- Japan

- /

- Semiconductors

- /

- TSE:6525

Discover May 2025's Asian Stocks That Could Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance and trade negotiations, Asian stocks have shown resilience, with key indices in China and Japan posting gains amid positive trade developments. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value relative to their estimated fair value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.80 | CN¥52.53 | 49% |

| Boditech Med (KOSDAQ:A206640) | ₩16120.00 | ₩31078.75 | 48.1% |

| People & Technology (KOSDAQ:A137400) | ₩38250.00 | ₩73496.26 | 48% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩556000.00 | ₩1081643.83 | 48.6% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.01 | CN¥34.35 | 47.6% |

| GEM (SZSE:002340) | CN¥6.33 | CN¥12.10 | 47.7% |

| Shanghai OPM Biosciences (SHSE:688293) | CN¥40.51 | CN¥77.39 | 47.7% |

| Kolmar Korea (KOSE:A161890) | ₩84400.00 | ₩167658.11 | 49.7% |

| Taiyo Yuden (TSE:6976) | ¥2354.50 | ¥4607.14 | 48.9% |

| True Corporation (SET:TRUE) | THB12.50 | THB24.22 | 48.4% |

Let's explore several standout options from the results in the screener.

Wus Printed Circuit (Kunshan) (SZSE:002463)

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. is involved in the research, development, design, manufacture, and sale of printed circuit boards in China and has a market cap of CN¥60.86 billion.

Operations: Wus Printed Circuit (Kunshan) Co., Ltd. generates revenue through the research, development, design, manufacture, and sale of printed circuit boards within China.

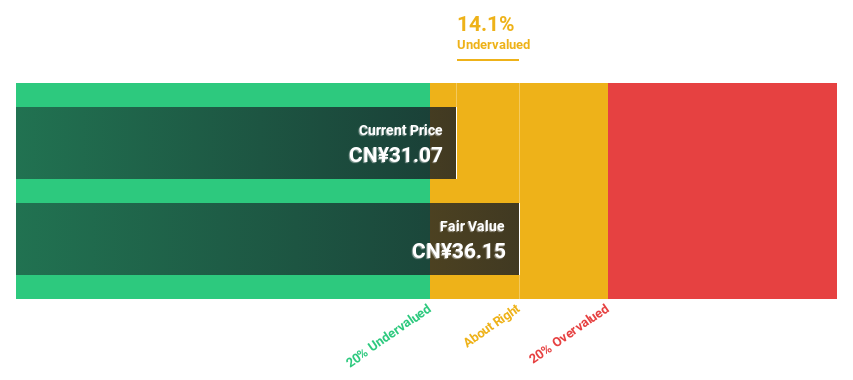

Estimated Discount To Fair Value: 11.9%

Wus Printed Circuit (Kunshan) reported strong earnings growth with net income rising to CNY 762.47 million in Q1 2025 from CNY 514.81 million a year ago. Trading at CN¥31.64, the stock is approximately 11.9% below its estimated fair value of CN¥35.9 and offers good relative value compared to peers, though its dividend yield of 1.58% is not well covered by free cash flows, indicating potential sustainability concerns despite robust profit forecasts.

- Upon reviewing our latest growth report, Wus Printed Circuit (Kunshan)'s projected financial performance appears quite optimistic.

- Navigate through the intricacies of Wus Printed Circuit (Kunshan) with our comprehensive financial health report here.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally and has a market cap of ¥724.92 billion.

Operations: The company's revenue segments include the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

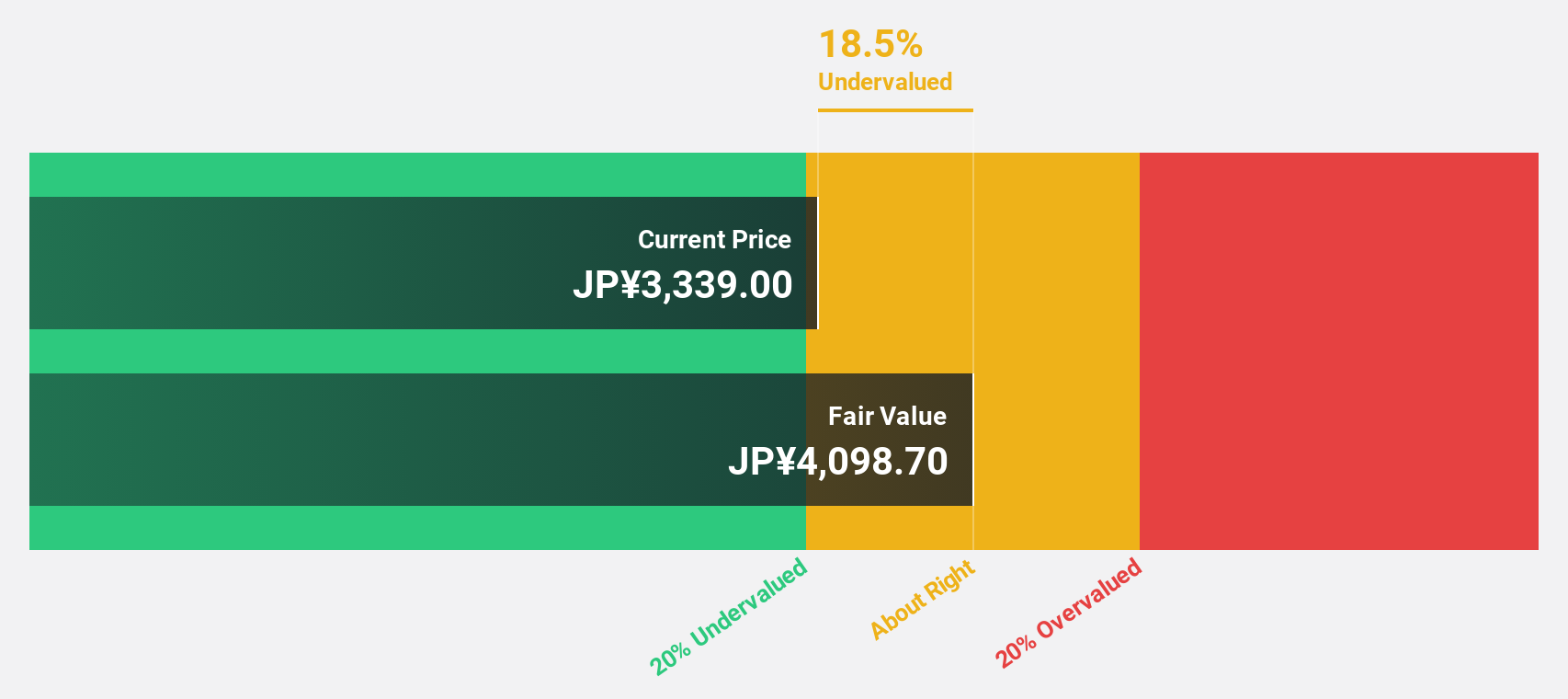

Estimated Discount To Fair Value: 33.2%

Kokusai Electric, trading at ¥3112, is significantly undervalued with a fair value estimate of ¥4656.8. Despite recent dividend adjustments, the company demonstrates strong earnings potential with forecasted annual profit growth of 14.3%, outpacing the JP market's 7.5%. Recent corporate guidance confirms robust revenue and net income expectations for fiscal year 2026, supporting its attractive valuation based on cash flows amidst a volatile share price environment and strategic debt management initiatives.

- Our comprehensive growth report raises the possibility that Kokusai Electric is poised for substantial financial growth.

- Dive into the specifics of Kokusai Electric here with our thorough financial health report.

Baycurrent (TSE:6532)

Overview: Baycurrent, Inc. is a consulting services provider in Japan with a market cap of ¥1.23 trillion.

Operations: Baycurrent's revenue is derived entirely from its Consulting Business, amounting to ¥116.06 billion.

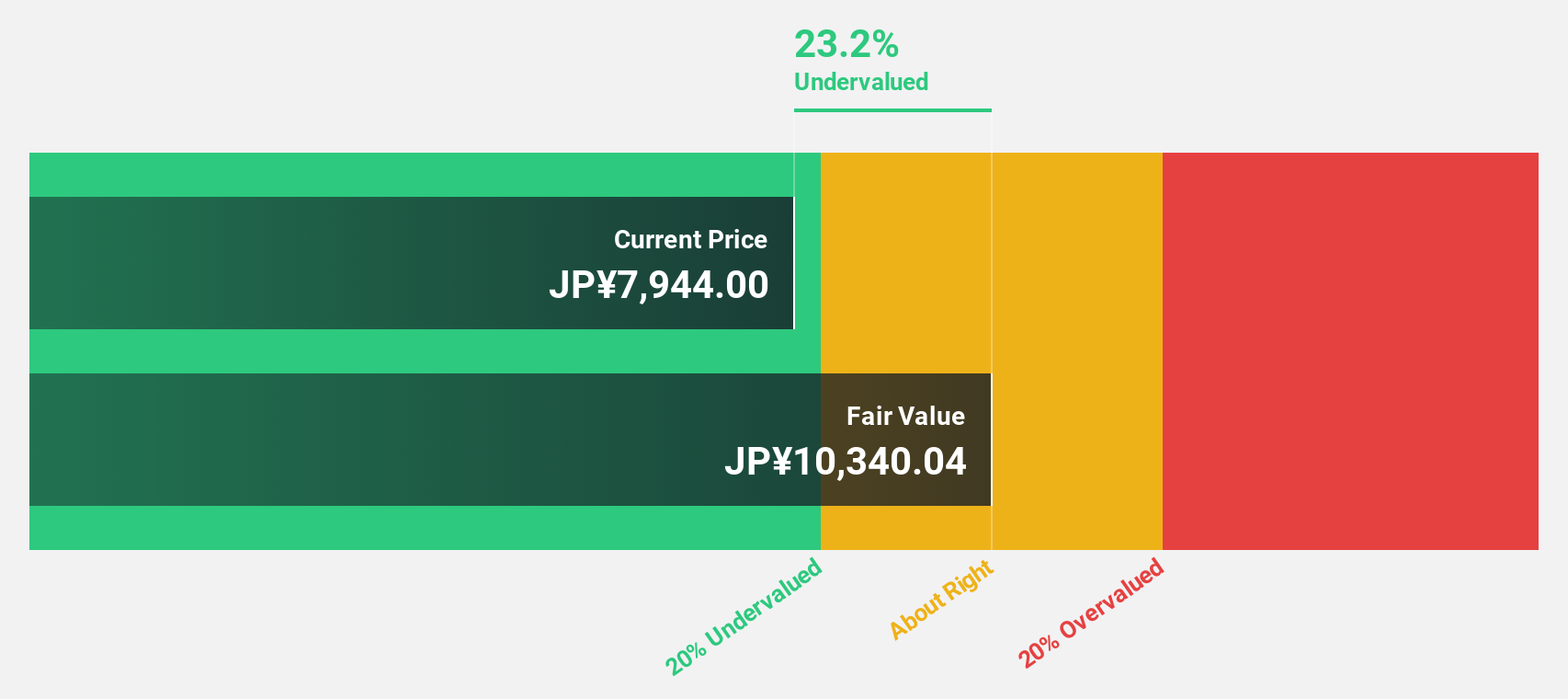

Estimated Discount To Fair Value: 23.3%

Baycurrent, trading at ¥8107, is undervalued with an estimated fair value of ¥10566.82. The company has initiated a share repurchase program worth ¥3 billion to enhance shareholder value and improve capital efficiency. With forecasted earnings growth of 18.9% annually, surpassing the JP market's 7.5%, Baycurrent's revenue growth also exceeds market expectations at 18.3% per year, reflecting its strong cash flow potential despite moderate profit growth forecasts for the coming years.

- Our earnings growth report unveils the potential for significant increases in Baycurrent's future results.

- Get an in-depth perspective on Baycurrent's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Reveal the 275 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kokusai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6525

Kokusai Electric

Engages in the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives