- Japan

- /

- Real Estate

- /

- TSE:8919

3 Japanese Stocks Estimated To Be Up To 48.6% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets recently experienced significant volatility due to political developments and monetary policy shifts, with the Nikkei 225 Index and TOPIX Index both declining. Despite this turbulence, opportunities may exist for investors seeking undervalued stocks that are trading below their intrinsic value. Identifying such stocks involves assessing factors like financial health, earnings potential, and market position amid current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3470.00 | ¥6808.79 | 49% |

| Densan System Holdings (TSE:4072) | ¥2713.00 | ¥5299.51 | 48.8% |

| Akatsuki (TSE:3932) | ¥2068.00 | ¥3772.62 | 45.2% |

| Kotobuki Spirits (TSE:2222) | ¥1776.50 | ¥3434.73 | 48.3% |

| Stella Chemifa (TSE:4109) | ¥4255.00 | ¥8092.75 | 47.4% |

| Pilot (TSE:7846) | ¥4558.00 | ¥8874.56 | 48.6% |

| Hibino (TSE:2469) | ¥3545.00 | ¥7039.05 | 49.6% |

| Infomart (TSE:2492) | ¥325.00 | ¥617.44 | 47.4% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3285.00 | ¥6029.15 | 45.5% |

| KeePer Technical Laboratory (TSE:6036) | ¥4335.00 | ¥7837.01 | 44.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Nippon Kayaku (TSE:4272)

Overview: Nippon Kayaku Co., Ltd. is a company that, along with its subsidiaries, develops, manufactures, and sells functional chemicals, pharmaceuticals, safety systems, and agrochemicals both in Japan and internationally; it has a market cap of ¥209.43 billion.

Operations: The company's revenue segments include Fine Chemicals at ¥59.50 billion, Life Science Business Unit at ¥62.72 billion, and Mobility & Imaging Business Unit at ¥84.83 billion.

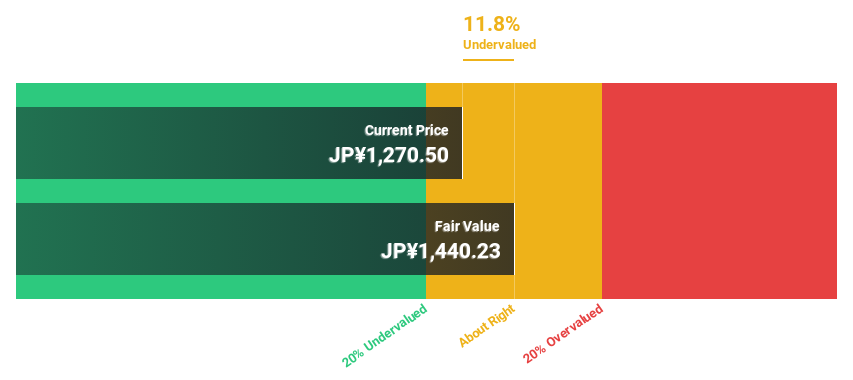

Estimated Discount To Fair Value: 11.3%

Nippon Kayaku is trading at ¥1,281, below its estimated fair value of ¥1,444.3. While the stock is not significantly undervalued, it presents potential due to forecasted earnings growth of 34.4% annually, outpacing the Japanese market's 8.7%. Despite lower profit margins compared to last year and a dividend not well covered by cash flows, recent buybacks and revised upward corporate guidance indicate strategic financial management aimed at enhancing shareholder value.

- Our earnings growth report unveils the potential for significant increases in Nippon Kayaku's future results.

- Click here to discover the nuances of Nippon Kayaku with our detailed financial health report.

Pilot (TSE:7846)

Overview: Pilot Corporation manufactures, purchases, and sells writing instruments, stationery products, and toys across Japan, the Americas, Europe, and Asia with a market cap of ¥176.93 billion.

Operations: The company's revenue segments are ¥20.93 billion from Asia, ¥84.15 billion from Japan, ¥25.87 billion from Europe, and ¥37.06 billion from the Americas.

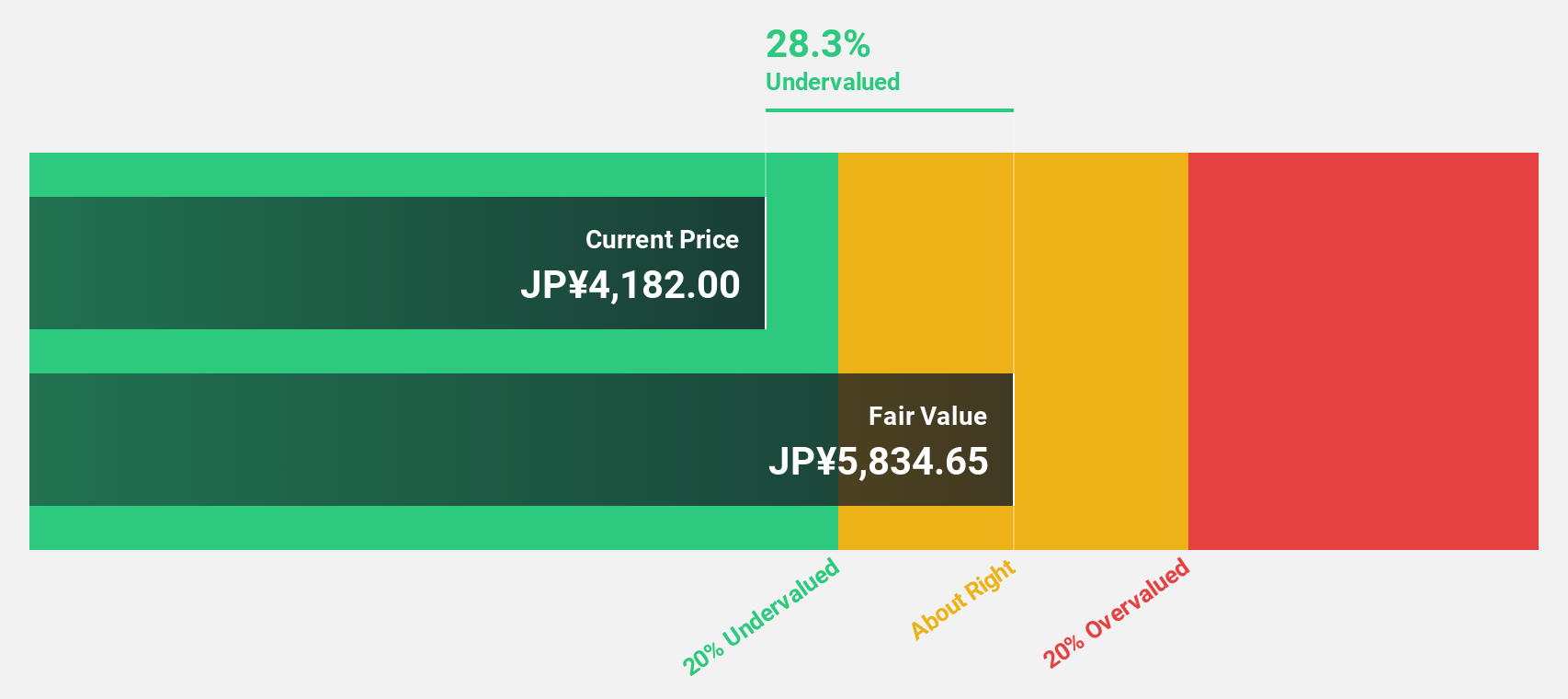

Estimated Discount To Fair Value: 48.6%

Pilot is trading at ¥4,558, significantly below its estimated fair value of ¥8,874.56, indicating potential undervaluation. Earnings are projected to grow 9.7% annually, outpacing the Japanese market's average growth rate of 8.7%. Despite a dividend yield of 2.33% not being well covered by free cash flows, recent share buybacks and expansion into the Middle East reflect strategic moves to enhance market position and shareholder value over time.

- The growth report we've compiled suggests that Pilot's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Pilot.

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan, with a market cap of ¥159.42 billion.

Operations: The company's revenue is primarily generated from its House for Resale Reproduction Business, amounting to ¥126.30 billion.

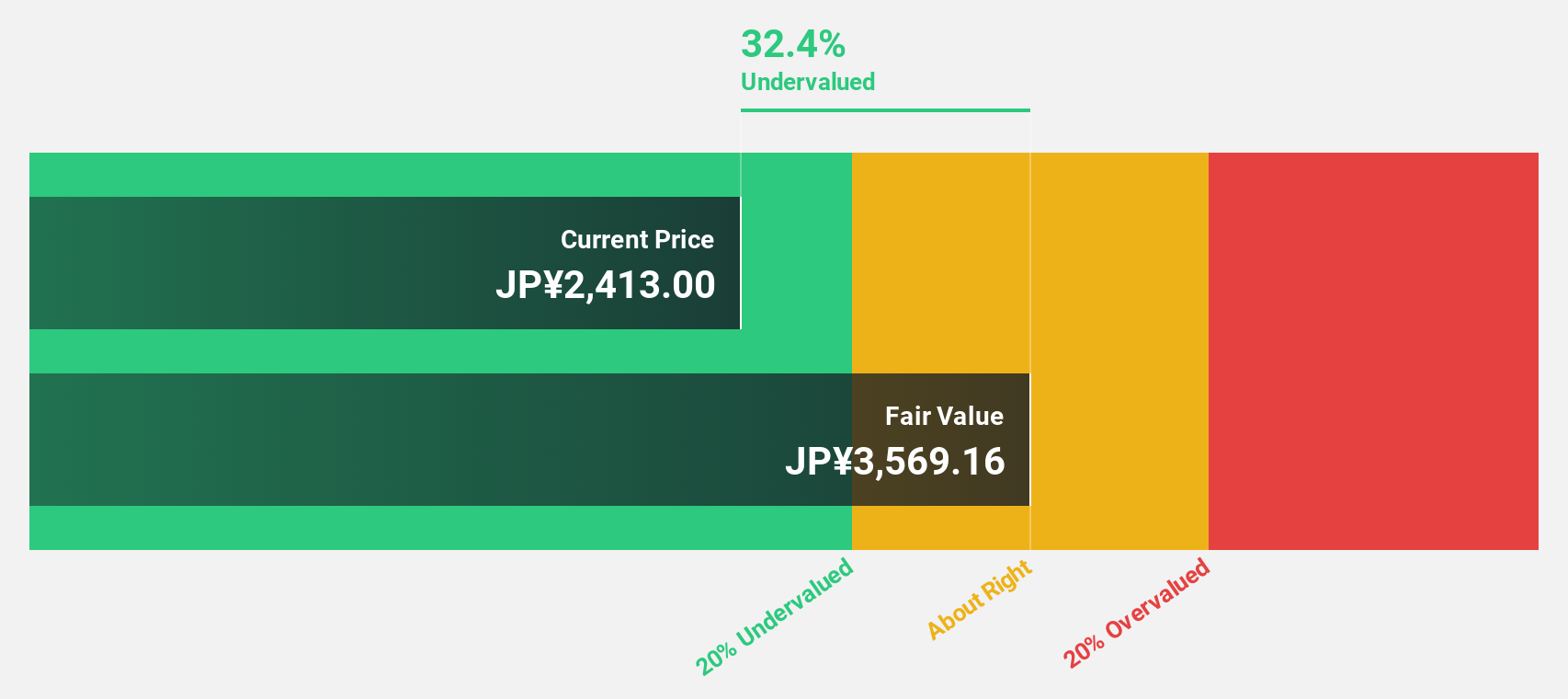

Estimated Discount To Fair Value: 35.8%

KATITAS is trading at ¥2,040, well below its estimated fair value of ¥3,177.57, highlighting potential undervaluation based on cash flows. Earnings have grown by 43.2% over the past year and are forecasted to grow annually by 9.8%, surpassing the Japanese market average of 8.7%. Despite being dropped from the FTSE All-World Index recently and having an unstable dividend track record, its revenue growth outlook remains robust at 7.4% per year.

- Our comprehensive growth report raises the possibility that KATITAS is poised for substantial financial growth.

- Get an in-depth perspective on KATITAS' balance sheet by reading our health report here.

Next Steps

- Unlock more gems! Our Undervalued Japanese Stocks Based On Cash Flows screener has unearthed 72 more companies for you to explore.Click here to unveil our expertly curated list of 75 Undervalued Japanese Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KATITAS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8919

KATITAS

KATITAS CO., Ltd. surveys, purchases, refurbishes, remodels, and sells used homes to individuals and families in Japan.

Outstanding track record with flawless balance sheet.