As global markets navigate a landscape marked by fluctuating interest rates and geopolitical uncertainties, investors are keenly observing how these dynamics impact corporate earnings and stock performance. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, even when market volatility is high. In this environment, selecting dividend stocks with strong fundamentals and resilient business models can be a prudent strategy for maintaining portfolio stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

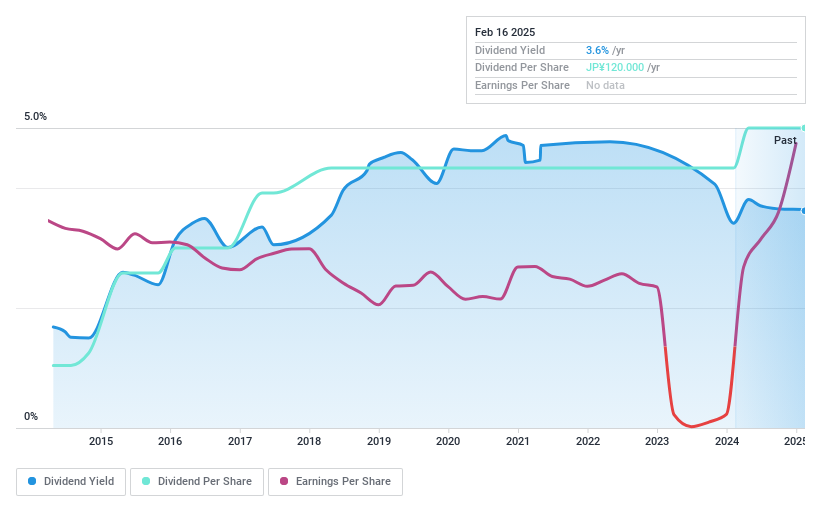

Chudenko (TSE:1941)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chudenko Corporation is an equipment engineering company in Japan with a market cap of ¥175.43 billion.

Operations: Chudenko Corporation's revenue segments include electrical work, telecommunications work, and civil engineering work.

Dividend Yield: 3.7%

Chudenko offers a stable dividend yield of 3.71%, with dividends reliably growing over the past decade. The company's payout ratio is low at 14%, indicating strong coverage by earnings, while an 80.2% cash payout ratio suggests dividends are adequately supported by cash flows. Recent share buybacks totaling ¥1.65 billion aim to enhance shareholder returns and capital efficiency, reflecting a commitment to returning value to investors alongside its consistent dividend strategy.

- Unlock comprehensive insights into our analysis of Chudenko stock in this dividend report.

- In light of our recent valuation report, it seems possible that Chudenko is trading beyond its estimated value.

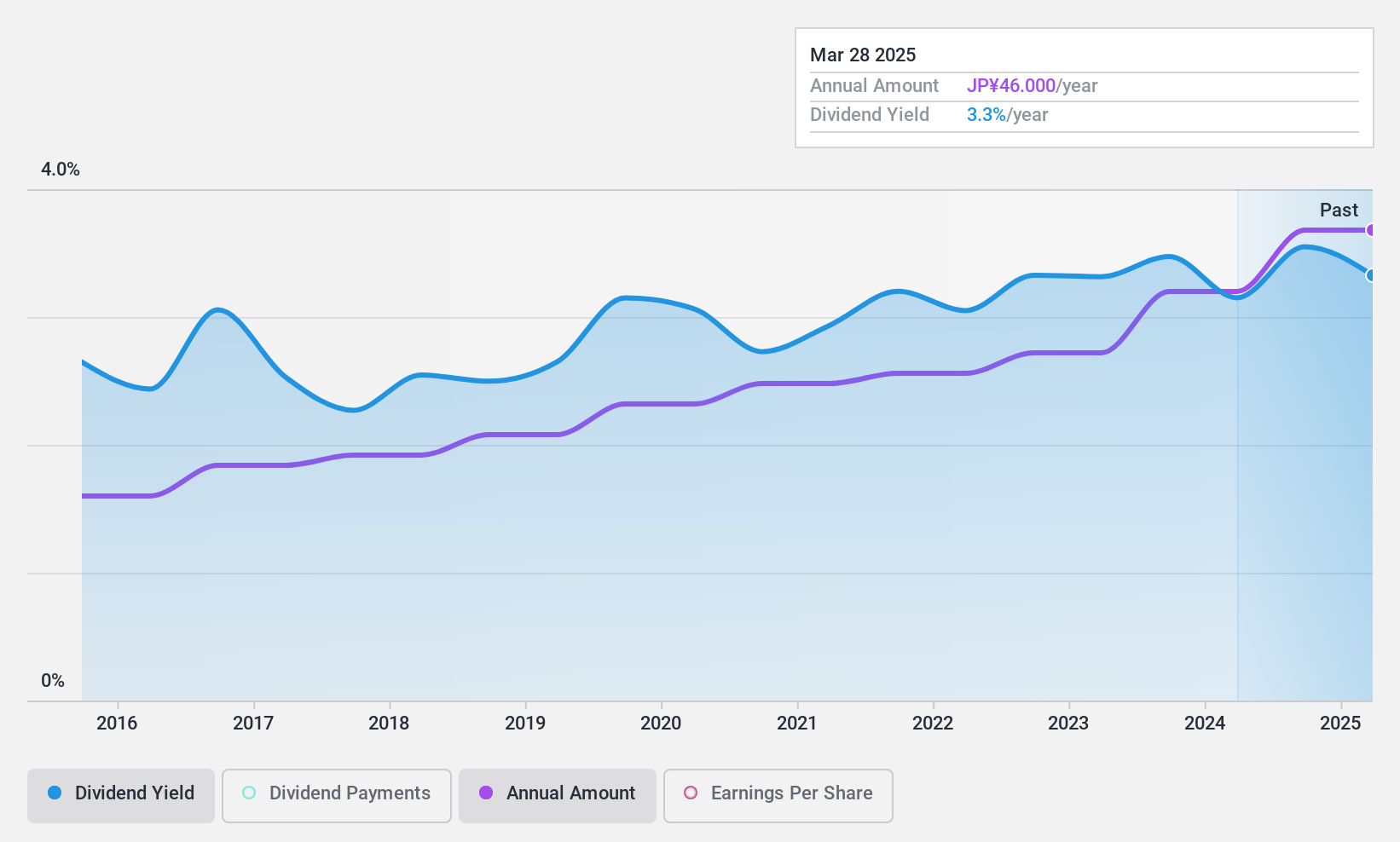

Kondotec (TSE:7438)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kondotec Inc. is involved in the manufacture, procurement, import, sale, wholesale, and export of industrial materials mainly within the retail hardware sector both in Japan and internationally; it has a market cap of approximately ¥34.42 billion.

Operations: Kondotec Inc. generates its revenue from several key segments, including Industrial Materials (¥37.76 billion), Scaffolding Construction (¥8.54 billion), Steel Structure Materials (¥21.21 billion), and Electrical Equipment Materials (¥11.08 billion).

Dividend Yield: 3.4%

Kondotec's dividends are well-covered by earnings and cash flows, with payout ratios of 33.8% and 50.2%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and growing, although the current yield of 3.42% is below Japan's top tier. Recently, Kondotec increased its quarterly dividend from ¥20 to ¥23 per share and provided guidance for strong fiscal year performance with expected net sales of ¥81.5 billion and profit of ¥3.3 billion.

- Click here to discover the nuances of Kondotec with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kondotec shares in the market.

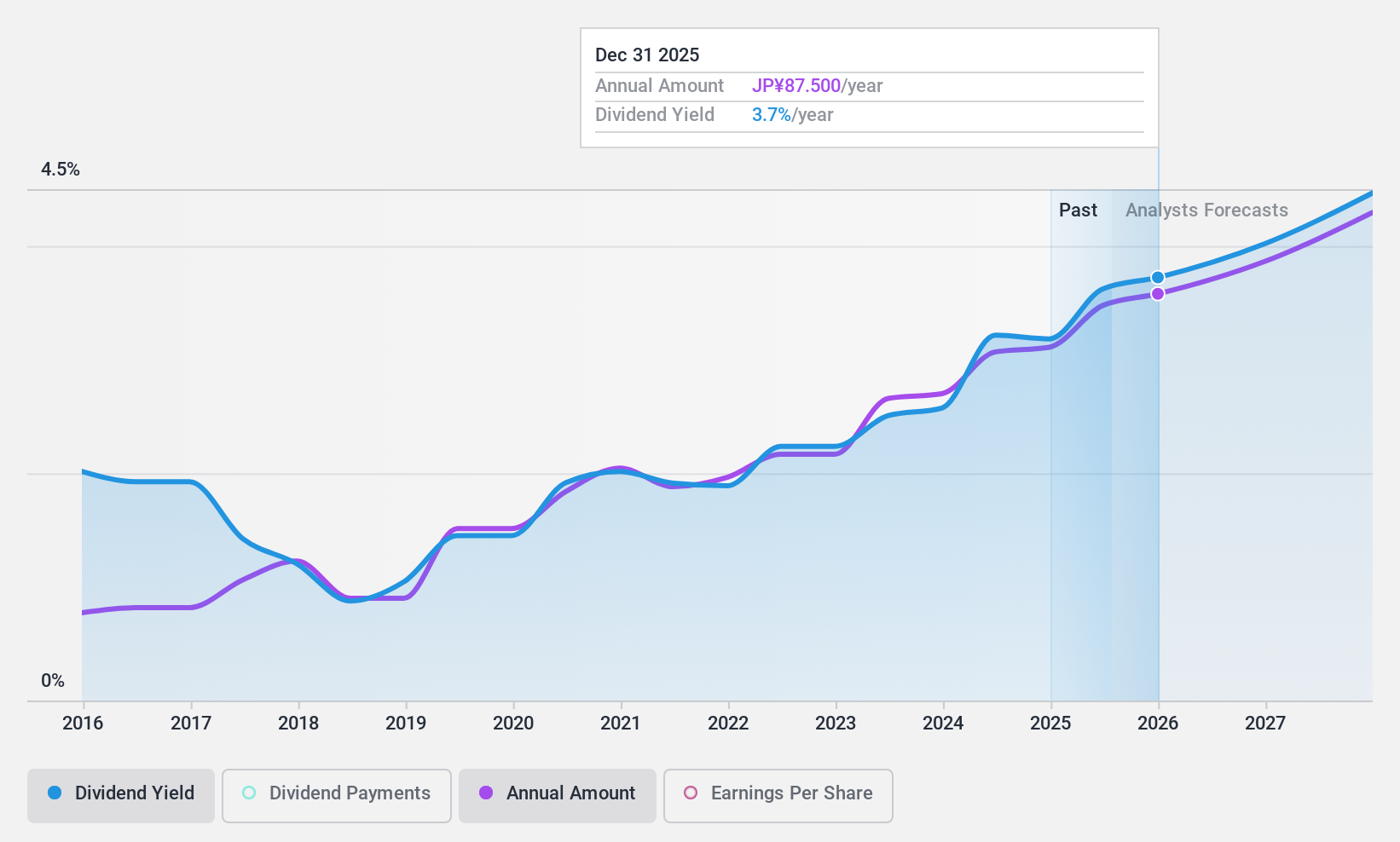

Funai Soken Holdings (TSE:9757)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Funai Soken Holdings Incorporated offers consulting services across various industries in Japan and has a market cap of ¥111.82 billion.

Operations: Funai Soken Holdings generates revenue through its segments, including Consulting at ¥22.51 billion, Digital Solutions at ¥4.77 billion, and Logistics at ¥4.63 billion.

Dividend Yield: 3.2%

Funai Soken Holdings' dividend yield of 3.15% falls short of Japan's top tier, but its payout ratios—57.1% from earnings and 68.6% from cash flows—indicate sustainability. Despite a decade of increased payments, dividends have been volatile with past drops over 20%. Earnings grew by 21.8% last year and are projected to rise annually by 10.66%, suggesting potential for future stability in dividends despite historical unreliability.

- Click to explore a detailed breakdown of our findings in Funai Soken Holdings' dividend report.

- Our valuation report unveils the possibility Funai Soken Holdings' shares may be trading at a discount.

Summing It All Up

- Embark on your investment journey to our 1950 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kondotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7438

Kondotec

Engages in the manufacture, procurement, import, sale, wholesale, and export of industrial materials primarily in the retail hardware business in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.