- Japan

- /

- Professional Services

- /

- TSE:5131

Some Confidence Is Lacking In Linkers Corporation (TSE:5131) As Shares Slide 37%

Linkers Corporation (TSE:5131) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

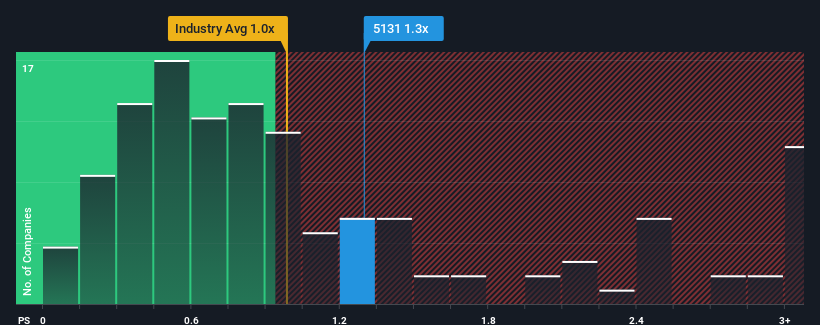

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Linkers' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Professional Services industry in Japan is also close to 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Linkers

What Does Linkers' Recent Performance Look Like?

For instance, Linkers' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Linkers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Linkers' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Linkers' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.4%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 5.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Linkers' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Linkers looks to be in line with the rest of the Professional Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Linkers revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Linkers (at least 2 which are potentially serious), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5131

Adequate balance sheet low.

Market Insights

Community Narratives