- Japan

- /

- Professional Services

- /

- TSE:6098

Is Recruit Holdings (TSE:6098) Using Share Buybacks to Balance Capital Efficiency With Future Flexibility?

Reviewed by Sasha Jovanovic

- Recruit Holdings Co., Ltd. recently announced a share repurchase program, authorizing the buyback of up to 38,000,000 shares, about 2.68% of its outstanding stock excluding treasury shares, for a total amount of ¥250 billion, with the aim to improve capital efficiency and maximize shareholder returns by April 2026.

- The company has positioned the repurchased shares for potential use in stock compensation, strategic mergers and acquisitions, or cancellation, offering flexibility in how it manages future capital allocation.

- With the company's new share buyback initiative signaling a focus on capital efficiency, we'll assess its impact on Recruit Holdings' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Recruit Holdings Investment Narrative Recap

To be a shareholder in Recruit Holdings, you need to believe in the company’s ability to drive long-term value through automation, digitalization, and global HR platform integration. The recent share buyback announcement highlights a focus on capital efficiency but does not materially alter the short-term risk tied to persistent weakness in U.S. and international job postings, which remains the most significant concern for revenue growth ahead of the November earnings release.

The board’s decision in July to reduce the HR Technology workforce by roughly 1,300 employees is closely related to the buyback initiative, signaling a disciplined approach to cost control. Both moves reinforce Recruit’s push toward operating efficiency, a key catalyst that could help defend margins during softer global labor market conditions, but sustained revenue recovery is still uncertain.

But for investors, it’s crucial to recognize that ongoing weakness in developed market staffing revenue could...

Read the full narrative on Recruit Holdings (it's free!)

Recruit Holdings' outlook anticipates ¥4,042.8 billion in revenue and ¥580.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 4.6% and a ¥157.9 billion increase in earnings from the current ¥423.0 billion.

Uncover how Recruit Holdings' forecasts yield a ¥9868 fair value, a 25% upside to its current price.

Exploring Other Perspectives

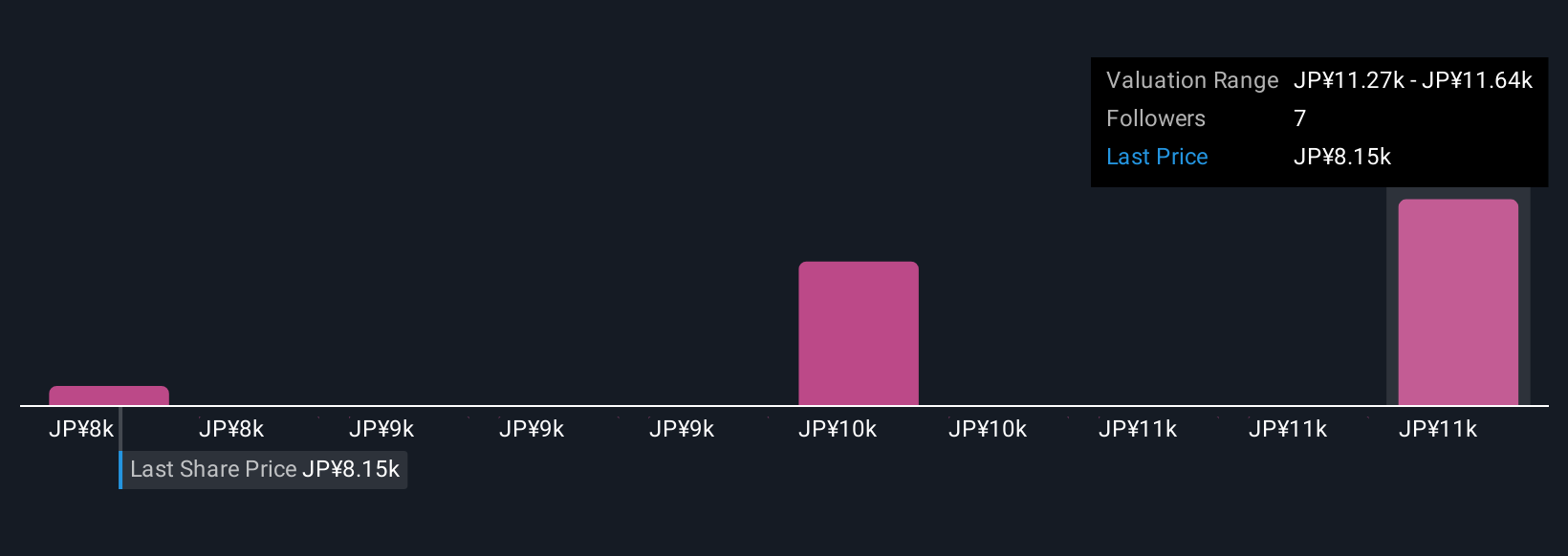

Four community fair value estimates for Recruit Holdings range from ¥7,900 to ¥11,760, highlighting nearly ¥4,000 difference in perceived worth. While some forecast a margin-driven boost, the risk of international revenue stagnation continues to weigh heavily on the company’s outlook, inviting you to consider a wide spectrum of potential outcomes.

Explore 4 other fair value estimates on Recruit Holdings - why the stock might be worth as much as 48% more than the current price!

Build Your Own Recruit Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recruit Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Recruit Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recruit Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives