- Japan

- /

- Professional Services

- /

- TSE:7041

The Market Doesn't Like What It Sees From CRG Holdings Co.,Ltd.'s (TSE:7041) Revenues Yet

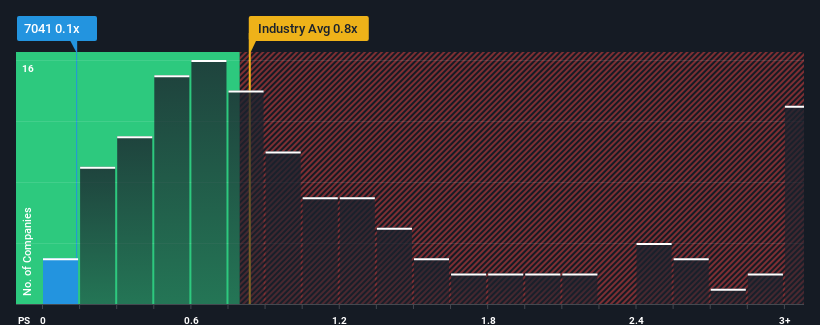

When close to half the companies operating in the Professional Services industry in Japan have price-to-sales ratios (or "P/S") above 0.8x, you may consider CRG Holdings Co.,Ltd. (TSE:7041) as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CRG HoldingsLtd

What Does CRG HoldingsLtd's Recent Performance Look Like?

As an illustration, revenue has deteriorated at CRG HoldingsLtd over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on CRG HoldingsLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as CRG HoldingsLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 5.7% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why CRG HoldingsLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On CRG HoldingsLtd's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of CRG HoldingsLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You need to take note of risks, for example - CRG HoldingsLtd has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on CRG HoldingsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7041

CRG HoldingsLtd

Engages in the human resource, outsourcing, system solution, and M and A and investment businesses in Japan.

Mediocre balance sheet low.

Market Insights

Community Narratives