- Japan

- /

- Commercial Services

- /

- TSE:7846

Undiscovered Gems with Strong Fundamentals for February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and economic policy uncertainties, U.S. stock indexes are edging toward record highs, with growth stocks taking the lead over their value counterparts. Amid this backdrop, small-cap stocks have lagged behind larger indices like the S&P 500, presenting a unique opportunity for investors to explore companies with strong fundamentals that may not yet be on everyone's radar. Identifying such undiscovered gems requires a keen eye for robust financial health and resilience in navigating current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

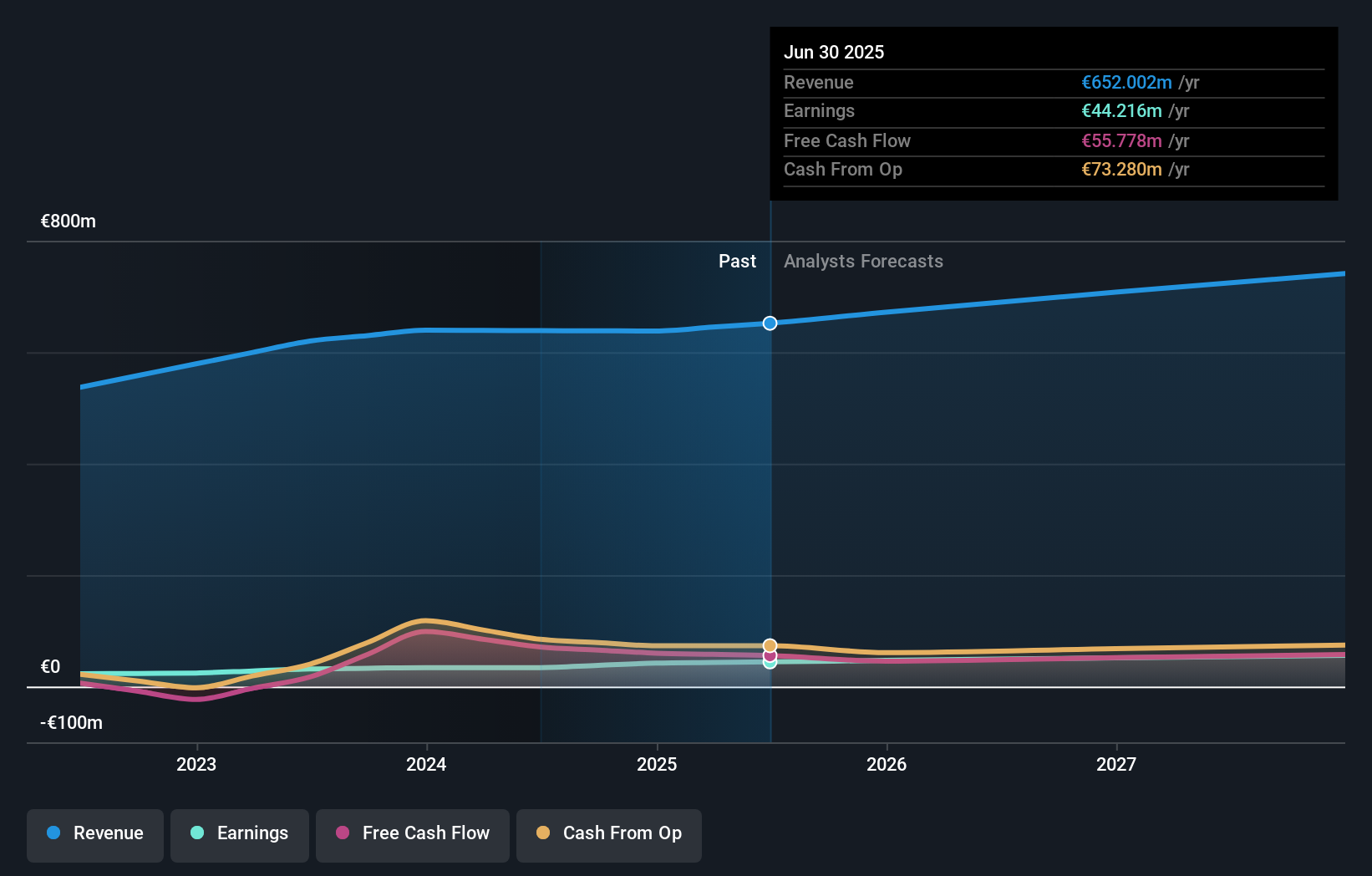

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, specializes in the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of €531.38 million.

Operations: FRoSTA generates revenue primarily from the sale of frozen food products across several European countries. The company's cost structure includes expenses related to production and marketing, impacting its overall profitability. Gross profit margin trends provide insight into the efficiency of its operations over time.

FRoSTA, a notable player in the frozen food sector, shows a compelling financial profile with earnings growing at 16% annually over the past five years. Despite this growth, its recent performance of 7.6% earnings growth lags behind the industry average of 48.7%. The company's debt to equity ratio has impressively decreased from 31.6% to 8.2%, reflecting strong financial management and reduced leverage risk. Trading at a significant discount of approximately 94.6% below estimated fair value, FRoSTA presents an intriguing opportunity for investors seeking undervalued stocks with potential upside in the food industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of FRoSTA.

Evaluate FRoSTA's historical performance by accessing our past performance report.

MATSUDA SANGYO (TSE:7456)

Simply Wall St Value Rating: ★★★★★☆

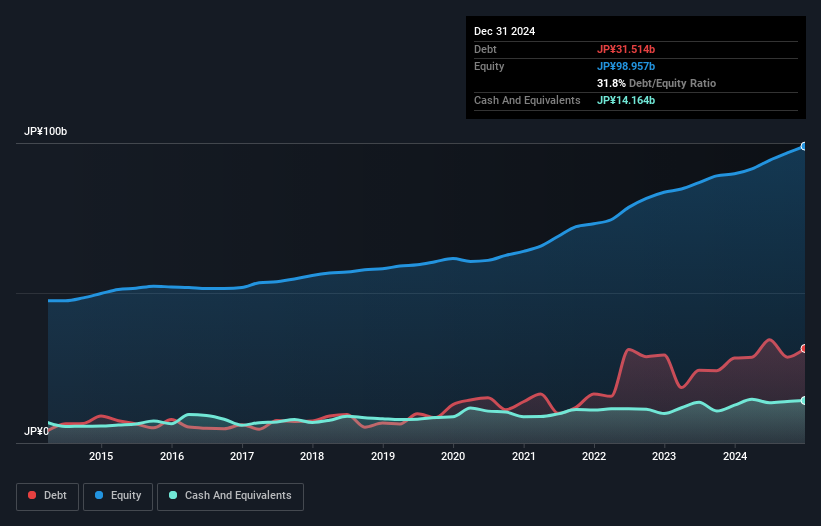

Overview: MATSUDA SANGYO Co., Ltd. operates in Japan, focusing on precious metals, environmental solutions, and food businesses with a market capitalization of ¥86.69 billion.

Operations: The company generates revenue primarily from its precious metals business, which accounts for ¥332.43 billion, and its food-related business, contributing ¥105.41 billion. The net profit margin shows a notable trend at 2.5%.

Matsuda Sangyo is making waves with its impressive 42% earnings growth over the past year, outpacing the Commercial Services industry average of 11.1%. The company stands on solid ground with high-quality past earnings and an EBIT that covers interest payments by a factor of 49, which is quite robust. Trading at a value that's 43% below estimated fair value, it offers potential upside for investors. A recent board meeting discussed acquiring shares to establish a subsidiary, hinting at strategic expansion plans. With satisfactory net debt to equity ratio of 17.5%, Matsuda Sangyo seems poised for continued stability and growth.

- Delve into the full analysis health report here for a deeper understanding of MATSUDA SANGYO.

Review our historical performance report to gain insights into MATSUDA SANGYO's's past performance.

Pilot (TSE:7846)

Simply Wall St Value Rating: ★★★★★★

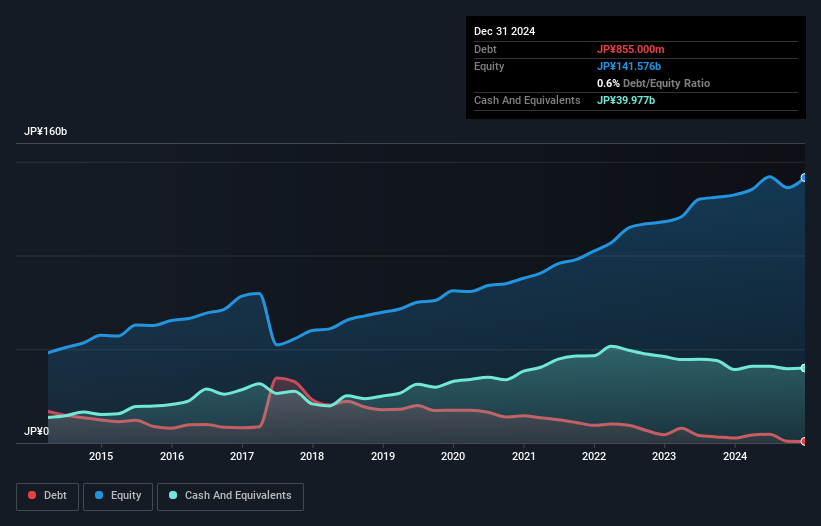

Overview: Pilot Corporation engages in the manufacturing, purchasing, and selling of writing instruments, stationery products, and toys across Japan, the United States, Europe, and Asia with a market cap of ¥173.16 billion.

Operations: Pilot generates revenue primarily from the sale of writing instruments, stationery products, and toys in multiple regions including Japan, the United States, Europe, and Asia. The company's financial performance is influenced by its ability to manage production costs and optimize sales across these diverse markets.

Pilot, a smaller player in the industry, has demonstrated impressive financial health with its debt-to-equity ratio dropping from 21.6% to just 0.6% over five years. The company is trading at a significant discount of 37% below its estimated fair value, indicating potential room for appreciation. Earnings have shown robust growth of 11% last year, outpacing the Commercial Services sector's average and suggesting solid operational performance. Recent board changes and an increased dividend from JPY 50 to JPY 64 per share reflect strategic moves aimed at enhancing shareholder value and adapting leadership for future challenges.

- Dive into the specifics of Pilot here with our thorough health report.

Explore historical data to track Pilot's performance over time in our Past section.

Make It Happen

- Gain an insight into the universe of 4714 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion