- China

- /

- Construction

- /

- SZSE:002929

3 Growth Stocks With High Insider Ownership And Earnings Growth Up To 30%

Reviewed by Simply Wall St

As global markets witness a surge, with U.S. stock indexes nearing record highs and growth stocks outperforming value shares, investors are keenly observing the landscape for opportunities that align with these trends. In this environment, companies exhibiting strong earnings growth coupled with high insider ownership often stand out as compelling choices, offering potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

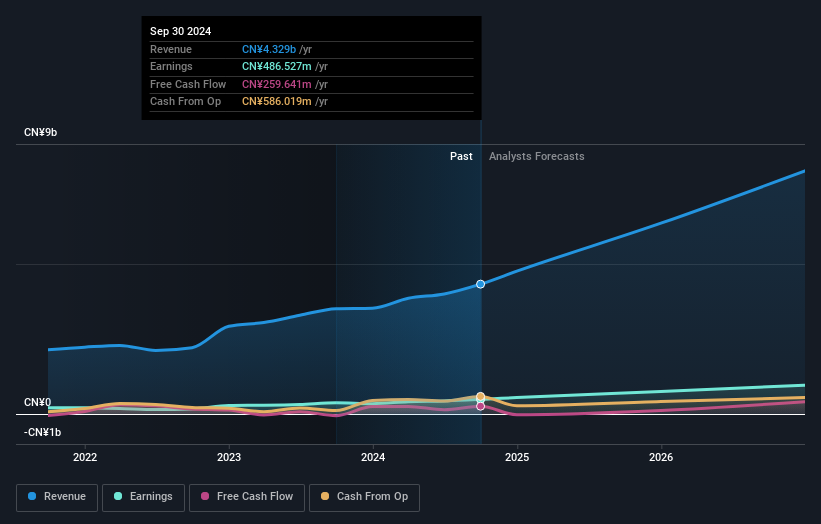

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥32.76 billion.

Operations: The company generates revenue from its Precision Temperature Control Energy Saving Equipment segment, amounting to CN¥4.33 billion.

Insider Ownership: 18.3%

Earnings Growth Forecast: 30.2% p.a.

Shenzhen Envicool Technology is positioned for robust growth, with earnings expected to rise by 30.2% annually over the next three years, outpacing the broader Chinese market. Revenue projections also indicate a strong trajectory at 28% per year. Despite recent share price volatility, its high forecasted return on equity of 23.7% underscores potential profitability. No recent insider trading activity has been reported, and an upcoming shareholder meeting will address corporate governance matters.

- Get an in-depth perspective on Shenzhen Envicool Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Shenzhen Envicool Technology's shares may be trading at a premium.

Runjian (SZSE:002929)

Simply Wall St Growth Rating: ★★★★☆☆

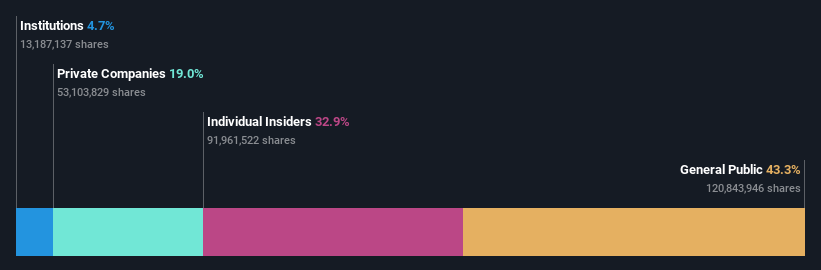

Overview: Runjian Co., Ltd. is a communication technology service company focused on network construction and maintenance in China, with a market cap of CN¥14.42 billion.

Operations: Runjian Co., Ltd. generates its revenue primarily from communication network construction and maintenance services in China.

Insider Ownership: 32.9%

Earnings Growth Forecast: 28.4% p.a.

Runjian demonstrates potential as a growth company with expected earnings growth of 28.4% annually, surpassing the broader Chinese market. The company's revenue is projected to grow at 16.2% per year, although this is below the high-growth threshold of 20%. Recent shareholder meetings have addressed strategic initiatives like stock incentives and business scope expansion, which could influence future performance. Despite financial challenges with debt coverage and share price volatility, no significant insider trading activity has been reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Runjian.

- In light of our recent valuation report, it seems possible that Runjian is trading beyond its estimated value.

Baycurrent (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

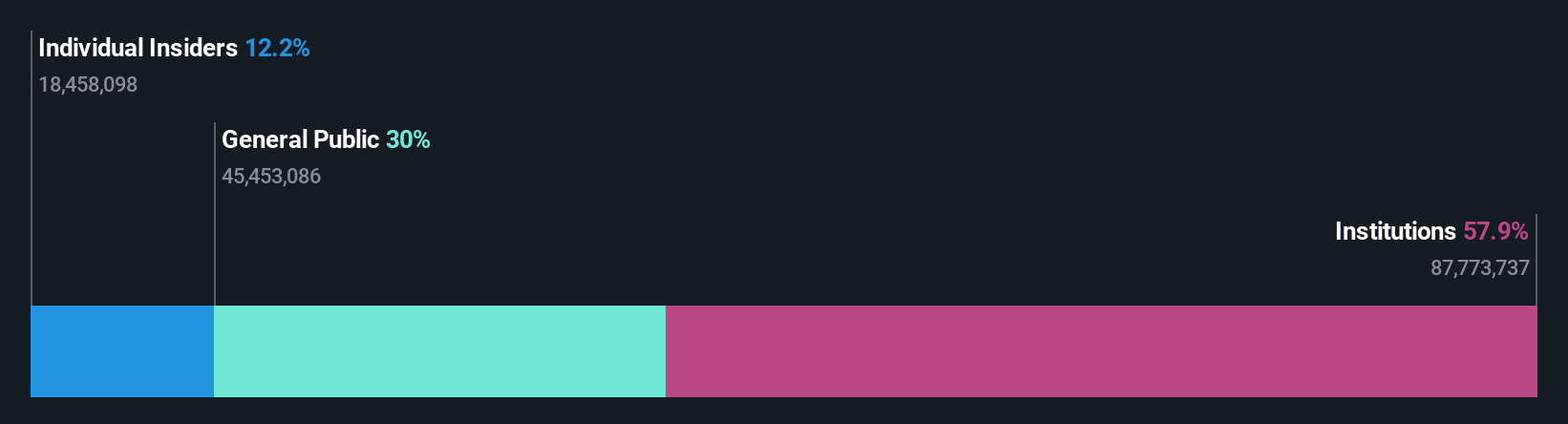

Overview: Baycurrent, Inc. is a consulting services provider in Japan with a market cap of ¥1.07 trillion.

Operations: The company generates revenue through its consulting services in Japan.

Insider Ownership: 13.9%

Earnings Growth Forecast: 17.9% p.a.

BayCurrent Consulting shows promise with expected revenue and earnings growth rates of 17.9% annually, outpacing the Japanese market. Despite a volatile share price recently, it trades at 22.4% below its estimated fair value, offering potential upside. The company has not experienced substantial insider trading in the past three months, which may indicate confidence in its strategy and future performance ahead of its Q3 2025 earnings release on January 14, 2025.

- Click here to discover the nuances of Baycurrent with our detailed analytical future growth report.

- According our valuation report, there's an indication that Baycurrent's share price might be on the expensive side.

Where To Now?

- Click through to start exploring the rest of the 1462 Fast Growing Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002929

Runjian

A communication technology service company, engages in the communication network construction and maintenance business in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives