- Japan

- /

- Professional Services

- /

- TSE:6098

3 Global Stocks Estimated To Be Up To 48.1% Undervalued

Reviewed by Simply Wall St

As global markets navigate a period of heightened uncertainty, with central banks holding rates steady amid mixed economic signals, investors are keenly observing the shifting dynamics between growth and value stocks. In such an environment, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK259.93 | 49.9% |

| CTT Systems (OM:CTT) | SEK221.00 | SEK440.81 | 49.9% |

| Comet Holding (SWX:COTN) | CHF233.00 | CHF464.46 | 49.8% |

| Net Insight (OM:NETI B) | SEK4.82 | SEK9.58 | 49.7% |

| Takara Bio (TSE:4974) | ¥849.00 | ¥1686.78 | 49.7% |

| Cowell e Holdings (SEHK:1415) | HK$32.25 | HK$64.06 | 49.7% |

| Deutsche Beteiligungs (XTRA:DBAN) | €26.55 | €53.05 | 50% |

| dormakaba Holding (SWX:DOKA) | CHF681.00 | CHF1356.93 | 49.8% |

| Neosperience (BIT:NSP) | €0.532 | €1.06 | 49.7% |

| Sunny Optical Technology (Group) (SEHK:2382) | HK$84.60 | HK$167.83 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Bide Pharmatech (SHSE:688073)

Overview: Bide Pharmatech Co., Ltd. is involved in the research, development, production, and sale of pharmaceutical products in China with a market capitalization of CN¥4.64 billion.

Operations: The company's revenue primarily comes from the Research and Experimental Development Industry, amounting to CN¥1.10 billion.

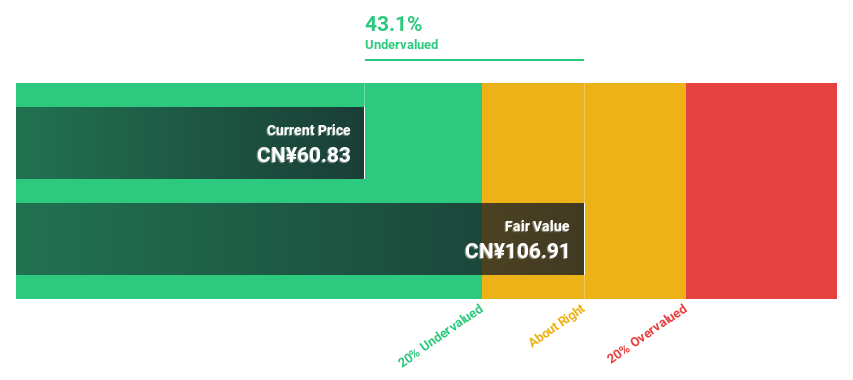

Estimated Discount To Fair Value: 48.1%

Bide Pharmatech is trading at CN¥55.45, significantly below its estimated fair value of CN¥106.91, indicating potential undervaluation based on cash flows. The company has announced a share repurchase program worth up to CNY 100 million, which could enhance long-term shareholder value. Despite forecasted earnings growth of 29.55% per year, profit margins have decreased from last year and the stock remains volatile with a low return on equity forecasted at 7.7%.

- The growth report we've compiled suggests that Bide Pharmatech's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Bide Pharmatech.

SWS Hemodialysis Care (SHSE:688410)

Overview: SWS Hemodialysis Care Co., Ltd. offers integrated blood purification solutions for renal failure and critically ill patients globally, with a market cap of CN¥3.47 billion.

Operations: I apologize, but it seems there is no specific revenue segment information provided in the text you shared. If you have additional details or another section that includes this information, please share it so I can assist further.

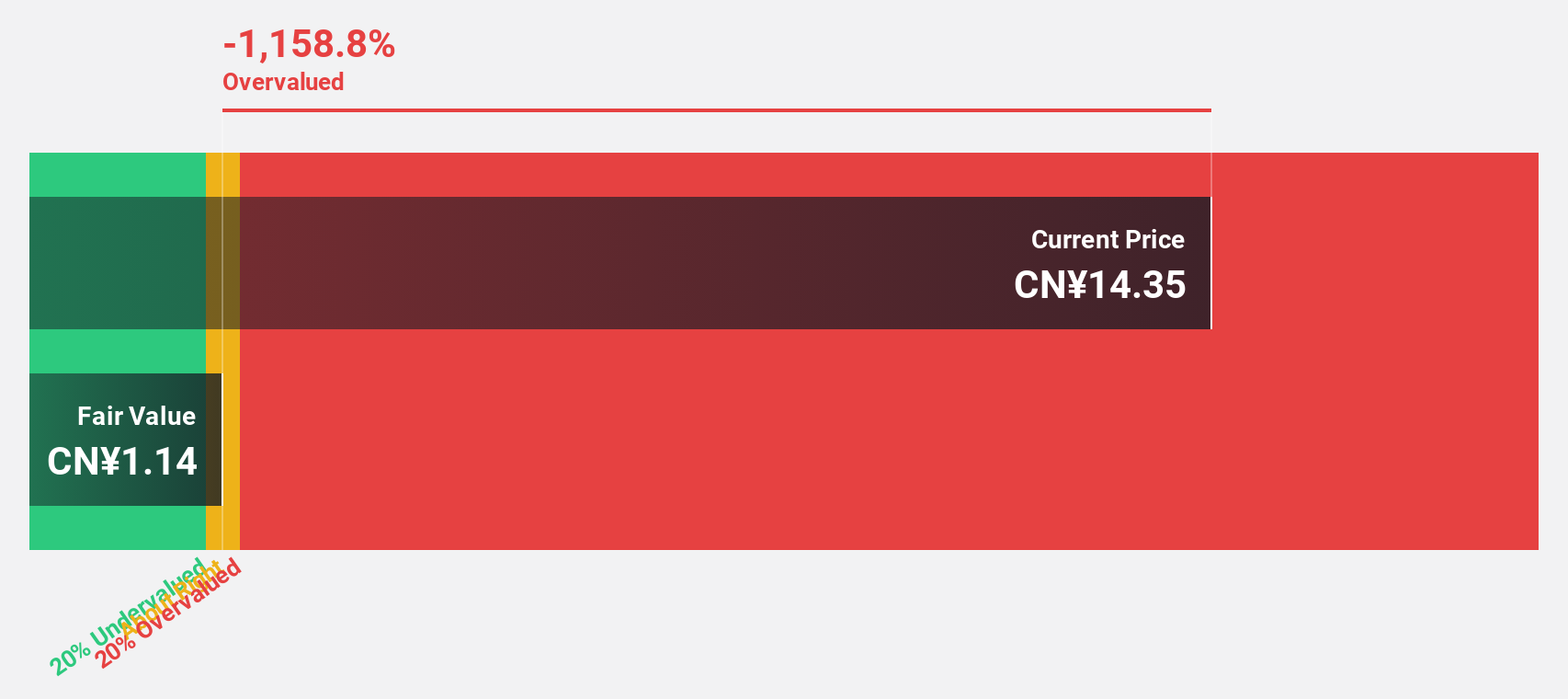

Estimated Discount To Fair Value: 27.5%

SWS Hemodialysis Care is trading at CNY 11.63, considerably below its estimated fair value of CNY 16.04, highlighting potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 56.1% annually over the next three years, outpacing the market average. However, recent financials show a decline in profit margins from 28.2% to 13.1%, and return on equity is forecasted to remain low at 12.8%.

- Our earnings growth report unveils the potential for significant increases in SWS Hemodialysis Care's future results.

- Dive into the specifics of SWS Hemodialysis Care here with our thorough financial health report.

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions to transform the world of work, with a market cap of ¥12.04 trillion.

Operations: The company's revenue segments include HR Technology at ¥1.10 billion, Temporary Staffing at ¥1.67 billion, and Matching & Solutions at ¥815.40 million.

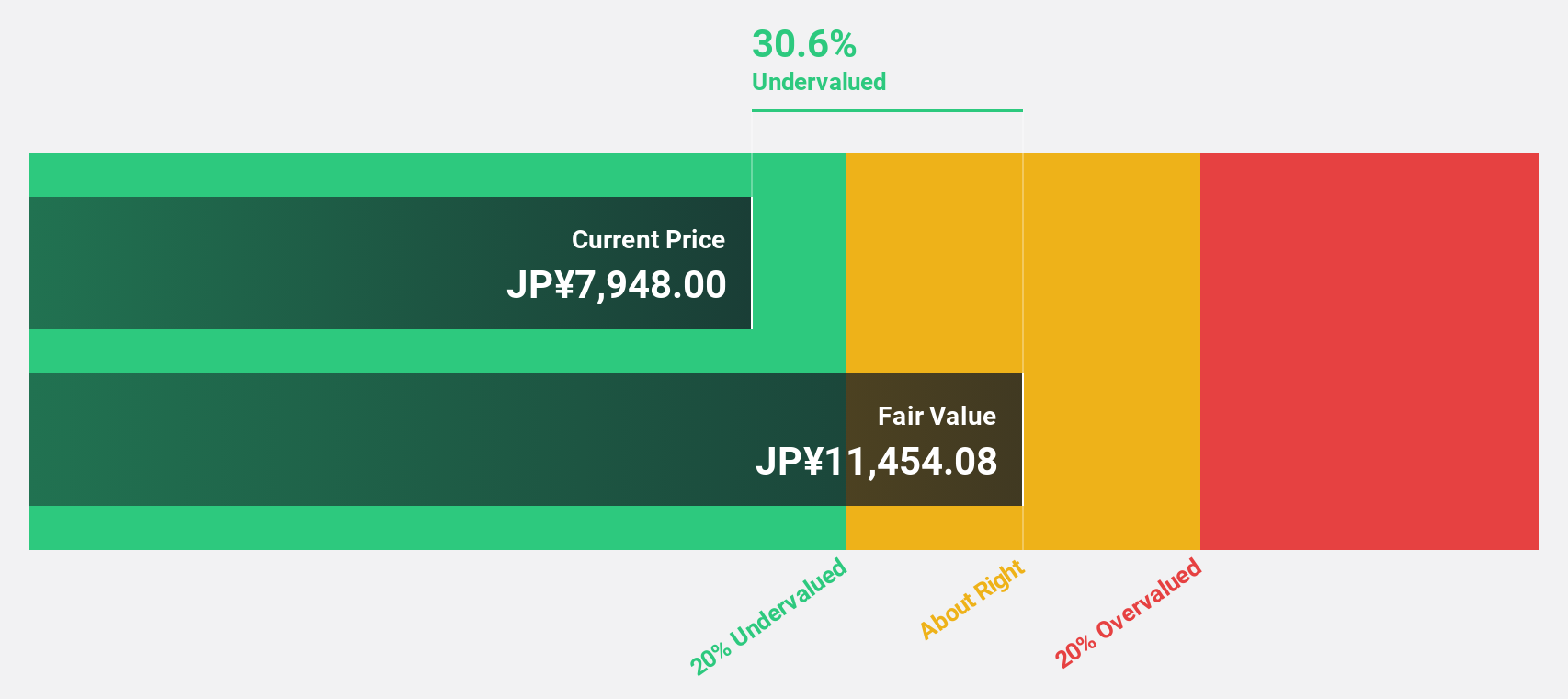

Estimated Discount To Fair Value: 17.1%

Recruit Holdings, trading at ¥8,278, is undervalued compared to its estimated fair value of ¥9,990.84. The company has initiated a share repurchase program worth ¥450 billion to enhance shareholder returns and support long-term growth strategies. Despite recent volatility in its share price, Recruit's earnings are projected to grow 10.51% annually, surpassing the JP market average of 8%. Analysts anticipate a 27.5% increase in stock price from current levels.

- In light of our recent growth report, it seems possible that Recruit Holdings' financial performance will exceed current levels.

- Click here to discover the nuances of Recruit Holdings with our detailed financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 512 Undervalued Global Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives