- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8157

Top Dividend Stocks On The Japanese Exchange In July 2024

Reviewed by Simply Wall St

As global markets navigate through fluctuating economic signals, Japan's stock market has shown resilience, particularly intriguing for those interested in dividend stocks. Amidst recent interventions to support the yen and speculation around monetary policy adjustments, investors might find stability and potential income in Japan's dividend-yielding equities.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Takeuchi Mfg (TSE:6432) | 3.64% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.63% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.65% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.49% | ★★★★★★ |

| Globeride (TSE:7990) | 3.81% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.16% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.43% | ★★★★★★ |

| Innotech (TSE:9880) | 3.98% | ★★★★★★ |

Click here to see the full list of 375 stocks from our Top Japanese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Open House Group (TSE:3288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Open House Group Co., Ltd. is a company that operates primarily in the real estate sector, with a market capitalization of approximately ¥650.56 billion.

Operations: Open House Group Co., Ltd. primarily generates its revenue from the real estate sector.

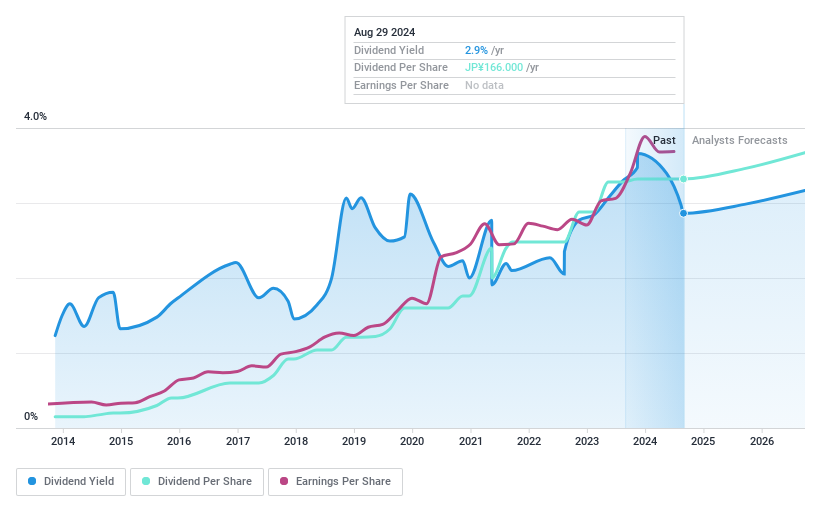

Dividend Yield: 3%

Open House Group maintains a conservative dividend profile with a low payout ratio of 9.9%, ensuring dividends are well-covered by earnings, alongside a cash payout ratio of 71.2%. Despite its modest yield of 3%, the company has demonstrated reliability in its dividend payments over the past decade. Recent corporate activities include significant share buybacks, with ¥3,337.5 million spent to repurchase shares as part of an ongoing strategy to enhance shareholder value, reflecting solid financial health and commitment to returning capital to shareholders.

- Click here and access our complete dividend analysis report to understand the dynamics of Open House Group.

- Our comprehensive valuation report raises the possibility that Open House Group is priced lower than what may be justified by its financials.

Nice (TSE:8089)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nice Corporation, with a market cap of ¥23.83 billion, operates in the importation, distribution, and sale of building materials for housing across Japan and internationally.

Operations: Nice Corporation generates its revenue primarily through the importation, distribution, and sale of building materials for housing markets both domestically and abroad.

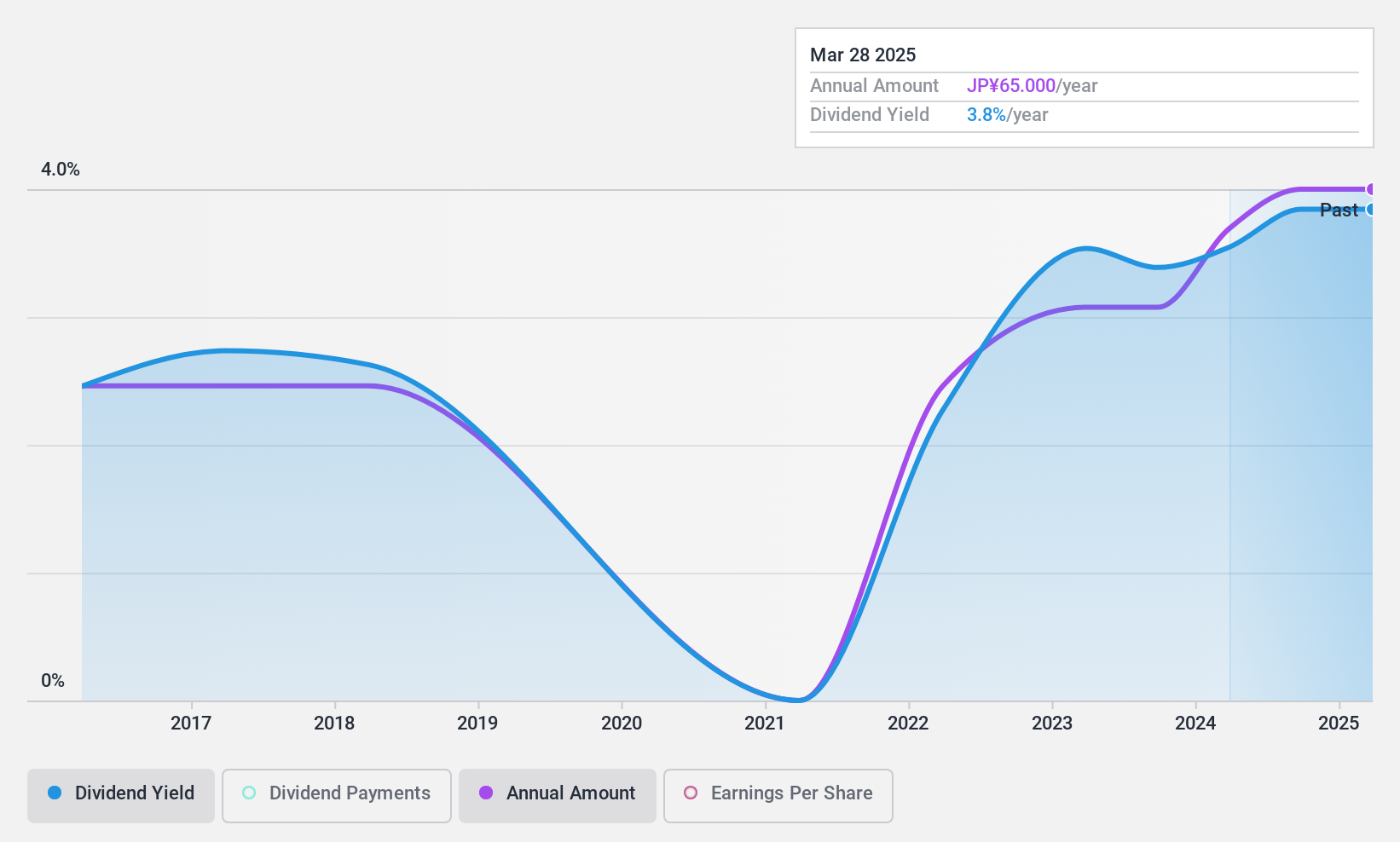

Dividend Yield: 3.2%

Nice Corporation, trading significantly below its fair value, offers a conservative dividend profile with a payout ratio of 14.4%, ensuring dividends are well-covered by both earnings and cash flows (cash payout ratio: 11.1%). However, the company's dividend yield at 3.22% remains below the top quartile in Japan's market and has experienced volatility over the past decade without consistent growth, reflecting some instability in its dividend policy despite recent financial improvements.

- Unlock comprehensive insights into our analysis of Nice stock in this dividend report.

- The valuation report we've compiled suggests that Nice's current price could be quite moderate.

Tsuzuki Denki (TSE:8157)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tsuzuki Denki Co., Ltd. specializes in the design, development, construction, and maintenance of network and information systems, with a market capitalization of approximately ¥46.84 billion.

Operations: Tsuzuki Denki Co., Ltd. generates its revenue primarily from the design, development, construction, and maintenance of network and information systems.

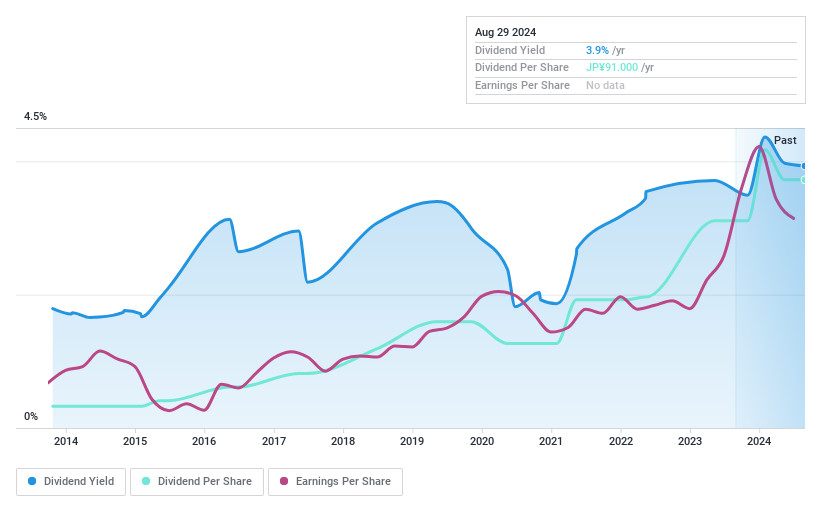

Dividend Yield: 3.5%

Tsuzuki Denki has maintained a low payout ratio of 19.7%, ensuring that dividends are comfortably covered by earnings, with a further safety net provided by a cash payout ratio of 39.4%. Despite this strong coverage, the company's dividend history shows volatility and unreliability over the past decade. Earnings have increased by 55.6% over the last year, supporting potential future dividend stability. Currently, its dividend yield stands at 3.5%, positioning it among the top quartile of Japanese dividend payers.

- Click here to discover the nuances of Tsuzuki Denki with our detailed analytical dividend report.

- Our valuation report unveils the possibility Tsuzuki Denki's shares may be trading at a discount.

Seize The Opportunity

- Dive into all 375 of the Top Japanese Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuzuki Denki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8157

Tsuzuki Denki

Engages in the design, development, construction, and maintenance of network and information systems.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives