- Japan

- /

- Professional Services

- /

- TSE:4490

Market Might Still Lack Some Conviction On VisasQ Inc. (TSE:4490) Even After 44% Share Price Boost

VisasQ Inc. (TSE:4490) shares have continued their recent momentum with a 44% gain in the last month alone. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

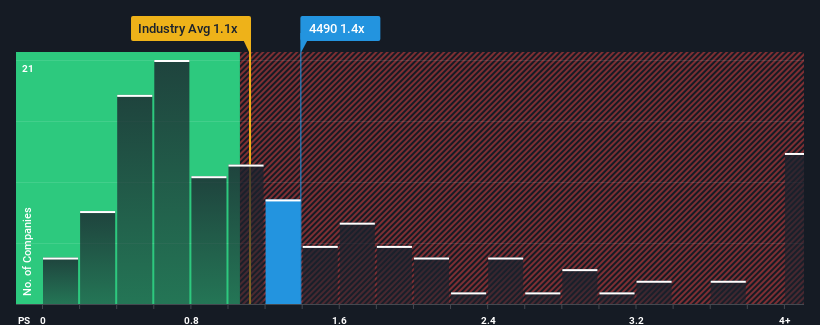

Even after such a large jump in price, it's still not a stretch to say that VisasQ's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Professional Services industry in Japan, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for VisasQ

What Does VisasQ's P/S Mean For Shareholders?

Recent times have been advantageous for VisasQ as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think VisasQ's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, VisasQ would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 12% each year over the next three years. That's shaping up to be materially higher than the 7.1% per year growth forecast for the broader industry.

In light of this, it's curious that VisasQ's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On VisasQ's P/S

Its shares have lifted substantially and now VisasQ's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that VisasQ currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider and we've discovered 2 warning signs for VisasQ (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of VisasQ's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4490

VisasQ

Provides professional knowledge sharing platform/consulting services for business and organizational development in Japan.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives