- Japan

- /

- Commercial Services

- /

- TSE:7994

Okamura (TSE:7994): Fresh Momentum Spurs a Closer Look at Valuation

Reviewed by Simply Wall St

Okamura (TSE:7994) has drawn fresh attention among investors this week, as the recent move in its share price has some wondering if the market is sensing a shift beneath the surface. While there was no specific event sparking this activity, it is exactly these kinds of unexplained moves that leave investors debating whether developments are brewing behind the scenes or if the current valuation is simply being reassessed. In moments like this, it pays to take a closer look at the fundamentals and what could be driving sentiment higher or lower.

Stepping back, Okamura’s stock has delivered a 29% return over the past year, with momentum accelerating lately, as shown by its 22% gain so far this year and an 11% increase over the past 3 months. While there has not been a headline-grabbing event recently, this run is happening against a backdrop of steady revenue growth of 3% and net income rising 6% annually, helping to keep confidence strong even when the news flow is quiet.

But with shares rallying hard, the question for investors is clear: does this open up a fresh buying opportunity, or is the market already baking in all of Okamura’s future growth potential?

Price-to-Earnings of 11.7x: Is it justified?

Based on its price-to-earnings (P/E) ratio of 11.7x, Okamura appears to be trading at a discount relative to both its industry peers and the broader sector average.

The P/E ratio compares a company's share price to its per-share earnings. It serves as a quick indicator of how much investors are paying for current and future earnings. For Okamura, this metric is particularly relevant because it provides a standardized benchmark to assess whether the company is being undervalued or overvalued compared to others in the Commercial Services industry.

Since Okamura's P/E multiple is lower than both the industry average of 13.4x and the estimated fair P/E ratio of 18.3x, the market may not be fully appreciating the company’s earnings strength or could be underestimating its future growth. This suggests a potential opportunity for investors who believe the company can sustain or improve its profitability.

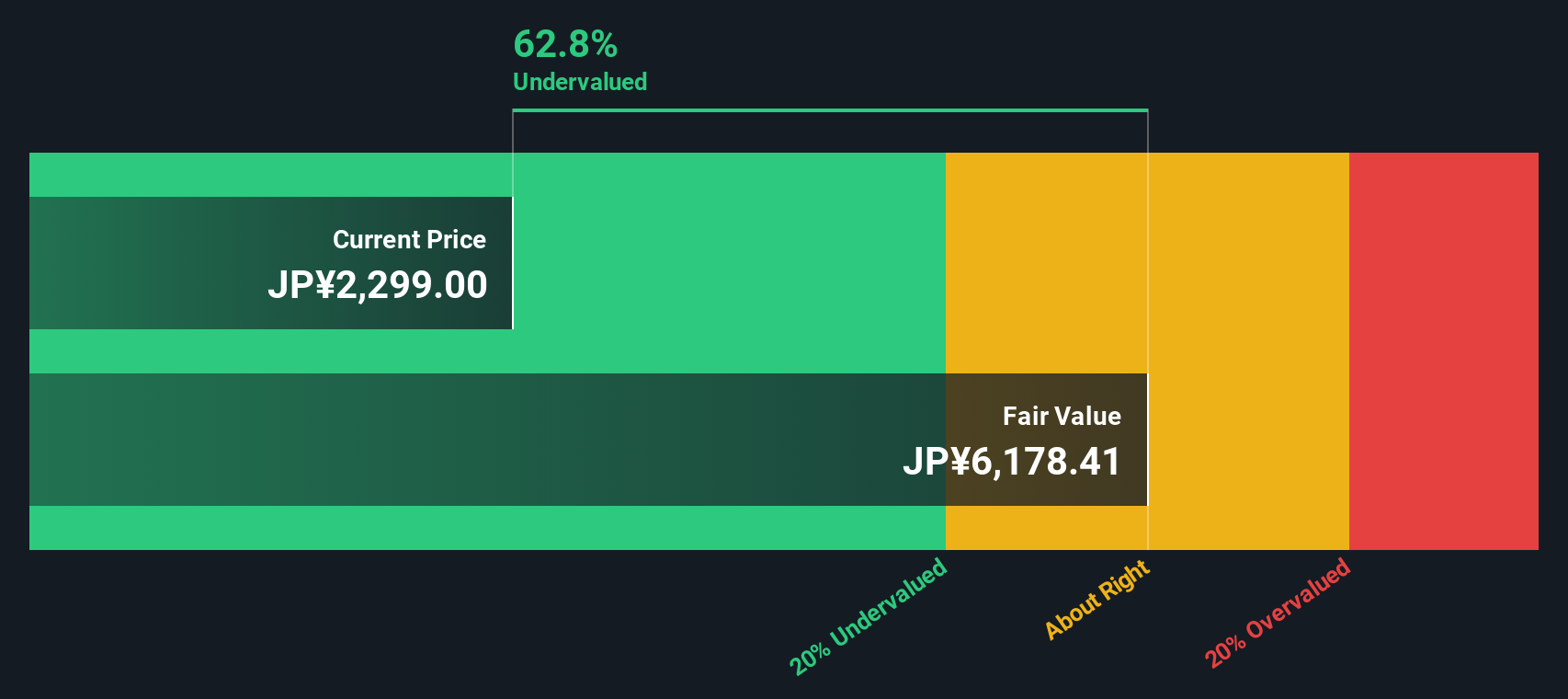

Result: Fair Value of ¥6,479 (UNDERVALUED)

See our latest analysis for Okamura.However, risks such as unexpected shifts in industry demand or a slowdown in revenue growth could quickly change the current market sentiment around Okamura.

Find out about the key risks to this Okamura narrative.Another Perspective: Discounted Cash Flow Says Undervalued Too

Looking at the SWS DCF model, it echoes the view that Okamura is undervalued and supports what multiples are already hinting at. However, does market pricing ever really let bargains last for long?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Okamura Narrative

If you see things differently or enjoy crafting your own investment thesis, you can quickly put together a unique analysis in just a few minutes. Do it your way.

A great starting point for your Okamura research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities often fly under the radar. Don’t miss out—let the Simply Wall Street screeners guide you to your next standout stock.

- Tap into future financial power by tracking high-yield opportunities through our dividend stocks with yields > 3% dividend stocks with yields > 3%.

- Ride technology’s hottest trends and be among the first to uncover promising AI penny stocks set to transform diverse industries AI penny stocks.

- Find hidden value before the market does by targeting undervalued stocks based on cash flows, helping you spot tomorrow’s winners early undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7994

Okamura

Engages in office furniture, store displays, and material handling systems businesses in Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives