- Japan

- /

- Professional Services

- /

- TSE:6532

Top Growth Companies With Insider Confidence December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate adjustments and mixed economic signals, the Nasdaq Composite has reached new heights, driven by growth stocks outperforming their value counterparts. In this environment, companies with high insider ownership can signal strong internal confidence and alignment with shareholder interests, making them attractive considerations for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market cap of approximately ¥820.20 billion.

Operations: BayCurrent Consulting, Inc. generates revenue through its consulting services in Japan.

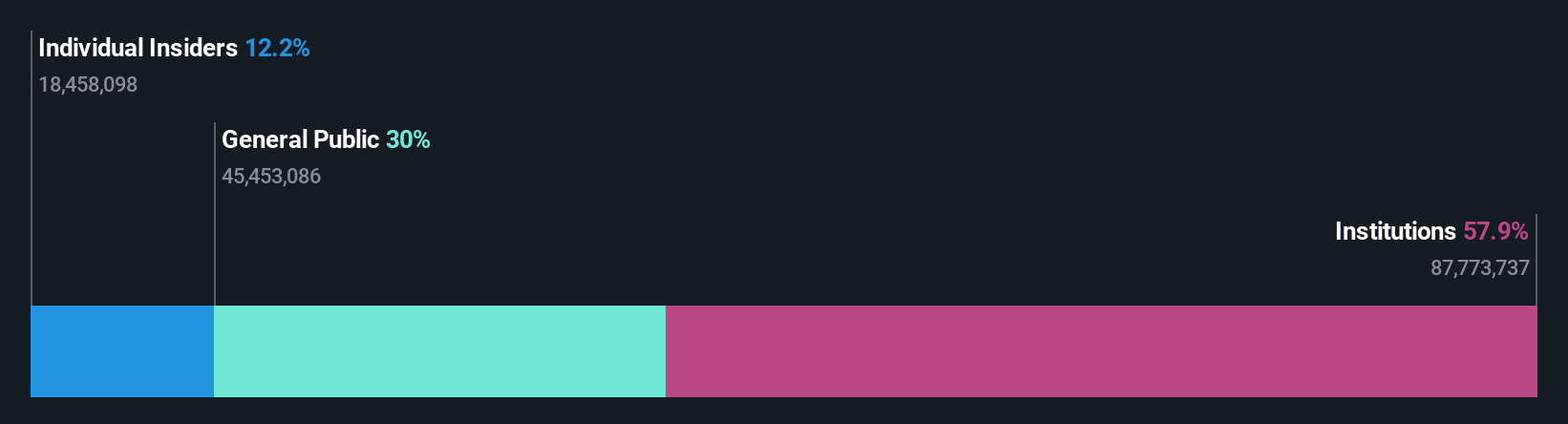

Insider Ownership: 13.9%

Revenue Growth Forecast: 18.4% p.a.

BayCurrent Consulting is positioned for growth with a strong forecasted return on equity of 35% in three years. While its expected revenue growth of 18.4% annually is below the 20% threshold, it still surpasses the Japanese market average of 4.2%. Earnings are projected to grow at 19%, outpacing the market's 7.9%. Despite no recent insider trading activity, BayCurrent trades at a significant discount to its estimated fair value, suggesting potential upside.

- Click here and access our complete growth analysis report to understand the dynamics of BayCurrent Consulting.

- The valuation report we've compiled suggests that BayCurrent Consulting's current price could be inflated.

Voltronic Power Technology (TWSE:6409)

Simply Wall St Growth Rating: ★★★☆☆☆

Overview: Voltronic Power Technology Corp., along with its subsidiaries, designs, manufactures, and sells uninterruptible power systems (UPS) in Taiwan and China, with a market cap of NT$164.91 billion.

Operations: The company generates revenue of NT$22.40 billion from the manufacturing and trading of uninterruptible power systems and inverters.

Insider Ownership: 14.8%

Revenue Growth Forecast: 12.9% p.a.

Voltronic Power Technology's recent earnings report shows substantial growth, with third-quarter sales reaching TWD 6.70 billion, up from TWD 4.46 billion a year ago, and net income rising to TWD 1.23 billion from TWD 629.64 million. Despite its volatile share price and slower projected earnings growth of 13.5% compared to the market's 19.3%, the company maintains a very high forecasted return on equity of 48.8% in three years, indicating strong potential for future profitability amidst stable insider ownership levels.

- Click here to discover the nuances of Voltronic Power Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Voltronic Power Technology implies its share price may be too high.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★★

Overview: Caliway Biopharmaceuticals Co. Ltd focuses on developing small molecule drugs for medical aesthetics and inflammatory diseases, with a market cap of NT$84.39 billion.

Operations: The company generates revenue of NT$49.98 million from its pharmaceuticals segment.

Insider Ownership: 24.4%

Revenue Growth Forecast: 125.4% p.a.

Caliway Biopharmaceuticals is poised for significant growth, with revenue projected to increase by 125.4% annually, outpacing the market's 12.1%. Despite recent share dilution and high volatility, the stock trades at a substantial discount to its estimated fair value. The company aims for profitability within three years, supported by promising Phase 2b results of CBL-514 for fat reduction and plans for a pivotal Phase 3 study in 2025.

- Dive into the specifics of Caliway Biopharmaceuticals here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Caliway Biopharmaceuticals is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 1567 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BayCurrent Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with reasonable growth potential.