David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Daiei Kankyo Co., Ltd. (TSE:9336) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Daiei Kankyo

What Is Daiei Kankyo's Debt?

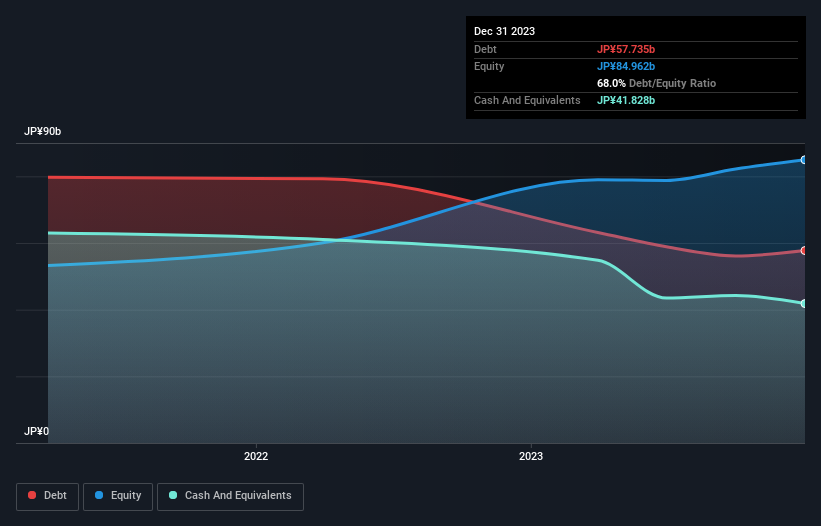

The image below, which you can click on for greater detail, shows that Daiei Kankyo had debt of JP¥57.7b at the end of December 2023, a reduction from JP¥63.2b over a year. However, it also had JP¥41.8b in cash, and so its net debt is JP¥15.9b.

A Look At Daiei Kankyo's Liabilities

Zooming in on the latest balance sheet data, we can see that Daiei Kankyo had liabilities of JP¥22.7b due within 12 months and liabilities of JP¥53.2b due beyond that. On the other hand, it had cash of JP¥41.8b and JP¥10.4b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥23.8b.

Of course, Daiei Kankyo has a market capitalization of JP¥266.8b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Daiei Kankyo has a low net debt to EBITDA ratio of only 0.71. And its EBIT covers its interest expense a whopping 331 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Daiei Kankyo has boosted its EBIT by 31%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Daiei Kankyo can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Daiei Kankyo actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Daiei Kankyo's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. When we consider the range of factors above, it looks like Daiei Kankyo is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Daiei Kankyo's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9336

Daiei Kankyo

Engages in waste-related and valuable resource recycling businesses in Japan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives