- Japan

- /

- Semiconductors

- /

- TSE:6055

JAPAN MATERIAL And 2 Other Stocks That May Be Trading Below Their Fair Value

Reviewed by Simply Wall St

As Japan's stock markets recently faced declines, driven by a U.S.-led sell-off in semiconductor stocks and strengthened yen, investors are increasingly on the lookout for undervalued opportunities. In this environment, identifying stocks that may be trading below their fair value can offer potential advantages for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3485.00 | ¥6724.44 | 48.2% |

| Kotobuki Spirits (TSE:2222) | ¥1738.50 | ¥3434.73 | 49.4% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2122.00 | ¥4162.31 | 49% |

| Stella Chemifa (TSE:4109) | ¥4200.00 | ¥8142.84 | 48.4% |

| I-PEX (TSE:6640) | ¥1518.00 | ¥2904.44 | 47.7% |

| Pilot (TSE:7846) | ¥4495.00 | ¥8891.46 | 49.4% |

| Ohara (TSE:5218) | ¥1304.00 | ¥2599.18 | 49.8% |

| West Holdings (TSE:1407) | ¥2641.00 | ¥5126.30 | 48.5% |

| Adventure (TSE:6030) | ¥3900.00 | ¥7474.73 | 47.8% |

| CIRCULATIONLtd (TSE:7379) | ¥653.00 | ¥1283.80 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics businesses in Japan with a market cap of ¥176.92 billion.

Operations: The company's revenue segments include Electronics at ¥47.65 billion, Graphics Solution Business at ¥1.56 billion, and Solar Power Generation Business at ¥206 million.

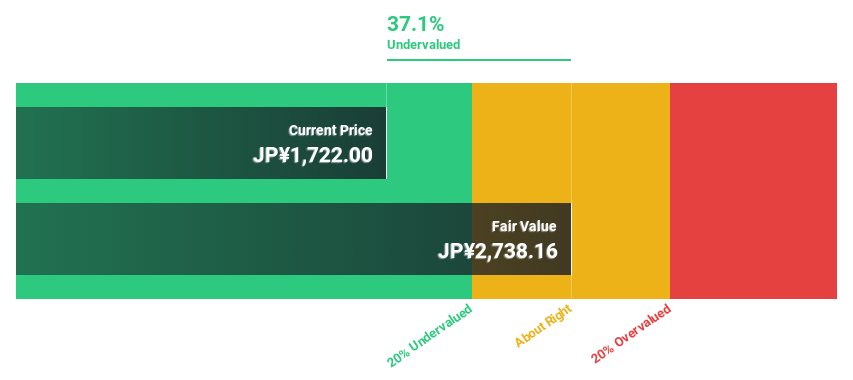

Estimated Discount To Fair Value: 37.1%

Japan Material is trading at ¥1722, significantly below its estimated fair value of ¥2738.25, presenting a strong case for being undervalued based on cash flows. Despite a highly volatile share price recently, the company's earnings are forecast to grow at 24.4% per year, outpacing the JP market's 8.6%. Revenue growth is also expected to be robust at 14.7% annually, faster than the market average of 4.2%.

- In light of our recent growth report, it seems possible that JAPAN MATERIAL's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of JAPAN MATERIAL.

BayCurrent Consulting (TSE:6532)

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market cap of ¥780.46 billion.

Operations: BayCurrent Consulting, Inc.'s revenue segments include consulting services in Japan.

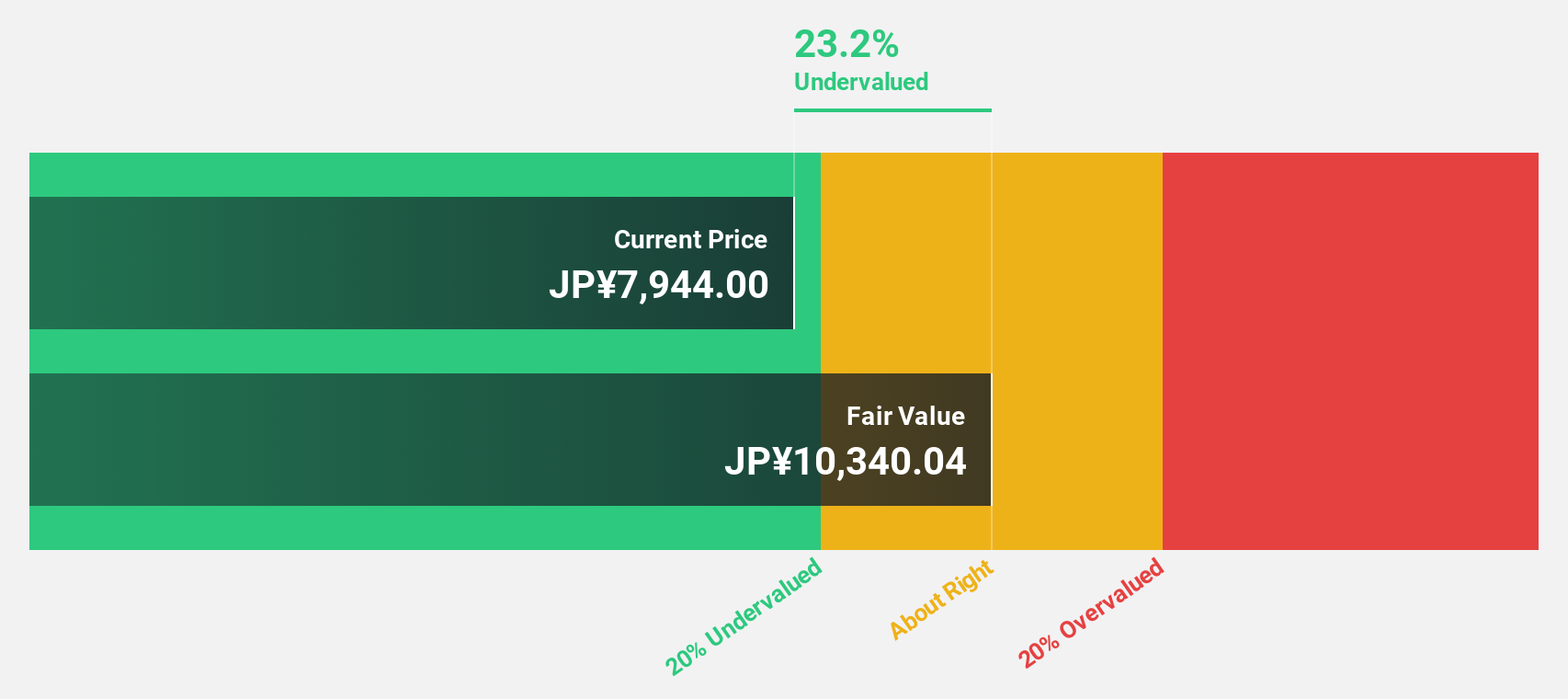

Estimated Discount To Fair Value: 46%

BayCurrent Consulting is trading at ¥5144, well below its estimated fair value of ¥9523.3, indicating it may be undervalued based on cash flows. The company's revenue is forecast to grow at 18.6% annually, significantly outpacing the JP market's 4.2%. Earnings are expected to increase by 18.8% per year, also surpassing the market average of 8.6%. Additionally, BayCurrent's Return on Equity is projected to reach a high 35.5% in three years' time.

- Our growth report here indicates BayCurrent Consulting may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of BayCurrent Consulting stock in this financial health report.

HOYA (TSE:7741)

Overview: HOYA Corporation, a med-tech company with a market cap of ¥6.52 trillion, provides high-tech and medical products worldwide.

Operations: The company's revenue segments include Life Care at ¥537.56 billion and Telecommunications at ¥253.04 billion.

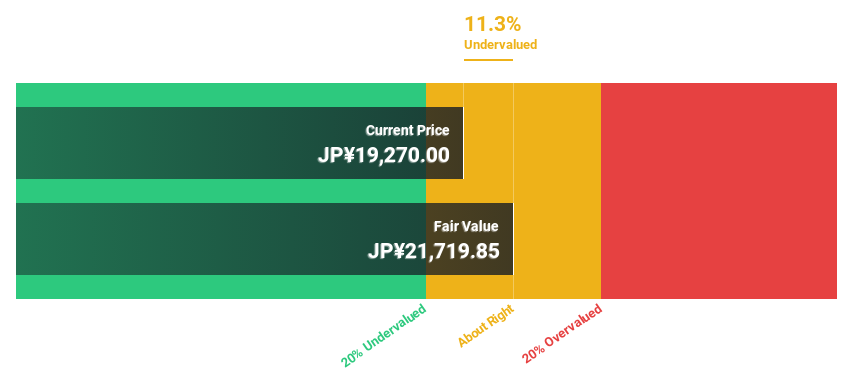

Estimated Discount To Fair Value: 10.7%

HOYA is trading at ¥19345, slightly below its estimated fair value of ¥21664.84. The company's earnings are forecast to grow at 11.27% annually, outpacing the JP market's 8.6%. Recent buybacks totaling ¥49,999.11 million and FDA clearance for a new sterilization product highlight strong cash flow management and innovation in healthcare solutions, respectively. Revenue growth is projected at 7.7% per year, faster than the market average of 4.2%.

- The analysis detailed in our HOYA growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in HOYA's balance sheet health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Japanese Stocks Based On Cash Flows screener has unearthed 81 more companies for you to explore.Click here to unveil our expertly curated list of 84 Undervalued Japanese Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6055

JAPAN MATERIAL

Operates in the electronics and graphics businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.