- Japan

- /

- Semiconductors

- /

- TSE:6871

Undiscovered Gems To Watch This February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, major U.S. stock indexes are approaching record highs, with growth stocks outpacing their value counterparts. Despite small-cap stocks lagging behind larger indices like the S&P 500, this environment presents a unique opportunity to identify promising small-cap companies that may be undervalued or overlooked. In such a dynamic market landscape, finding undiscovered gems requires focusing on companies with strong fundamentals and potential for growth amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Fauji Foods | 62.10% | 30.05% | 58.43% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Philippine Trust (PSE:PTC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Philippine Trust Company offers domestic and international banking and trust services, with a market capitalization of ₱98.05 billion.

Operations: Philippine Trust Company's revenue is primarily derived from its domestic and international banking and trust services. The company has a market capitalization of ₱98.05 billion.

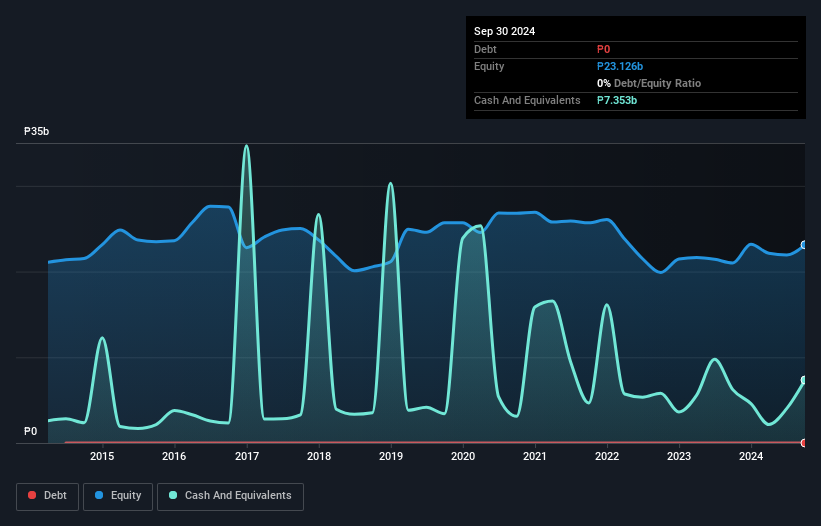

Philippine Trust, a smaller player in the banking sector, showcases total assets of ₱178 billion and equity at ₱23.1 billion. Despite its net interest margin of 2.1%, the bank faces challenges with a high bad loans ratio of 15% against total loans of ₱28 billion. Its liabilities are largely low-risk, sourced from customer deposits totaling ₱153.3 billion, which is reassuring for stability. Recent leadership changes include appointing Joseph F. Monzon as Chief Risk Officer to bolster risk management strategies amid earnings growth averaging 3.7% annually over five years but lagging behind industry peers last year at 15%.

- Navigate through the intricacies of Philippine Trust with our comprehensive health report here.

Evaluate Philippine Trust's historical performance by accessing our past performance report.

Micronics Japan (TSE:6871)

Simply Wall St Value Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. specializes in the development, manufacturing, and sale of body measuring instruments as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥150.50 billion.

Operations: Micronics Japan generates revenue primarily from the sale of body measuring instruments and semiconductor and liquid crystal display inspection equipment. The company has a market capitalization of ¥150.50 billion.

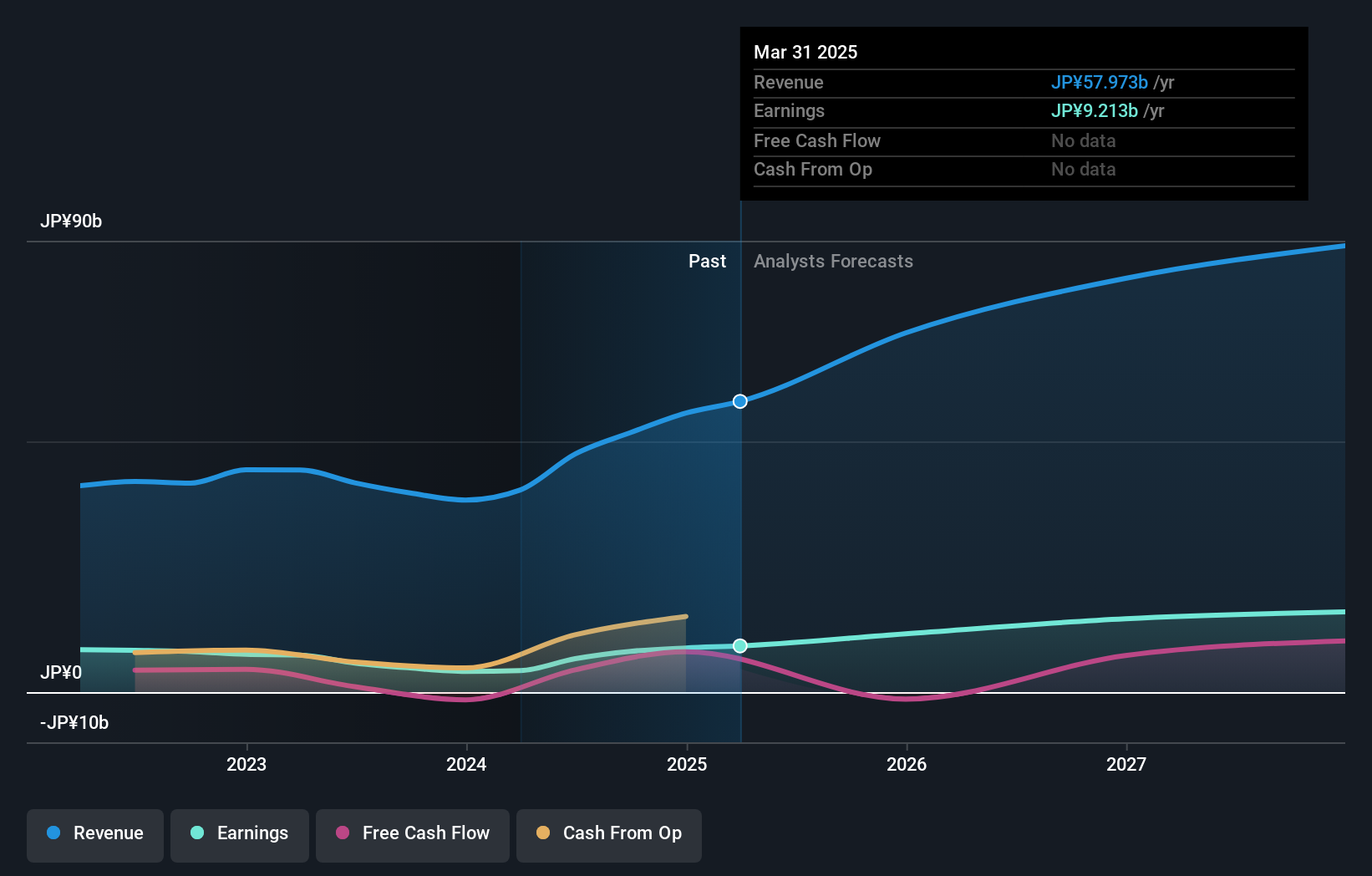

Micronics Japan, a burgeoning player in the semiconductor industry, has shown impressive financial resilience. Over the past year, its earnings surged by 114%, outpacing the industry's 23% growth. The company is trading at a significant discount of 56% below its estimated fair value, suggesting potential undervaluation. Its debt to equity ratio improved markedly from 8% to just over 2% in five years, indicating effective debt management. Despite recent share price volatility, Micronics maintains high-quality earnings and generates positive free cash flow, positioning it favorably for future growth within this dynamic sector.

- Delve into the full analysis health report here for a deeper understanding of Micronics Japan.

Review our historical performance report to gain insights into Micronics Japan's's past performance.

Aeon Delight (TSE:9787)

Simply Wall St Value Rating: ★★★★★★

Overview: Aeon Delight Co., Ltd. is a facility management services company operating in Japan, China, and the ASEAN region with a market capitalization of ¥1.93 trillion.

Operations: The company's revenue is primarily derived from Facilities Management, Cleaning Services, and Construction Work, with ¥73.91 billion, ¥72.46 billion, and ¥60.67 billion respectively. Other significant contributors include Security Services at ¥53.02 billion and Materials-Related Business at ¥48.03 billion.

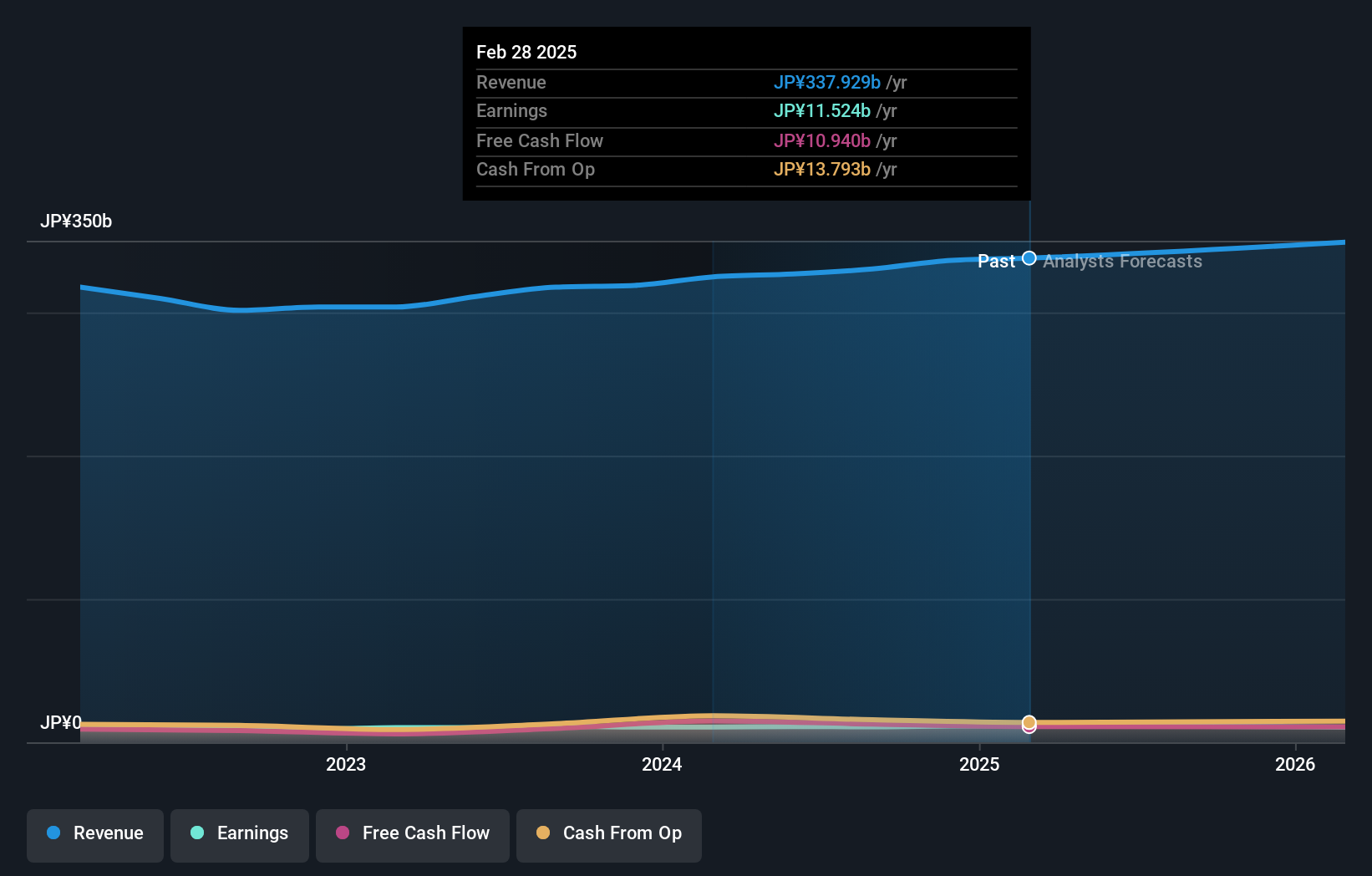

Aeon Delight, a notable player in the commercial services sector, has seen its earnings grow at 1.9% annually over the past five years, though it lags behind industry growth of 11.1%. The company trades at an enticing 11.4% discount to its estimated fair value and maintains high-quality earnings with more cash than total debt. Recently, Aeon Delight renewed a significant Master Services Agreement with AEON Stores (Hong Kong) for three years starting January 2025. Additionally, they completed a share buyback program repurchasing 700,000 shares for ¥2.79 billion by December 2024's end.

- Click here to discover the nuances of Aeon Delight with our detailed analytical health report.

Assess Aeon Delight's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 4713 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring instruments, semiconductor, and liquid crystal display inspection equipment worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives