As global markets navigate a complex landscape of interest rate changes, AI competition fears, and fluctuating earnings reports, investors are seeking stability amid volatility. In this environment, dividend stocks often appeal due to their potential for providing regular income and resilience against market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. produces and markets professional loudspeakers under the B&C brand both in Italy and internationally, with a market cap of €175.73 million.

Operations: B&C Speakers S.p.A. generates its revenue primarily from the Acoustic Transducers segment, which accounts for €99.40 million.

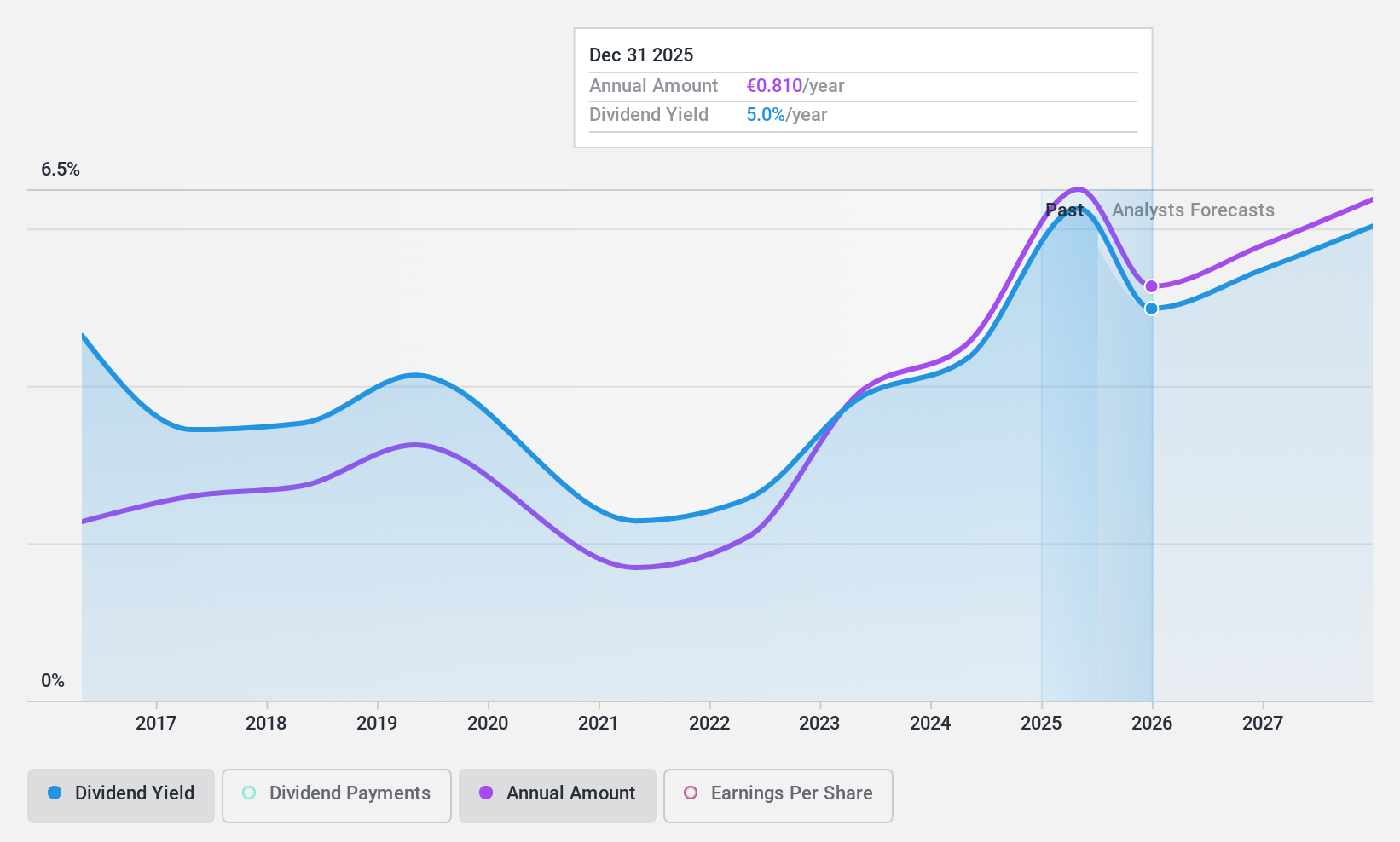

Dividend Yield: 4.4%

B&C Speakers offers a mixed dividend profile. While its payout ratios—44.1% from earnings and 50.8% from cash flow—indicate sustainable dividends, the company has an unstable dividend history with volatility over the past decade. Recent earnings growth of €15.78 million for nine months ended September 2024 suggests financial strength, yet its 4.38% yield is below top-tier Italian market payers, and dividends have been unreliable despite some growth over ten years.

- Navigate through the intricacies of B&C Speakers with our comprehensive dividend report here.

- Our valuation report unveils the possibility B&C Speakers' shares may be trading at a discount.

Japan Wool Textile (TSE:3201)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Japan Wool Textile Co., Ltd. operates in the textile industry in Japan with a market cap of ¥93.65 billion.

Operations: Japan Wool Textile Co., Ltd. generates revenue through its Clothing Textile Business (¥32.02 billion), Industrial Equipment Business (¥30.99 billion), Current Lifestyle segment (¥22.59 billion), and People and Future Development Project (¥27.29 billion).

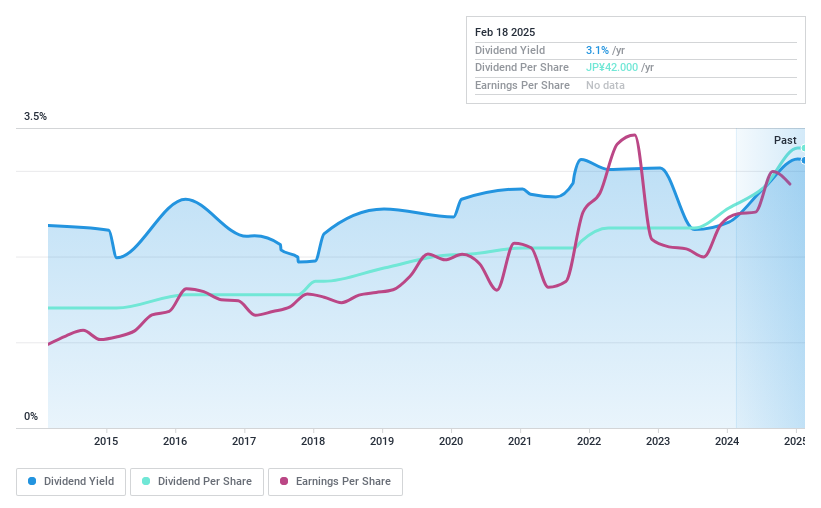

Dividend Yield: 3.1%

Japan Wool Textile's dividend profile is supported by a low payout ratio of 30.7% from earnings and 57.4% from cash flow, indicating sustainability. The company has consistently increased dividends over the past decade, with recent hikes to ¥24 per share for fiscal year-end 2024 and guidance for further increases in 2025. Despite a yield of 3.09%, which is below top-tier Japanese market payers, its stable dividend history enhances reliability for investors seeking income stability.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Wool Textile.

- The analysis detailed in our Japan Wool Textile valuation report hints at an deflated share price compared to its estimated value.

Musashino Bank (TSE:8336)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers banking products and financial services in Japan and has a market capitalization of ¥105.36 billion.

Operations: The Musashino Bank, Ltd. generates revenue through its primary segments: Banking with ¥65.01 billion, Leasing Business at ¥10.93 billion, and Credit Guarantee Business contributing ¥1.53 billion.

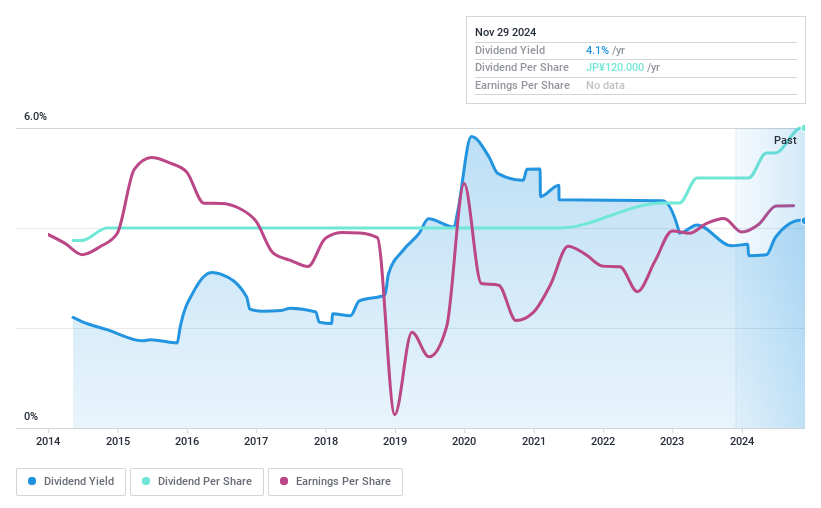

Dividend Yield: 3.8%

Musashino Bank offers a stable dividend profile, with dividends per share remaining consistent over the past decade. Despite a relatively low yield of 3.77%, slightly below top-tier Japanese payers, the bank's dividend is well-covered by earnings due to a low payout ratio of 29.2%. Earnings have grown at an annual rate of 8.3% over five years, supporting potential future payouts. However, there's insufficient data to assess long-term sustainability or coverage beyond three years.

- Get an in-depth perspective on Musashino Bank's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Musashino Bank is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 1960 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3201

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives