- Japan

- /

- Professional Services

- /

- TSE:6028

TechnoPro Holdings (TSE:6028): Reassessing Valuation After S&P Global BMI Index Removal

Reviewed by Simply Wall St

TechnoPro Holdings (TSE:6028) has been dropped from the S&P Global BMI Index, a shift that can prompt forced selling by index trackers and short term volatility, but also create opportunities for patient investors.

See our latest analysis for TechnoPro Holdings.

That backdrop makes TechnoPro’s roughly 66 percent year to date share price return and robust one year total shareholder return of about 69 percent look more like a pause in strong momentum, rather than a reversal in sentiment or fundamentals.

If this index change has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a curated way to spot other compelling ideas.

With earnings still growing, an intrinsic value estimate suggesting upside, and the share price now sitting above analyst targets, is TechnoPro objectively undervalued after the index exit, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 25.2% Overvalued

Compared with TechnoPro’s last close of ¥4,845, the most followed narrative points to a lower fair value anchored in more moderate future assumptions.

The analysts have a consensus price target of ¥3362.5 for TechnoPro Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3800.0, and the most bearish reporting a price target of just ¥2900.0.

Curious how solid revenue growth, rising margins and a higher future earnings multiple can still point to downside from here? The tension is in the forecasts. Click through to see which specific profit trajectory and discount rate combine to pull fair value below today’s market price.

Result: Fair Value of ¥3,868 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing top line growth and rising wage pressures could quickly squeeze margins and undermine the optimistic earnings and valuation trajectory baked into forecasts.

Find out about the key risks to this TechnoPro Holdings narrative.

Another View: Market Ratios Paint a Different Picture

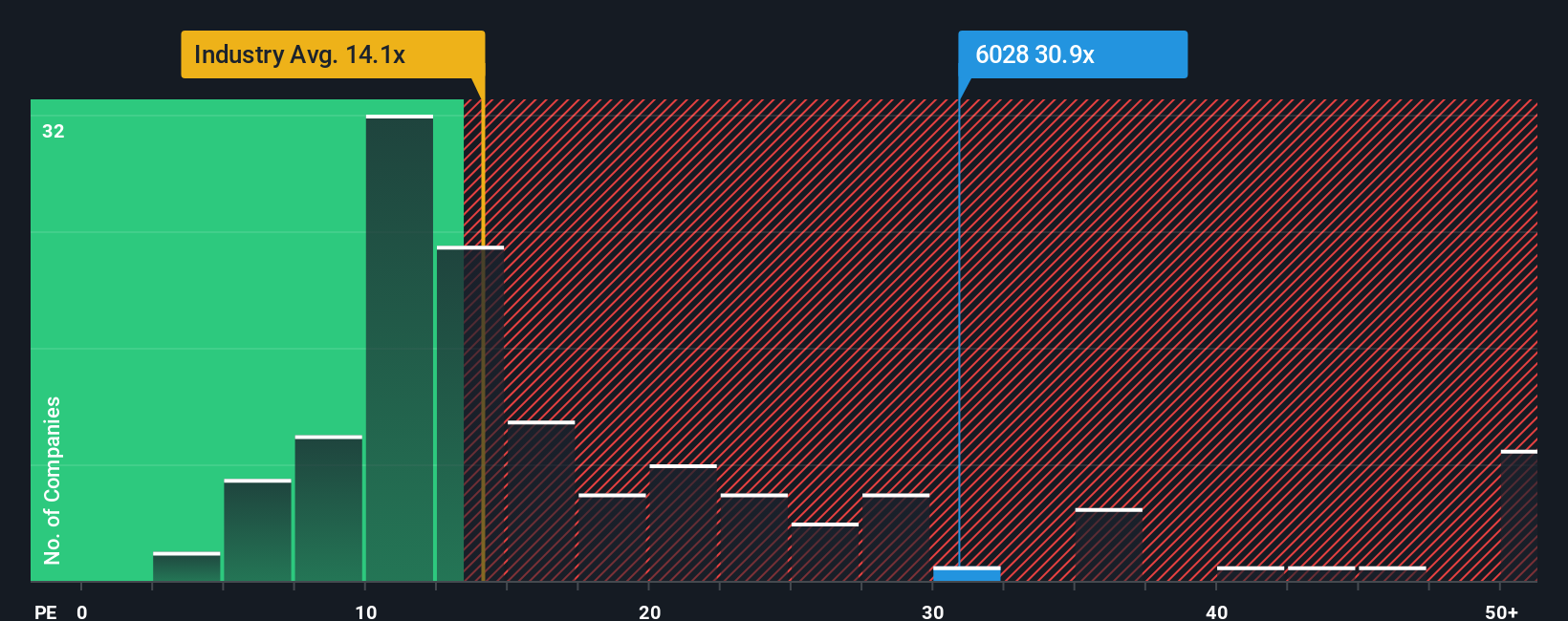

While the narrative fair value implies downside, the current price implies a rich P/E of 30.8 times, well above the industry at 14.2 times and even the 23.2 times fair ratio our models suggest the market could move toward. Is this premium confidence or complacency?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TechnoPro Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TechnoPro Holdings Narrative

If you would rather lean on your own assumptions and research instead of these views, you can build a complete narrative in under three minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TechnoPro Holdings.

Looking for more investment ideas?

If you stop at TechnoPro, you risk missing other powerful opportunities. Use the Simply Wall Street Screener to systematically uncover your next smart move.

- Explore powerful cash flow opportunities by targeting these 910 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Follow structural growth trends by focusing on these 30 healthcare AI stocks addressing critical challenges across diagnostics, treatment, and hospital efficiency.

- Enhance your income potential with these 15 dividend stocks with yields > 3% that pay reliable, above-average yields while still maintaining healthy fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion