- Japan

- /

- Commercial Services

- /

- TSE:7994

Okamura (TSE:7994): Assessing Valuation Following Dividend Hike and Special Payout Announcement

Reviewed by Kshitija Bhandaru

Okamura (TSE:7994) just approved a higher regular dividend along with a commemorative special dividend at its recent board meeting. These moves reflect the company’s intention to return more value to shareholders and may impact how investors view the stock.

See our latest analysis for Okamura.

The boost in both the regular and special dividends seems to have reinforced investor confidence, with Okamura’s share price up more than 13% year-to-date and total shareholder return reaching nearly 20% over the past year. Momentum has remained steady rather than explosive. The multi-year total returns reflect real staying power, which suggests that recent board decisions could contribute to an already impressive long-term track record.

If the dividend news has you thinking about where else value and growth are converging, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

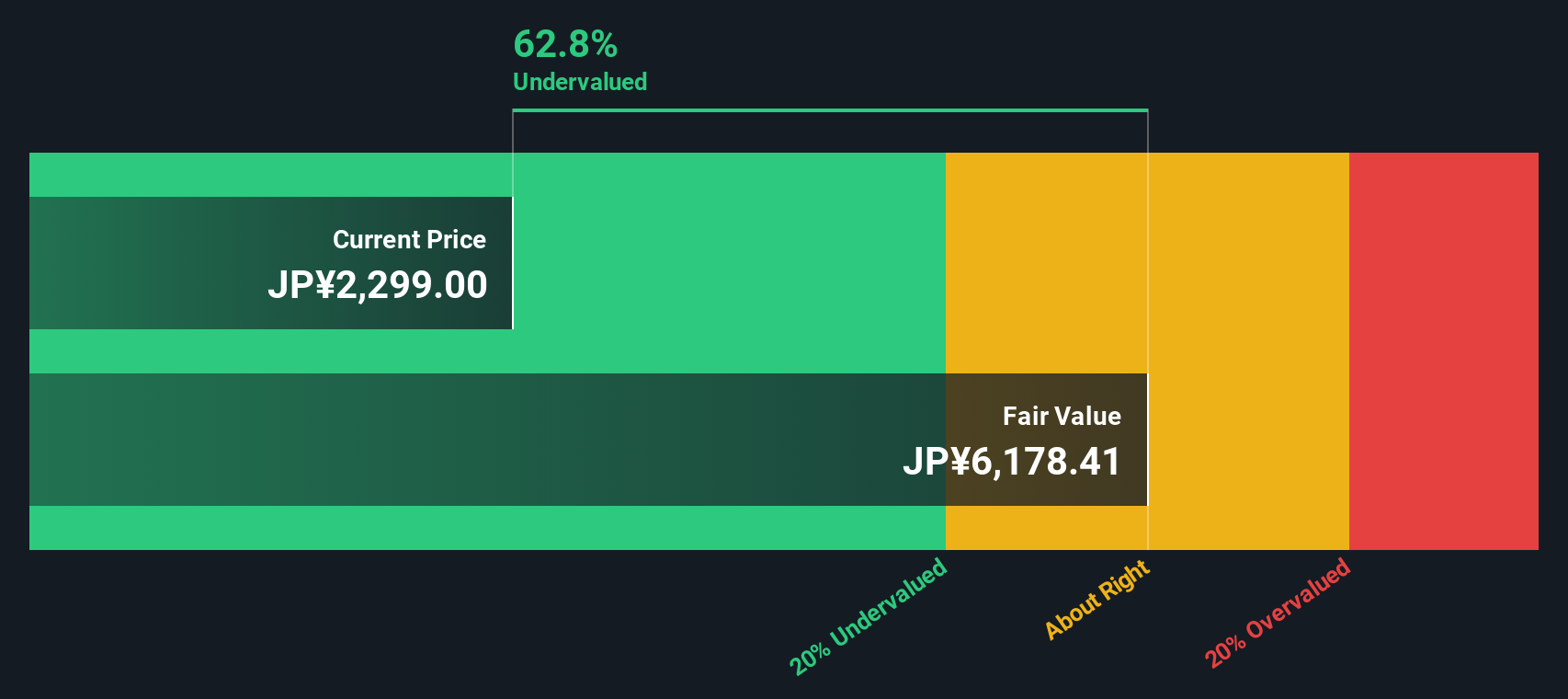

With a robust run-up in its share price and dividend increases on the table, there is growing debate over whether Okamura is still trading below its intrinsic value or if the market has already baked in the next leg of growth. Could this be a buying opportunity, or has optimism pushed the stock to fair value?

Price-to-Earnings of 10.9x: Is it justified?

Okamura is trading at a price-to-earnings (P/E) ratio of 10.9x, which positions it attractively against both its peer group and the broader industry. With the last close at ¥2,272, the market currently values Okamura’s earnings at a notable discount.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. It is a widely used tool for comparing valuations within the commercial services sector. A lower ratio often signals that the company is deemed undervalued, especially if the underlying business is stable and has a track record of solid profitability.

Compared to its closest peers, which average a P/E of 14.9x, and an industry average of 13.2x, Okamura’s multiple is markedly more conservative. Our fair P/E estimate is even higher at 18.2x. This suggests not only substantial room for market reappraisal but also a significant gap the market could move towards if sentiment shifts.

Explore the SWS fair ratio for Okamura

Result: Price-to-Earnings of 10.9x (UNDERVALUED)

However, slower revenue and earnings growth, or shifts in market sentiment, could quickly dampen enthusiasm and challenge the current valuation thesis.

Find out about the key risks to this Okamura narrative.

Another View: SWS DCF Model Points to Greater Undervaluation

To cross-check the value suggested by earnings multiples, our SWS DCF model estimates Okamura's fair value at ¥6,181.48. This is nearly three times its current price of ¥2,272. This perspective paints the stock as even more undervalued and may tempt bargain-seeking investors. But how much weight should you place on this forecasted value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Okamura for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Okamura Narrative

If you see the numbers differently or want to put the data through your own lens, you can shape your own view in just a few minutes, and Do it your way.

A great starting point for your Okamura research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to broaden your portfolio with fresh opportunities you might otherwise overlook. These fast-moving themes are gaining attention and you should not miss out.

- Benefit from consistent income streams and assess strong performers with these 18 dividend stocks with yields > 3%, which offer solid yields above 3%.

- Capture the potential of artificial intelligence by reviewing these 24 AI penny stocks, currently reshaping industries with technology-driven growth.

- Find value before the crowd by sizing up these 878 undervalued stocks based on cash flows, based on robust cash flow metrics and market mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7994

Okamura

Engages in office furniture, store displays, and material handling systems businesses in Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives