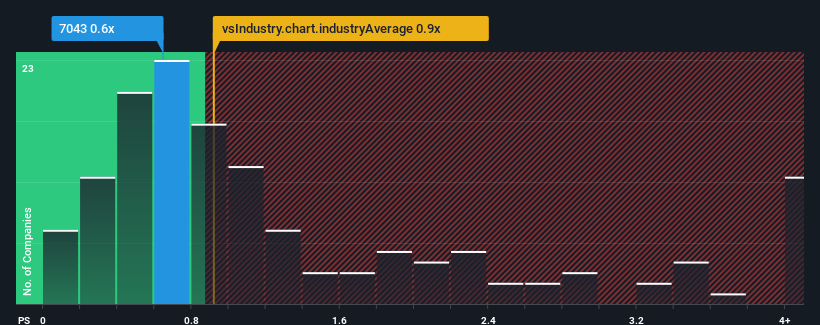

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Professional Services industry in Japan, you could be forgiven for feeling indifferent about Alue Co.,Ltd.'s (TSE:7043) P/S ratio of 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 1 warning sign about AlueLtd. View them for free.View our latest analysis for AlueLtd

What Does AlueLtd's P/S Mean For Shareholders?

It looks like revenue growth has deserted AlueLtd recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on AlueLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for AlueLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For AlueLtd?

The only time you'd be comfortable seeing a P/S like AlueLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 29% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 7.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that AlueLtd's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, AlueLtd's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for AlueLtd that you need to take into consideration.

If you're unsure about the strength of AlueLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7043

AlueLtd

Provides educational services for working adults using human resource development data and machine learning technology primarily in Japan.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives