- Japan

- /

- Professional Services

- /

- TSE:4490

After Leaping 28% VisasQ Inc. (TSE:4490) Shares Are Not Flying Under The Radar

Despite an already strong run, VisasQ Inc. (TSE:4490) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

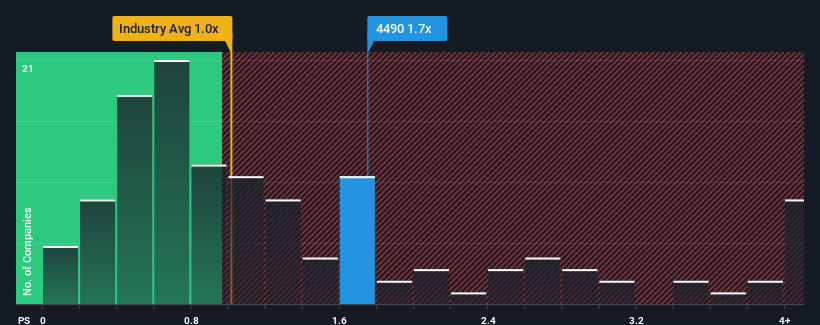

After such a large jump in price, when almost half of the companies in Japan's Professional Services industry have price-to-sales ratios (or "P/S") below 1x, you may consider VisasQ as a stock probably not worth researching with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for VisasQ

How VisasQ Has Been Performing

With revenue growth that's superior to most other companies of late, VisasQ has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on VisasQ will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For VisasQ?

In order to justify its P/S ratio, VisasQ would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.4%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 12% each year over the next three years. With the industry only predicted to deliver 6.5% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why VisasQ is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in VisasQ's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into VisasQ shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for VisasQ you should know about.

If you're unsure about the strength of VisasQ's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade VisasQ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4490

VisasQ

Provides professional knowledge sharing platform/consulting services for business and organizational development in Japan.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives