- Japan

- /

- Professional Services

- /

- TSE:6098

Recruit Holdings (TSE:6098) Is Up 12.4% After Raising Outlook and Dividend Guidance Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Recruit Holdings recently raised its full-year earnings outlook for the period ending March 2026, now forecasting revenue of ¥3.60 trillion, operating income of ¥566.0 billion, and profit attributable to shareholders of ¥448.3 billion, alongside a higher interim dividend of ¥12.50 per share for the September quarter.

- The simultaneous increase in both the company’s earnings guidance and interim dividend suggests management’s increased confidence in future performance and capacity to deliver greater shareholder returns.

- We’ll examine how Recruit Holdings’ improved outlook and higher dividend payment could reshape the company’s long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Recruit Holdings Investment Narrative Recap

To be a shareholder in Recruit Holdings, you typically need to believe that ongoing investments in automation, AI-powered services, and operational efficiency will ultimately drive stable earnings growth and allow Recruit to maintain or improve its competitive positioning despite global economic uncertainty. The recent upward revision of full-year earnings and dividend guidance provides some short-term reassurance but does not significantly mitigate the primary risk: continued softness in the US and European job markets could weigh on consolidated revenues in the near term.

Among the latest announcements, the expanded share repurchase authorization of up to ¥250,000 million stands out. This reinforces the company's focus on disciplined capital management, which could support earnings per share and reflect a commitment to returning capital to investors, even as management remains attentive to external headwinds and operating margin pressures.

By contrast, investors should be equally attentive to the lingering threat from prolonged weakness in international staffing demand, particularly in the US and Europe, which could...

Read the full narrative on Recruit Holdings (it's free!)

Recruit Holdings' narrative projects ¥4,042.8 billion in revenue and ¥580.9 billion in earnings by 2028. This requires 4.6% yearly revenue growth and a ¥157.9 billion earnings increase from the current earnings of ¥423.0 billion.

Uncover how Recruit Holdings' forecasts yield a ¥9868 fair value, a 20% upside to its current price.

Exploring Other Perspectives

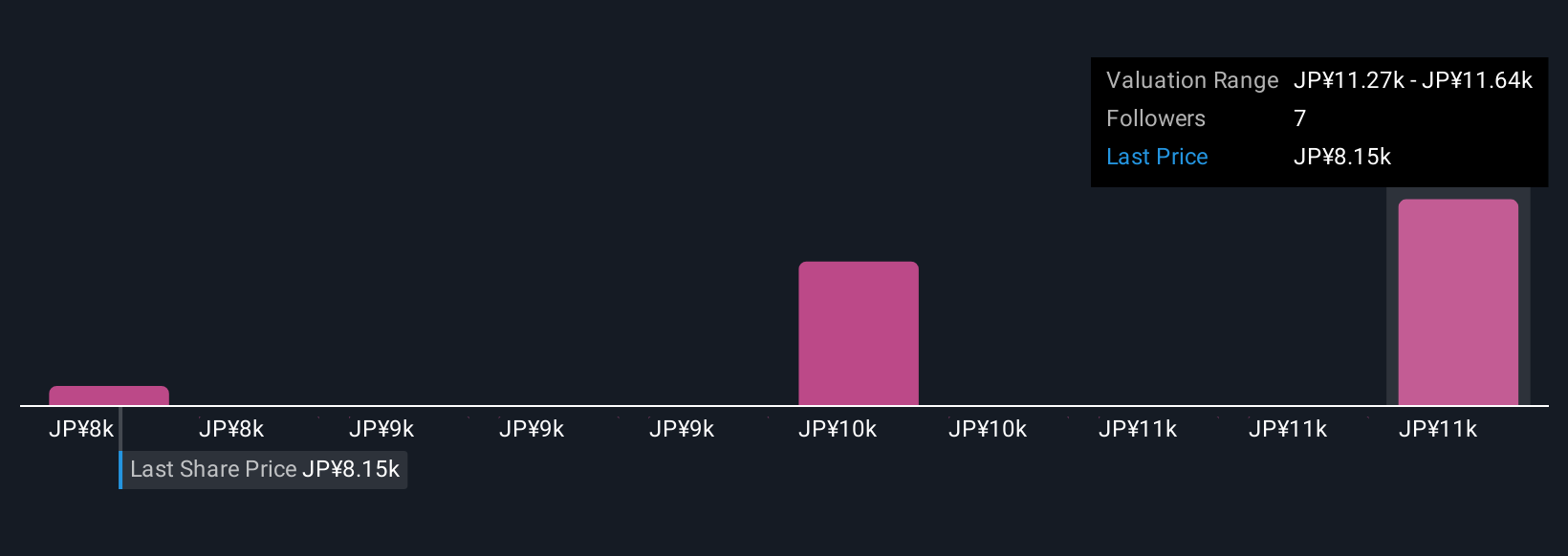

Four members of the Simply Wall St Community estimated Recruit Holdings' fair value from ¥7,900 to ¥11,690 per share. While views differ, many are watching how ongoing macro softness in key markets could impact future revenue streams, explore these perspectives to see which outlook matches yours.

Explore 4 other fair value estimates on Recruit Holdings - why the stock might be worth as much as 42% more than the current price!

Build Your Own Recruit Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recruit Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Recruit Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recruit Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives