Those Who Purchased Festaria Holdings (TYO:2736) Shares Five Years Ago Have A 73% Loss To Show For It

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Anyone who held Festaria Holdings Co., Ltd. (TYO:2736) for five years would be nursing their metaphorical wounds since the share price dropped 73% in that time. We also note that the stock has performed poorly over the last year, with the share price down 41%. The falls have accelerated recently, with the share price down 40% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Festaria Holdings

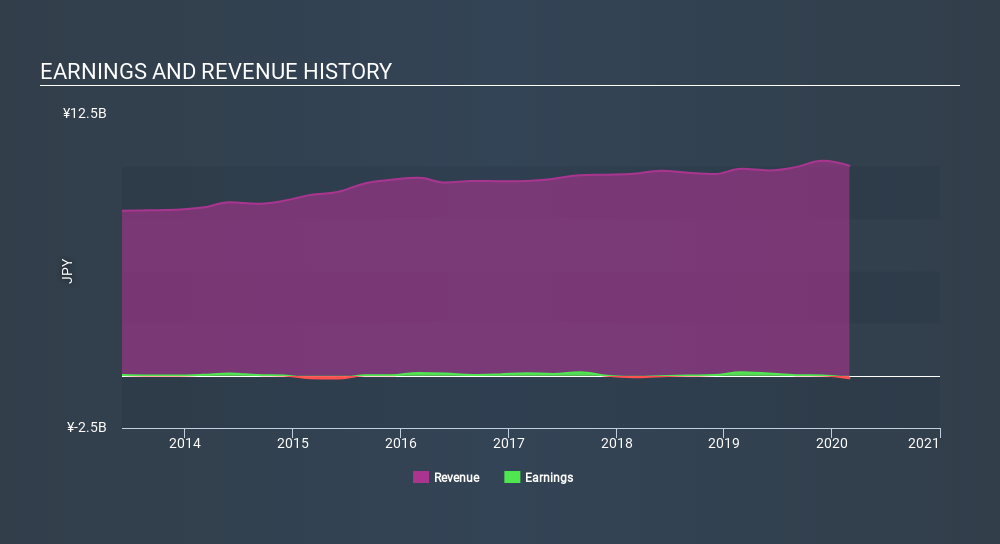

Given that Festaria Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Festaria Holdings saw its revenue increase by 2.5% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 23% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Festaria Holdings shareholders are down 40% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 2.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 22% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Festaria Holdings better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Festaria Holdings (including 1 which is is a bit concerning) .

Of course Festaria Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSE:2736

Festaria Holdings

Through its subsidiaries, engages in the manufacture and sale of jewelry products and accessories.

Solid track record and good value.

Market Insights

Community Narratives