- Japan

- /

- Commercial Services

- /

- TSE:9768

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and concerns about consumer spending, global markets have experienced volatility, with major indices like the S&P 500 and Dow Jones Industrial Average seeing declines. In such uncertain times, dividend stocks can offer a measure of stability to investors' portfolios by providing regular income streams, making them an appealing option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.67% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Khonburi Sugar (SET:KBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Khonburi Sugar Public Company Limited manufactures and distributes sugar in Thailand, Asia, Europe, and internationally with a market cap of THB3.68 billion.

Operations: Khonburi Sugar Public Company Limited generates its revenue primarily from the manufacture and distribution of sugar across Thailand, Asia, Europe, and other international markets.

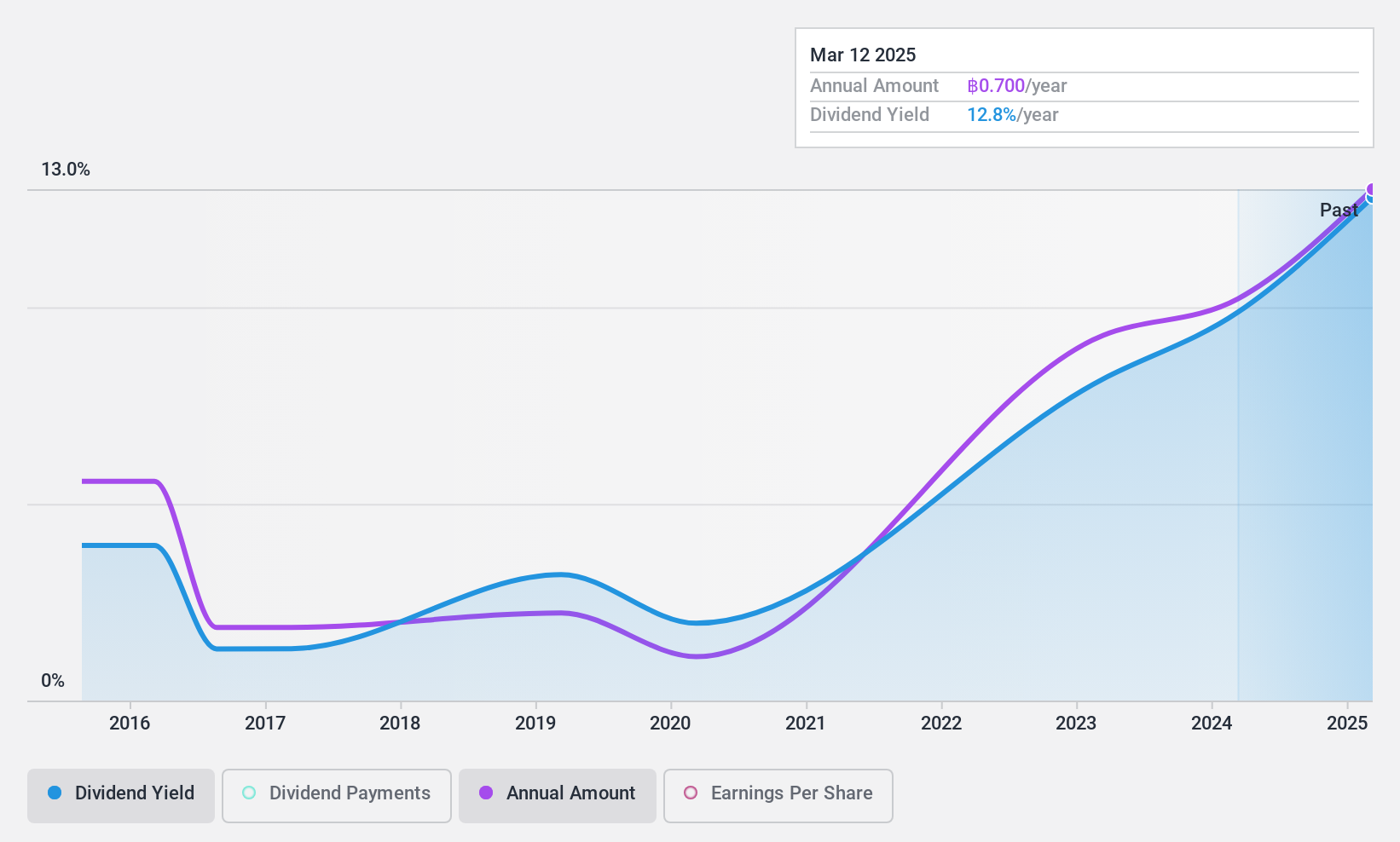

Dividend Yield: 8.9%

Khonburi Sugar's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 27.2% and a cash payout ratio of 29.3%. The company recently proposed a THB 0.70 per share dividend for 2024, reflecting its strong earnings growth despite slightly declining revenue. Trading significantly below estimated fair value, KBS offers an attractive yield in the top tier of the Thai market, though its historical dividend stability has been volatile due to past fluctuations.

- Navigate through the intricacies of Khonburi Sugar with our comprehensive dividend report here.

- The analysis detailed in our Khonburi Sugar valuation report hints at an deflated share price compared to its estimated value.

Rix (TSE:7525)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rix Corporation, with a market cap of ¥24.16 billion, manufactures and sells machinery equipment and industrial materials in Japan.

Operations: Rix Corporation's revenue is primarily derived from its segments in Steel and Iron (¥14.99 billion), Automobile (¥11.59 billion), Electronics and Semiconductor (¥7.05 billion), Rubber/Tire (¥3.74 billion), Environment (¥2.88 billion), Highly Functional Materials (¥2.49 billion), Machine Tools (¥2.29 billion), and Paper and Pulp (¥1.04 billion).

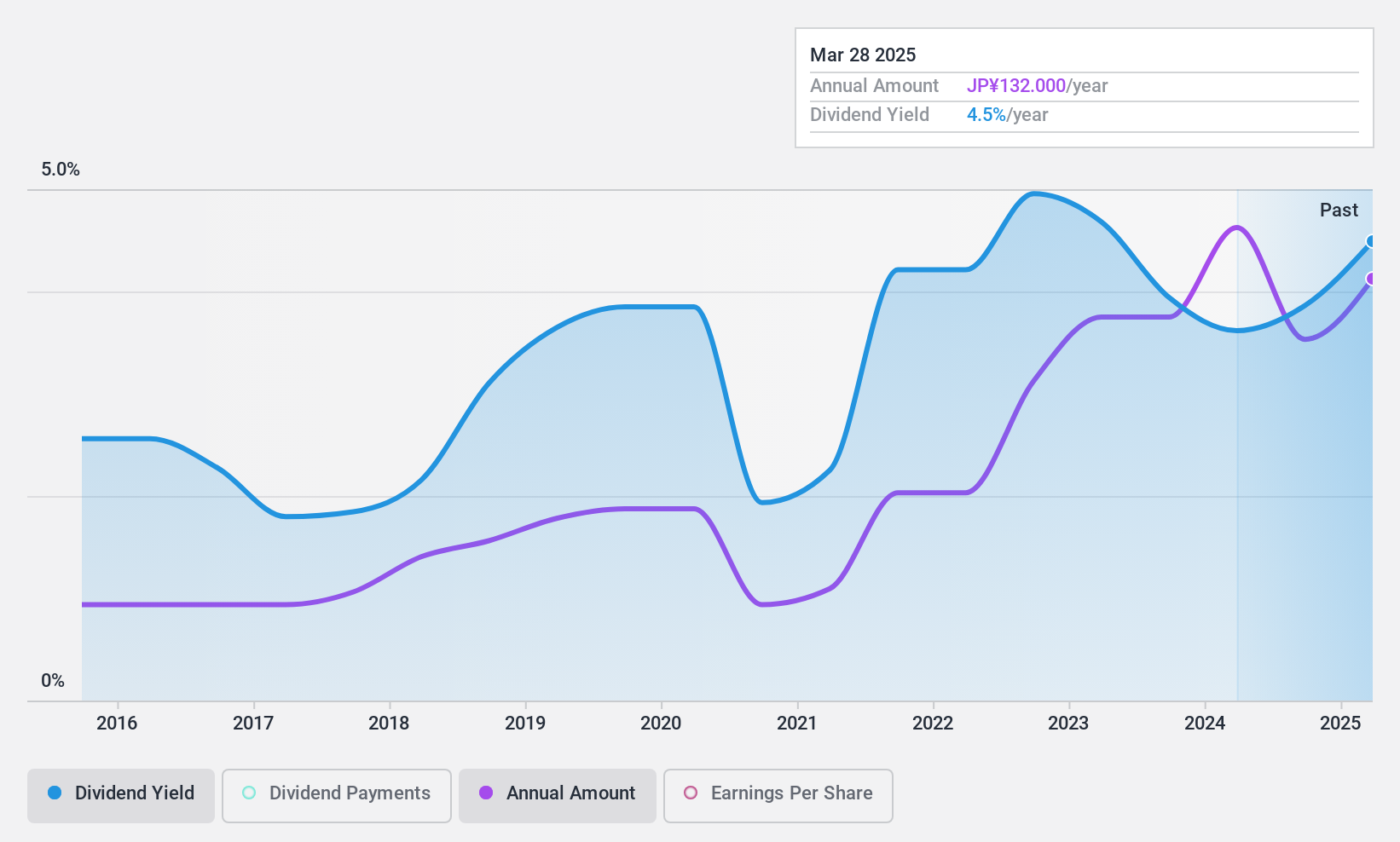

Dividend Yield: 4.4%

Rix Corporation's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 39.3% and a cash payout ratio of 57%. The company revised its year-end dividend guidance upward to JPY 79 per share, resulting in an annual dividend of JPY 132 per share. Despite trading at a significant discount to fair value and offering a top-tier yield in Japan, Rix has an unstable dividend track record due to past volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of Rix.

- Our valuation report here indicates Rix may be undervalued.

IDEA ConsultantsInc (TSE:9768)

Simply Wall St Dividend Rating: ★★★★★★

Overview: IDEA Consultants, Inc. offers integrated consultancy services focused on social infrastructure development and environmental conservation projects both in Japan and internationally, with a market cap of ¥19.05 billion.

Operations: IDEA Consultants, Inc. generates revenue through its Environmental Consulting Business (¥15.73 billion), Construction Consulting Business (¥7.33 billion), Information System Business (¥599.43 million), Real Estate Business (¥244.40 million), and Overseas Segment (¥503.03 million).

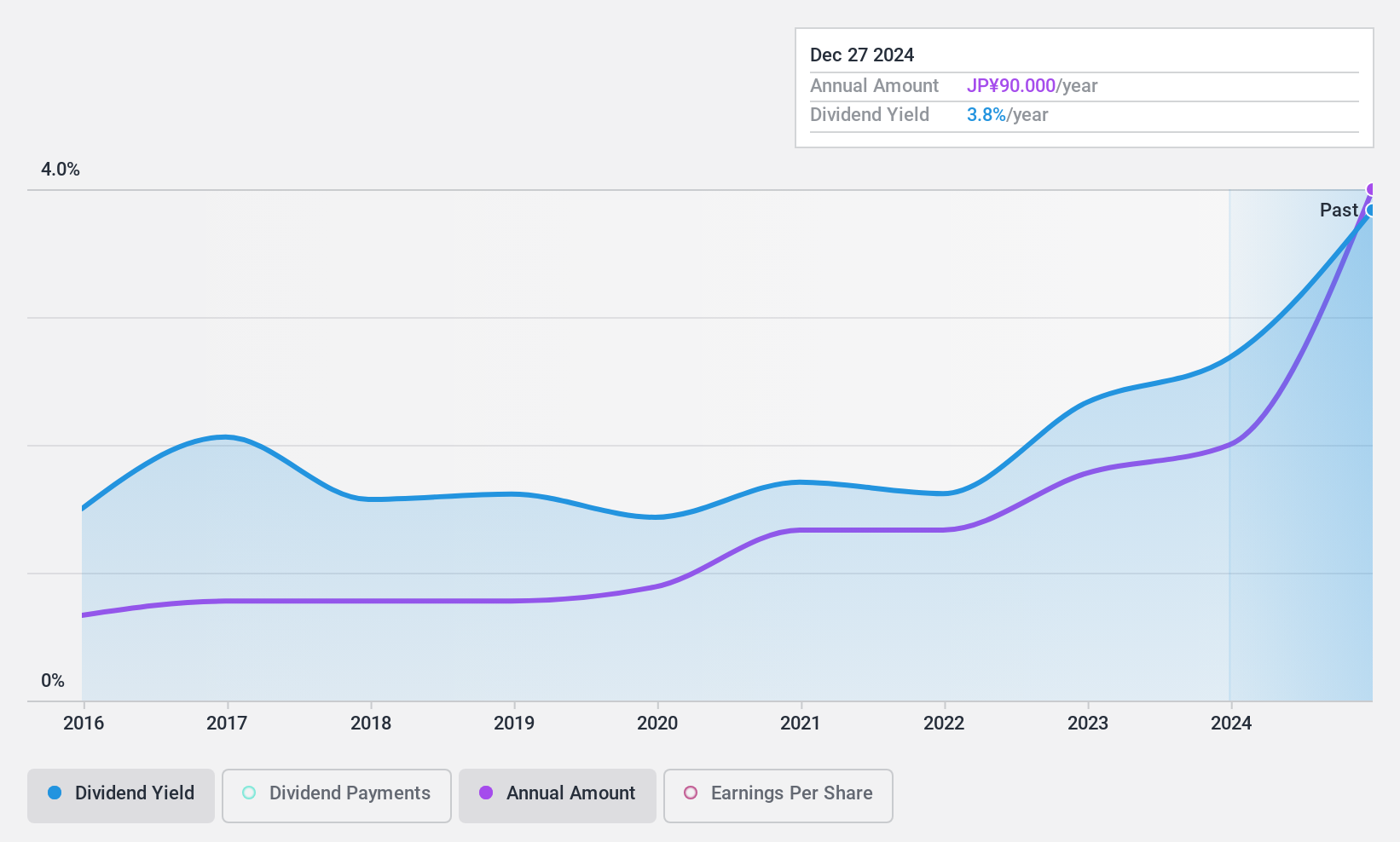

Dividend Yield: 4.4%

IDEA Consultants Inc. offers a high and stable dividend yield of 4.42%, ranking in the top 25% among Japanese dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 18.3% and 30.2% respectively, ensuring sustainability. Trading at a significant discount to its estimated fair value enhances its appeal for value investors, while consistent earnings growth further supports its reliable dividend history over the past decade.

- Click to explore a detailed breakdown of our findings in IDEA ConsultantsInc's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of IDEA ConsultantsInc shares in the market.

Taking Advantage

- Click here to access our complete index of 2013 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9768

IDEA ConsultantsInc

Provides integrated consultancy services on social infrastructure development and environmental conservation projects in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives