- Japan

- /

- Wireless Telecom

- /

- TSE:9433

3 Top Dividend Stocks Offering Up To 5.9% Yield

Reviewed by Simply Wall St

As global markets react to political developments and economic shifts, U.S. stocks have been marching toward record highs, buoyed by optimism around trade policies and advancements in artificial intelligence infrastructure. Amidst this backdrop of growth and change, investors are increasingly drawn to dividend stocks that offer stable income streams, especially as they navigate the complexities of a dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

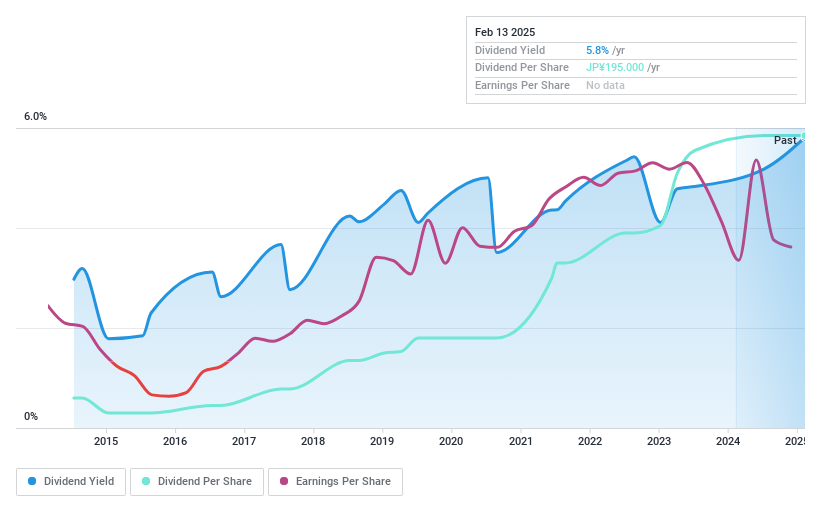

Tama Home (TSE:1419)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tama Home Co., Ltd. operates in Japan, focusing on construction, architectural design, real estate, and insurance agency services with a market cap of ¥91.02 billion.

Operations: Tama Home Co., Ltd.'s revenue is primarily derived from its Housing Business at ¥168.60 billion, followed by the Real Estate Business at ¥52.93 billion, with additional contributions from the Financial Business and Energy Business segments at ¥975 million and ¥814 million respectively.

Dividend Yield: 6%

Tama Home's dividend yield of 5.96% is attractive, ranking in the top 25% of JP market payers. However, dividends have been volatile and not consistently growing over the past decade. The high payout ratio of 110.8% indicates dividends are not well covered by earnings, though they are supported by cash flows with a reasonable cash payout ratio of 51.2%. Despite trading below estimated fair value, sustainability concerns persist due to earnings coverage issues.

- Delve into the full analysis dividend report here for a deeper understanding of Tama Home.

- Our expertly prepared valuation report Tama Home implies its share price may be too high.

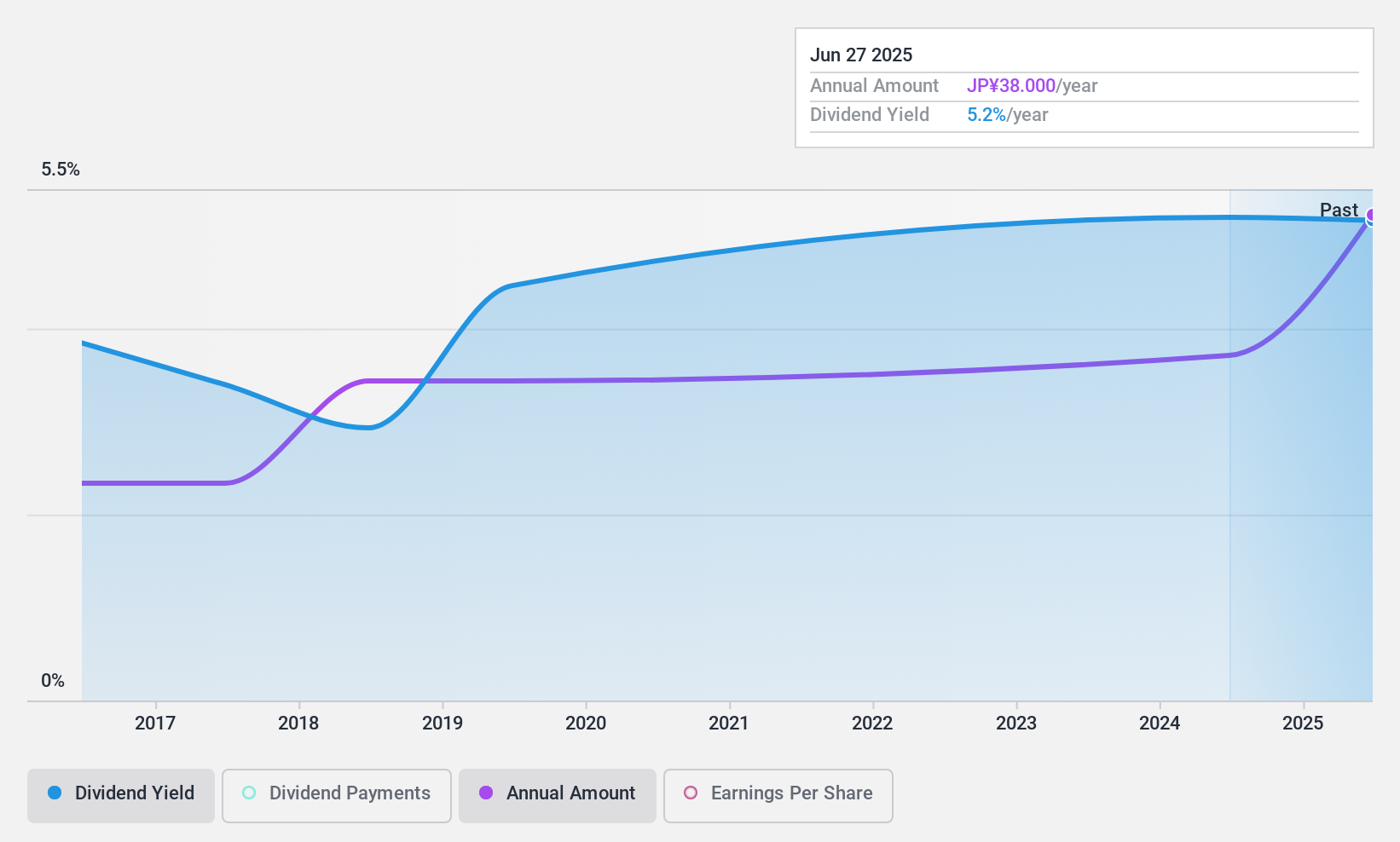

Global (TSE:3271)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ltd., with a market cap of ¥17.97 billion, operates through its subsidiaries in Japan, focusing on the development of condominiums, apartment complexes, earning properties, commercial facilities, hotels, and various other properties.

Operations: Global Ltd.'s revenue is primarily derived from its Income Property Business, which generates ¥9.64 billion, followed by the Sales Agency Business at ¥1.34 billion, the Hotel Business at ¥468 million, and the Building Management Business contributing ¥507 million.

Dividend Yield: 5.7%

Global's dividend yield of 5.66% is among the top 25% in Japan, but its payments have been volatile and unreliable over the past decade. Despite a low payout ratio of 27.1%, dividends are not covered by free cash flows, raising sustainability concerns. The company's earnings grew significantly by 48.6% last year, yet debt coverage remains an issue due to insufficient operating cash flow. Its price-to-earnings ratio of 6.3x suggests undervaluation compared to the market average.

- Take a closer look at Global's potential here in our dividend report.

- The valuation report we've compiled suggests that Global's current price could be inflated.

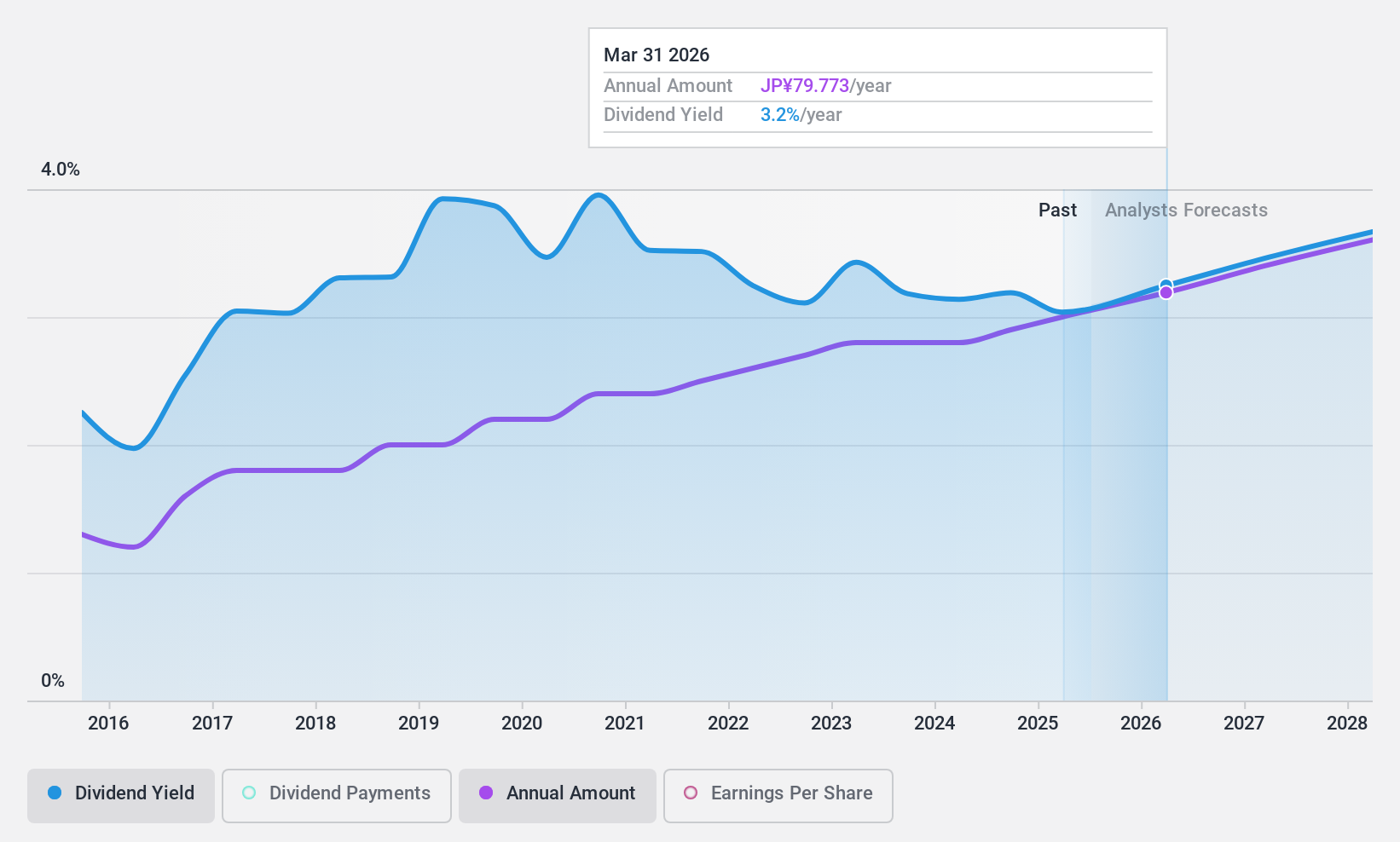

KDDI (TSE:9433)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KDDI Corporation provides telecommunications services both in Japan and internationally, with a market cap of ¥9.78 trillion.

Operations: KDDI Corporation's revenue is primarily derived from its Personal segment, generating ¥4.75 trillion, and its Business segment, contributing ¥1.35 trillion.

Dividend Yield: 2.9%

KDDI's dividend yield of 2.94% is below the top 25% in Japan, yet its payout ratio of 46.7% indicates dividends are well-covered by earnings and cash flows, with a cash payout ratio at just 24%. Despite past volatility and an unstable track record, dividends have grown over the last decade. Recent share buybacks totaling ¥39.63 billion and fixed-income offerings suggest strategic capital management aimed at enhancing shareholder value amidst evolving market conditions.

- Dive into the specifics of KDDI here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that KDDI is priced lower than what may be justified by its financials.

Summing It All Up

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KDDI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9433

KDDI

Engages in the provision of telecommunications services in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives