- Japan

- /

- Commercial Services

- /

- TSE:7846

What Pilot (TSE:7846)'s ¥6 Billion Share Buyback Completion Means For Shareholders

Reviewed by Sasha Jovanovic

- Pilot has completed its share repurchase program announced on May 9, 2025, buying back 1,354,600 shares, or 3.55% of its stock, for ¥5,999.74 million by November 28, 2025.

- This buyback’s completion reduces the company’s free-float share count, a capital allocation choice that can meaningfully influence how investors view Pilot.

- We’ll now examine how the completion of Pilot’s ¥5,999.74 million share repurchase program shapes the company’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Pilot's Investment Narrative?

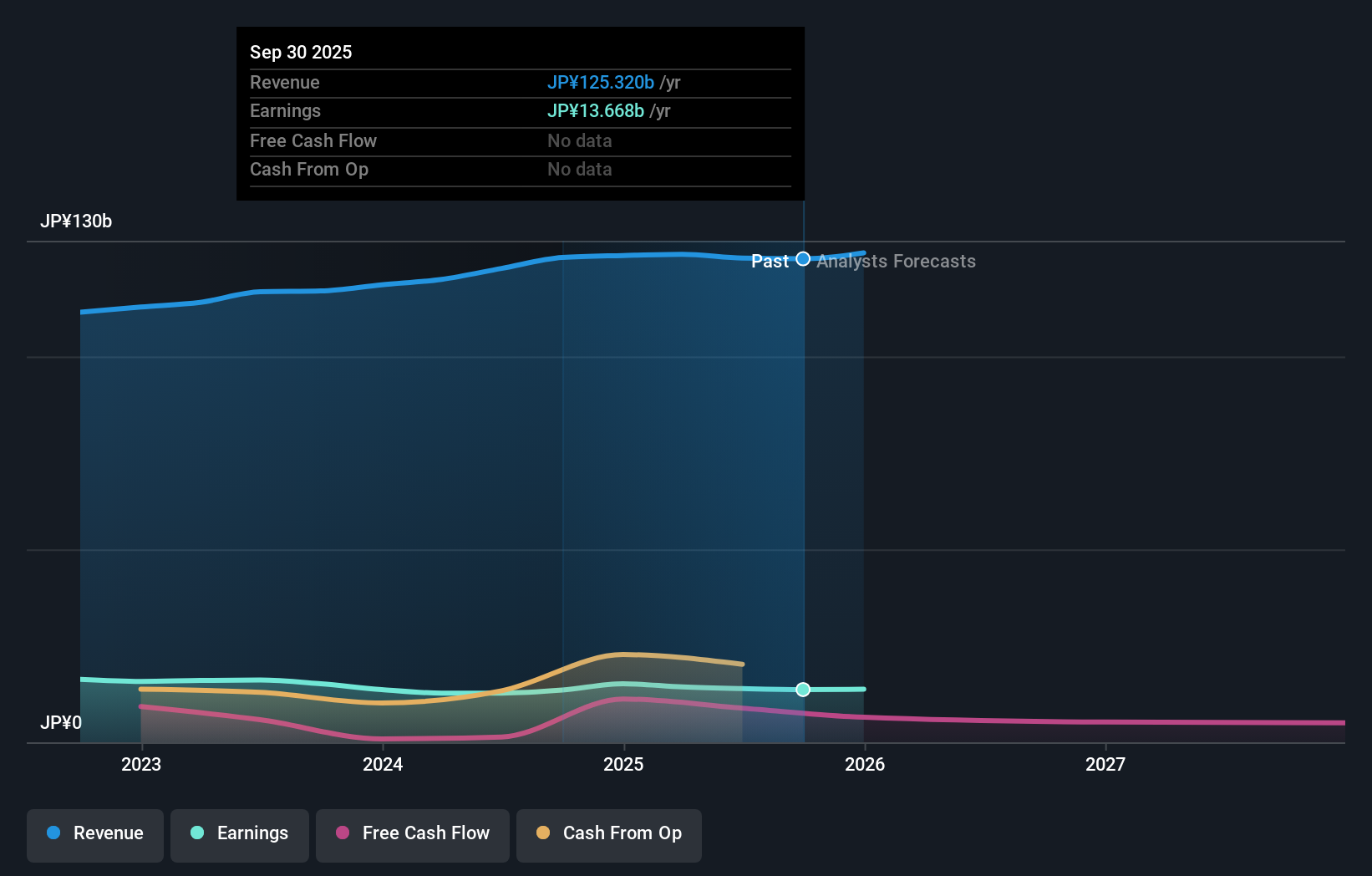

To own Pilot today, you need to believe in a steady, profit-focused business that can keep compounding modest earnings while returning cash to shareholders. The completion of the ¥5,999.74 million buyback, retiring 3.55% of the share base, reinforces that capital return story and slightly amplifies per-share metrics ahead of the February 2026 results. In the near term, the key catalyst remains whether management can deliver on its 2025 guidance after a year of relatively muted earnings growth and underperformance versus the broader Japanese market. The buyback itself is unlikely to change the fundamentals, but it could tighten trading liquidity and sharpen market reactions around earnings or any revision to dividend policy. Big picture, the investment case still turns on incremental profit growth, disciplined capital deployment and improving return on equity from a currently modest level.

However, investors should also be aware of the implications of Pilot’s relatively low return on equity. Pilot's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Pilot - why the stock might be worth as much as 29% more than the current price!

Build Your Own Pilot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilot research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Pilot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilot's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026