deeper understanding of Sankyo.

- Our comprehensive valuation report raises the possibility that Sankyo is priced lower than what may be justified by its financials.

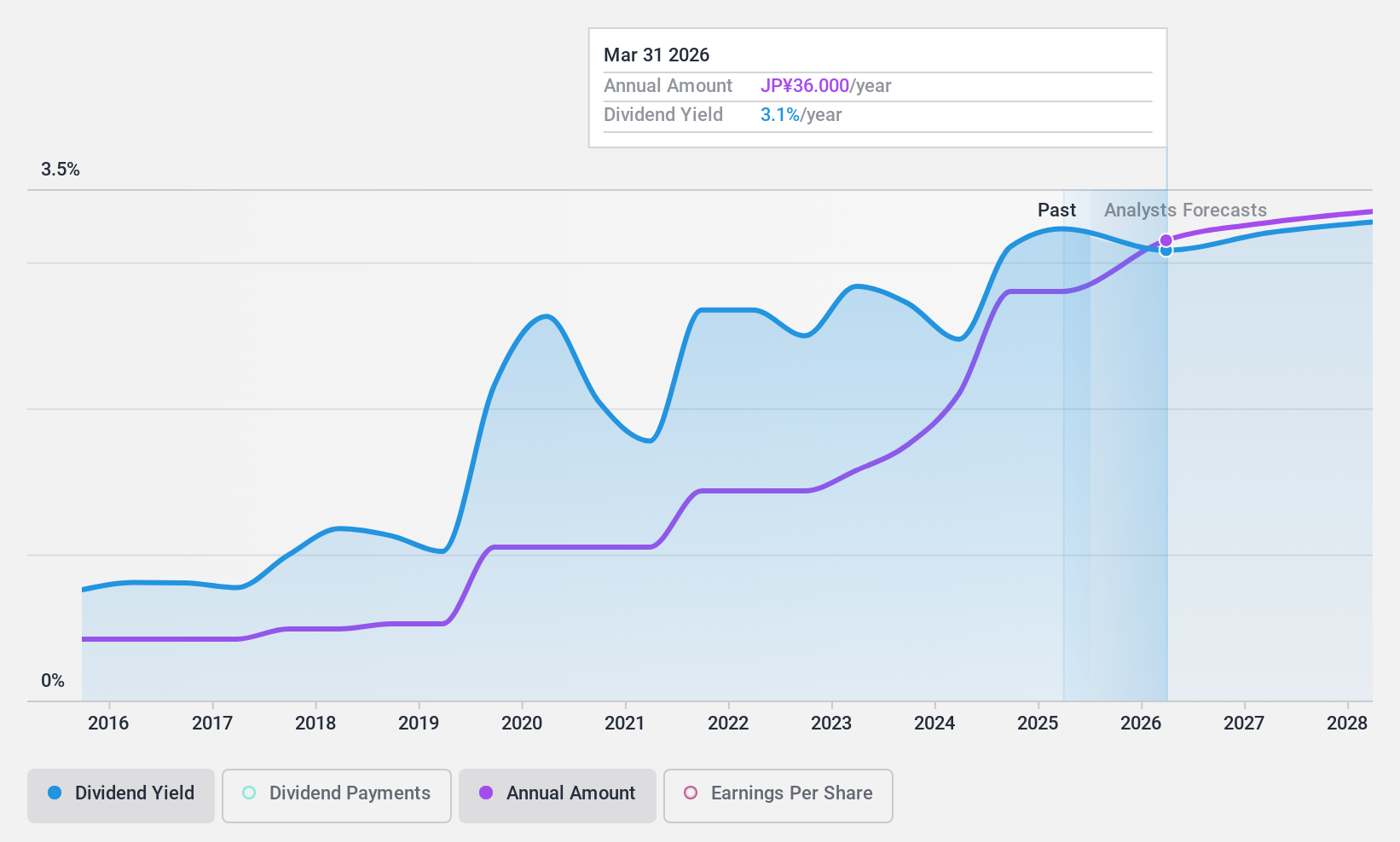

Mitsubishi Logistics (TSE:9301)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Logistics Corporation offers logistic services both in Japan and internationally, with a market cap of ¥393.79 billion.

Operations: Mitsubishi Logistics Corporation's revenue segments include logistics operations and real estate, with logistics services generating ¥188.58 billion and real estate contributing ¥27.68 billion.

Dividend Yield: 3%

Mitsubishi Logistics offers a stable dividend profile with a low payout ratio of 26.2%, ensuring dividends are well-covered by earnings. The company's dividend yield is 3.04%, lower than the top quartile in Japan, but it has maintained reliable and growing dividends over the past decade. Recent buyback activity saw the repurchase of 399,400 shares for ¥2.10 billion, reflecting management's confidence in financial stability despite anticipated earnings declines.

- Get an in-depth perspective on Mitsubishi Logistics' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Mitsubishi Logistics shares in the market.

Next Steps

- Explore the 469 names from our Top Japanese Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9301

Mitsubishi Logistics

Provides logistic services in Japan and internationally.

Excellent balance sheet established dividend payer.