- Japan

- /

- Commercial Services

- /

- TSE:7846

Assessing Pilot (TSE:7846) After Completing Its 1.3 Million Share Buyback: What Does the Valuation Say?

Reviewed by Simply Wall St

Pilot (TSE:7846) just wrapped up its latest share buyback, retiring over 1.3 million shares under the program that closed on November 28, 2025. This move tightens the share base for remaining investors.

See our latest analysis for Pilot.

That buyback has come on the heels of a steady grind higher, with a year to date share price return of 3.59% and a five year total shareholder return of 78.34%. This suggests that long term momentum remains intact even as short term trading stays relatively muted.

If Pilot’s disciplined capital moves have caught your attention, it might be a good moment to discover fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With buybacks complete and the share price still sitting well below analyst targets, the key question now is whether Pilot is quietly undervalued or if the market is already pricing in its next leg of growth.

Price-to-Earnings of 13x: Is it justified?

On a last close of ¥4,766, Pilot trades at roughly 13 times earnings, a modest discount to both the wider Japanese market and its Commercial Services peers.

The price to earnings multiple compares what investors pay today for each unit of current earnings. It is a core yardstick for mature, profitable businesses like Pilot. For a century-old stationery maker with steady, if unspectacular, profit growth, this metric gives a direct read on how the market values its established earnings base rather than blue sky forecasts.

With Pilot on 13x earnings, below the JP market at 14.1x, the market is not attaching a growth premium. Instead, it is pricing the stock slightly conservatively relative to the average listed company. That stance is consistent with its recent earnings profile, which has grown at low single digit rates and at a Return on Equity of 9.6 percent that sits firmly in the low category.

The discount becomes clearer against the Commercial Services industry and closer peers, where average price to earnings multiples of 14x to 14.3x suggest investors pay more for each yen of earnings elsewhere. Pilot’s lower multiple signals that, despite high quality earnings and marginally improving profit margins, the market is not yet valuing its earnings stream in line with the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13x (UNDERVALUED)

However, slower than expected earnings growth or a shift away from traditional stationery products could limit any valuation re-rating, despite the apparent discount.

Find out about the key risks to this Pilot narrative.

Another View: Our DCF Model Sounds A Caution

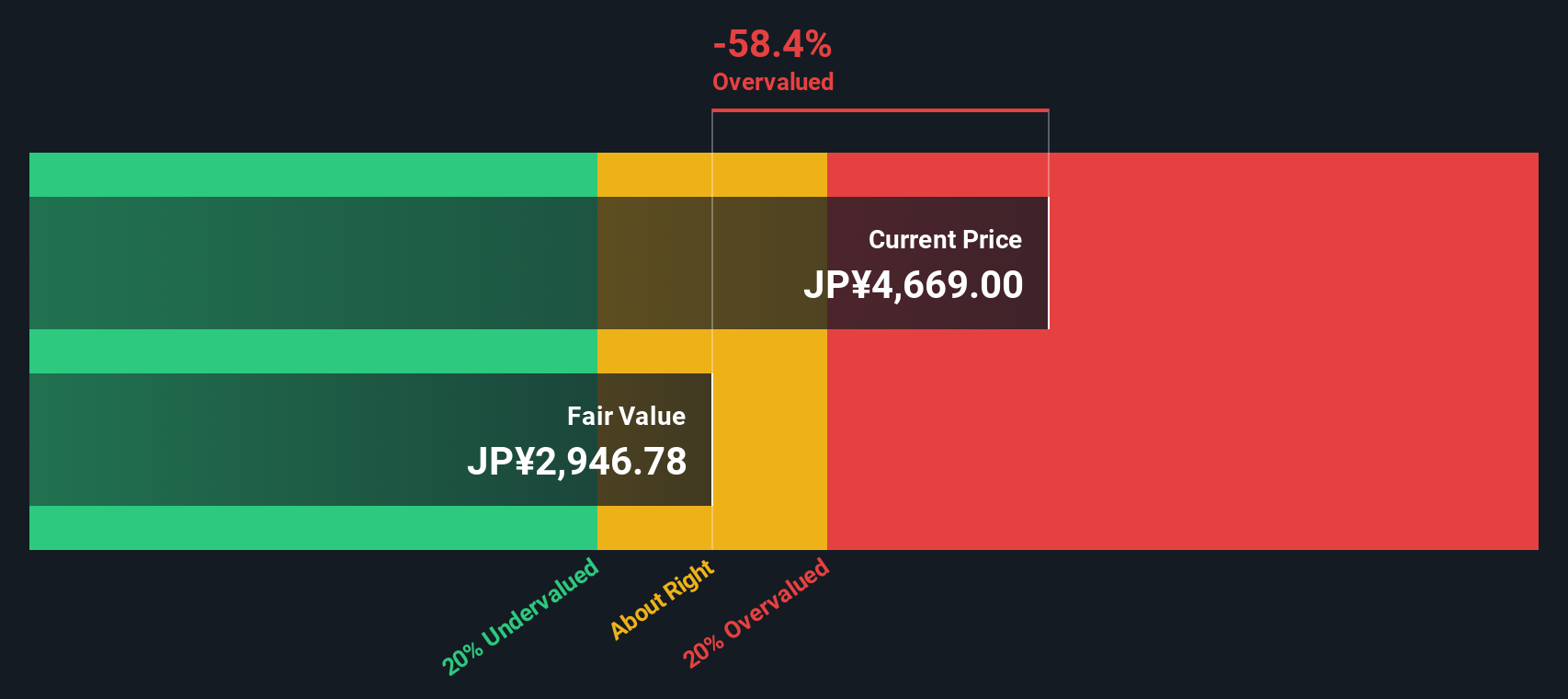

While the 13x earnings multiple hints at value, our DCF model paints a tougher picture, suggesting Pilot’s fair value is closer to ¥2,967 than the current ¥4,766. On that view, the shares look overvalued. This raises the question: which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pilot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pilot Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pilot.

Ready for your next investment move?

Before you move on, lock in your advantage by using the Simply Wall St Screener to uncover fresh, data driven opportunities that others are still overlooking.

- Capture potential market mispricings by scanning these 900 undervalued stocks based on cash flows that strong cash flow analysis suggests may be trading below their intrinsic worth.

- Capitalize on emerging innovation by targeting these 27 AI penny stocks positioned at the intersection of artificial intelligence, automation, and real world monetization.

- Strengthen your income strategy with these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable, fundamentals backed payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026