- Japan

- /

- Commercial Services

- /

- TSE:4384

Asian Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian equities have mirrored these trends with notable fluctuations. Despite this volatility, the search for undervalued stocks in Asia continues to attract attention, as investors look for opportunities where market sentiment may not fully reflect a company's intrinsic value. Identifying such stocks often involves assessing their fundamentals against broader market conditions and understanding how current economic factors might impact their perceived worth.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.85 | CN¥32.50 | 48.1% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.90 | CN¥305.62 | 49% |

| TLB (KOSDAQ:A356860) | ₩62400.00 | ₩120421.20 | 48.2% |

| SRE Holdings (TSE:2980) | ¥3120.00 | ¥6130.72 | 49.1% |

| Silergy (TWSE:6415) | NT$179.50 | NT$344.81 | 47.9% |

| Raksul (TSE:4384) | ¥1148.00 | ¥2276.91 | 49.6% |

| Nippon Thompson (TSE:6480) | ¥706.00 | ¥1407.35 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥15.12 | CN¥29.44 | 48.6% |

| IDEC (TSE:6652) | ¥2566.00 | ¥4975.59 | 48.4% |

| Cowell e Holdings (SEHK:1415) | HK$26.42 | HK$51.85 | 49% |

Let's uncover some gems from our specialized screener.

Raksul (TSE:4384)

Overview: Raksul Inc. operates in Japan, offering printing services, with a market cap of ¥66.51 billion.

Operations: The company's revenue is primarily derived from its Procurement Platform, which generates ¥57.64 billion, followed by the Marketing Platform contributing ¥3.84 billion.

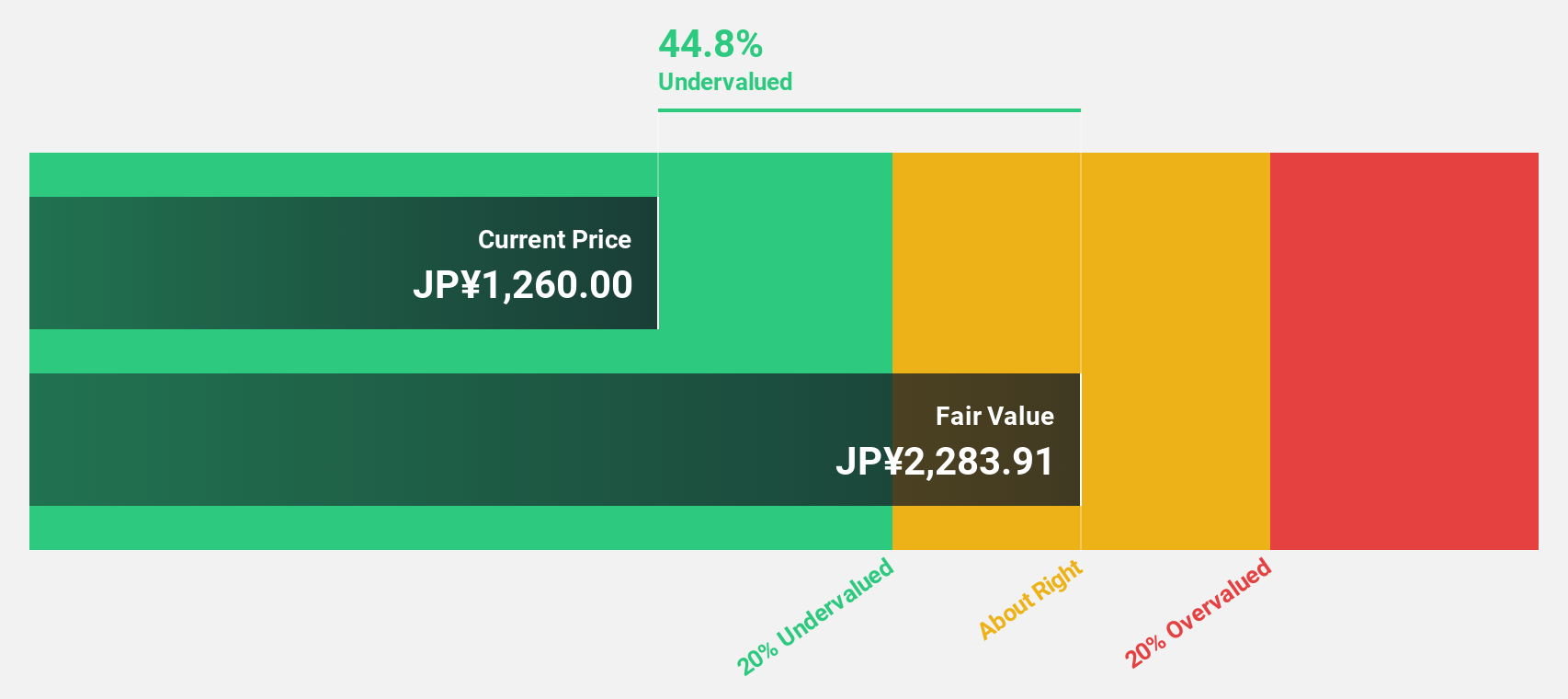

Estimated Discount To Fair Value: 49.6%

Raksul is trading significantly below its estimated fair value of ¥2276.91, presenting a potential opportunity for investors focused on cash flow valuation. The company has demonstrated strong earnings growth of 27.6% over the past year and is forecasted to grow at 19.2% annually, outpacing the Japanese market average of 8.1%. Despite slower revenue growth projections at 11.6%, Raksul's robust return on equity forecast and recent dividend increase highlight its financial health amid board changes and new share issuance plans.

- Insights from our recent growth report point to a promising forecast for Raksul's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Raksul.

Strike CompanyLimited (TSE:6196)

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥79.02 billion.

Operations: The company generates revenue of ¥20.31 billion from its M&A brokerage business, focusing on small and medium-sized enterprises in Japan.

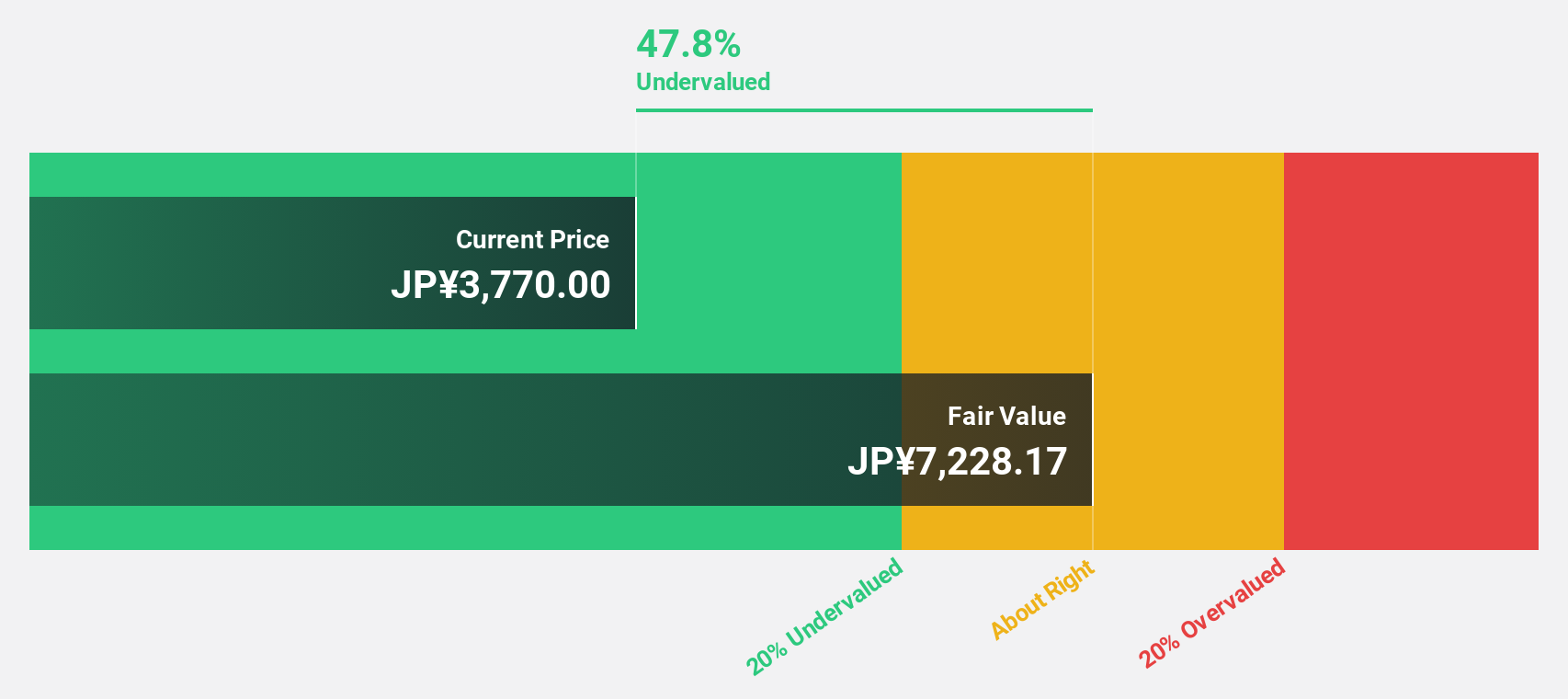

Estimated Discount To Fair Value: 39.9%

Strike Company Limited is trading at ¥4115, significantly undervalued compared to its estimated fair value of ¥6844.61, making it an attractive option for cash flow-focused investors. The company's earnings are projected to grow at 11.6% annually, outpacing the Japanese market's 8.1% growth rate, with revenue expected to increase by 12.7%. Recent board changes and strategic restructuring into a holding company aim to enhance business flexibility and future expansion potential despite concerns over dividend sustainability from free cash flows.

- Our earnings growth report unveils the potential for significant increases in Strike CompanyLimited's future results.

- Navigate through the intricacies of Strike CompanyLimited with our comprehensive financial health report here.

AEON Financial Service (TSE:8570)

Overview: AEON Financial Service Co., Ltd. operates through its subsidiaries to offer a range of financial services in Japan, with a market capitalization of approximately ¥335.81 billion.

Operations: AEON Financial Service Co., Ltd. generates revenue through its subsidiaries by offering a variety of financial services in Japan.

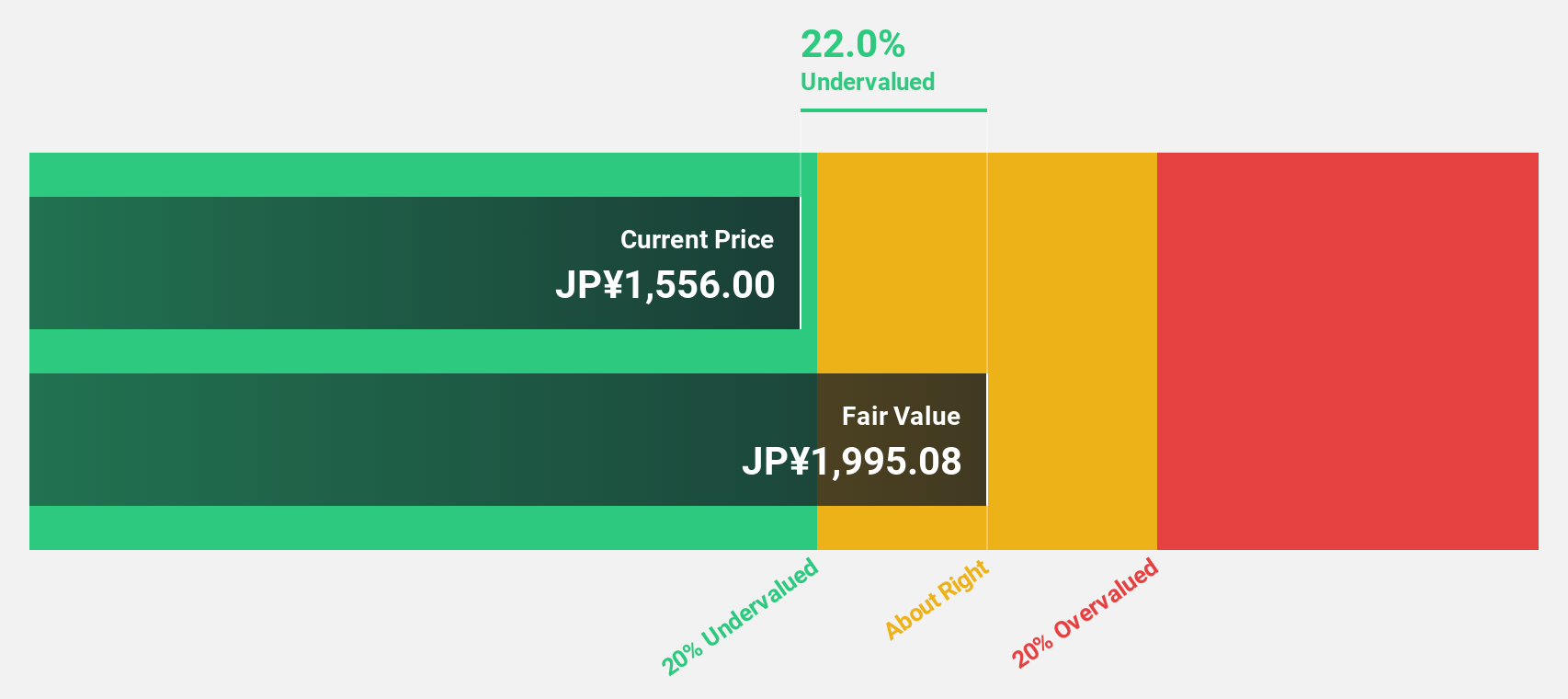

Estimated Discount To Fair Value: 22.3%

AEON Financial Service is trading at ¥1555.5, undervalued by 22.3% compared to its estimated fair value of ¥2001.4, making it appealing for investors focused on cash flows. Earnings are expected to grow significantly at 22.53% annually, surpassing the Japanese market's growth rate of 8.1%. However, the company's return on equity is forecasted to remain low at 8.1%, and its dividend track record is unstable despite recent strategic moves like a planned merger with AFS Corporation Co., Ltd.

- Our expertly prepared growth report on AEON Financial Service implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of AEON Financial Service with our detailed financial health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 275 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4384

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives