Insider-Favored Growth Stocks On The Japanese Exchange For July 2024

Reviewed by Simply Wall St

As global markets navigate through a period of economic recalibration, Japan's stock markets have shown remarkable resilience, with major indices like the Nikkei 225 and TOPIX reaching all-time highs. In this context, stocks with high insider ownership in Japan may offer investors unique growth opportunities, as these insiders often have a deeper commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 26.9% |

| Hottolink (TSE:3680) | 27% | 57.4% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.1% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

| freee K.K (TSE:4478) | 23.9% | 72.9% |

Let's uncover some gems from our specialized screener.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★☆

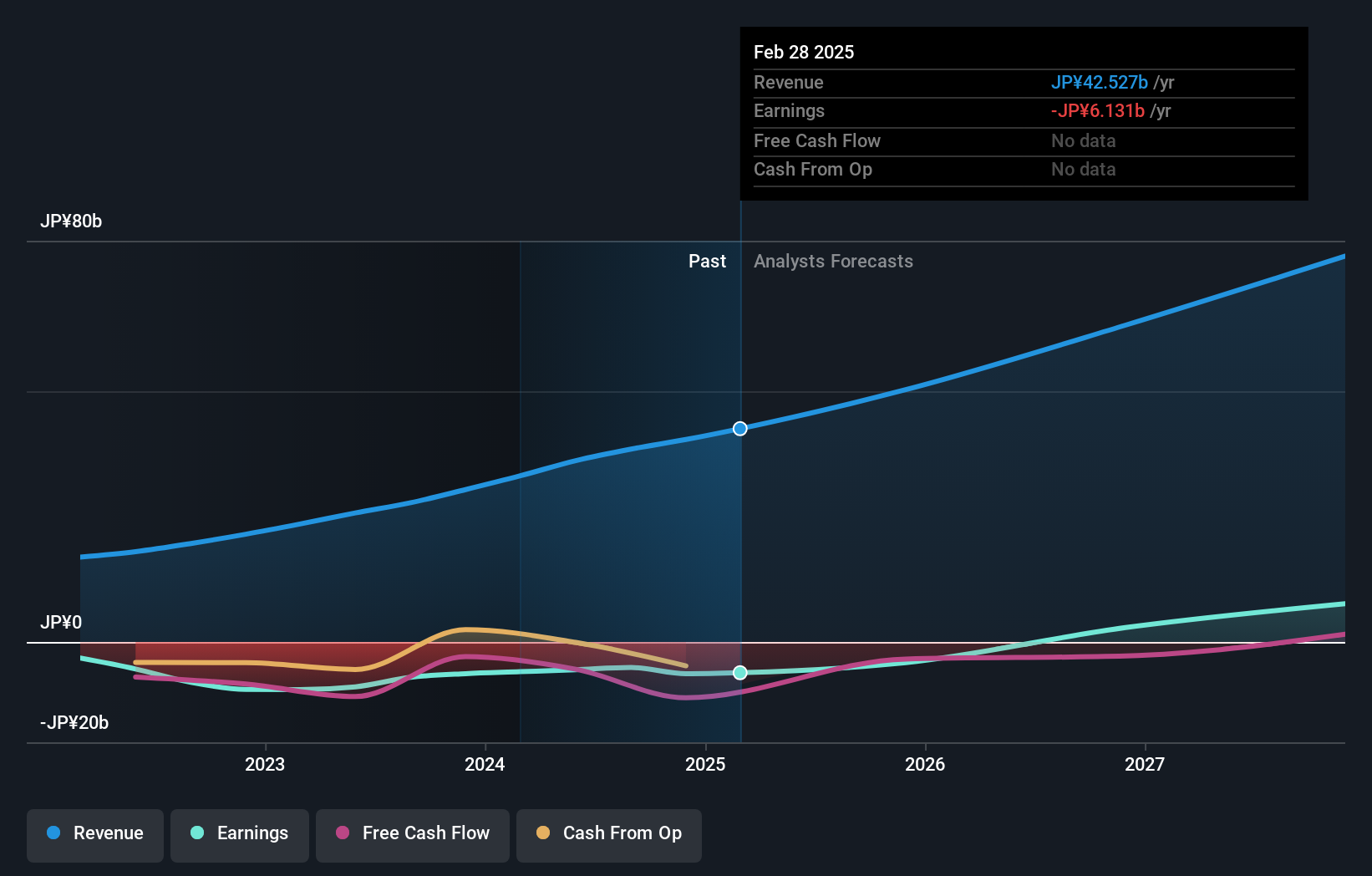

Overview: Money Forward, Inc. offers financial solutions to individuals, financial institutions, and corporations mainly in Japan, with a market capitalization of approximately ¥289.79 billion.

Operations: The firm generates revenue by delivering financial solutions primarily to individual clients, banks, and corporate entities within Japan.

Insider Ownership: 21.4%

Money Forward, a growth-oriented company in Japan, is expected to become profitable within the next three years with anticipated high Return on Equity of 21.2%. Despite its highly volatile share price recently, it trades at 48.8% below estimated fair value and forecasts suggest a robust annual revenue growth rate of 19.9%, outpacing the Japanese market average significantly. Recent strategic moves include planned mergers and business restructures aiming to enhance operational efficiencies and market presence by late 2024.

- Dive into the specifics of Money Forward here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Money Forward is trading beyond its estimated value.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc. operates in Japan, offering human resources platform solutions through its subsidiaries, with a market capitalization of approximately ¥314.44 billion.

Operations: The firm generates revenue through its human resources platform solutions in Japan.

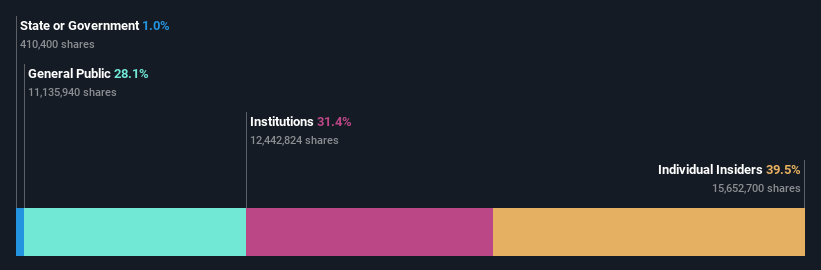

Insider Ownership: 39.6%

Visional, a Japanese company with high insider ownership, shows promising financial prospects despite not being the top in its class for growth. Its earnings are expected to increase by 11.98% annually, outperforming the Japanese market's average of 8.9%. Additionally, its revenue growth forecast at 12.7% annually also surpasses the market expectation of 4.3%. Recently, Visional revised its earnings forecast upwards during a board meeting on June 13, 2024, reflecting potential operational improvements and optimism about future performance. However, it faces challenges with a highly volatile share price and trades at a significant discount to estimated fair value (53.2% below).

- Navigate through the intricacies of Visional with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Visional implies its share price may be lower than expected.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

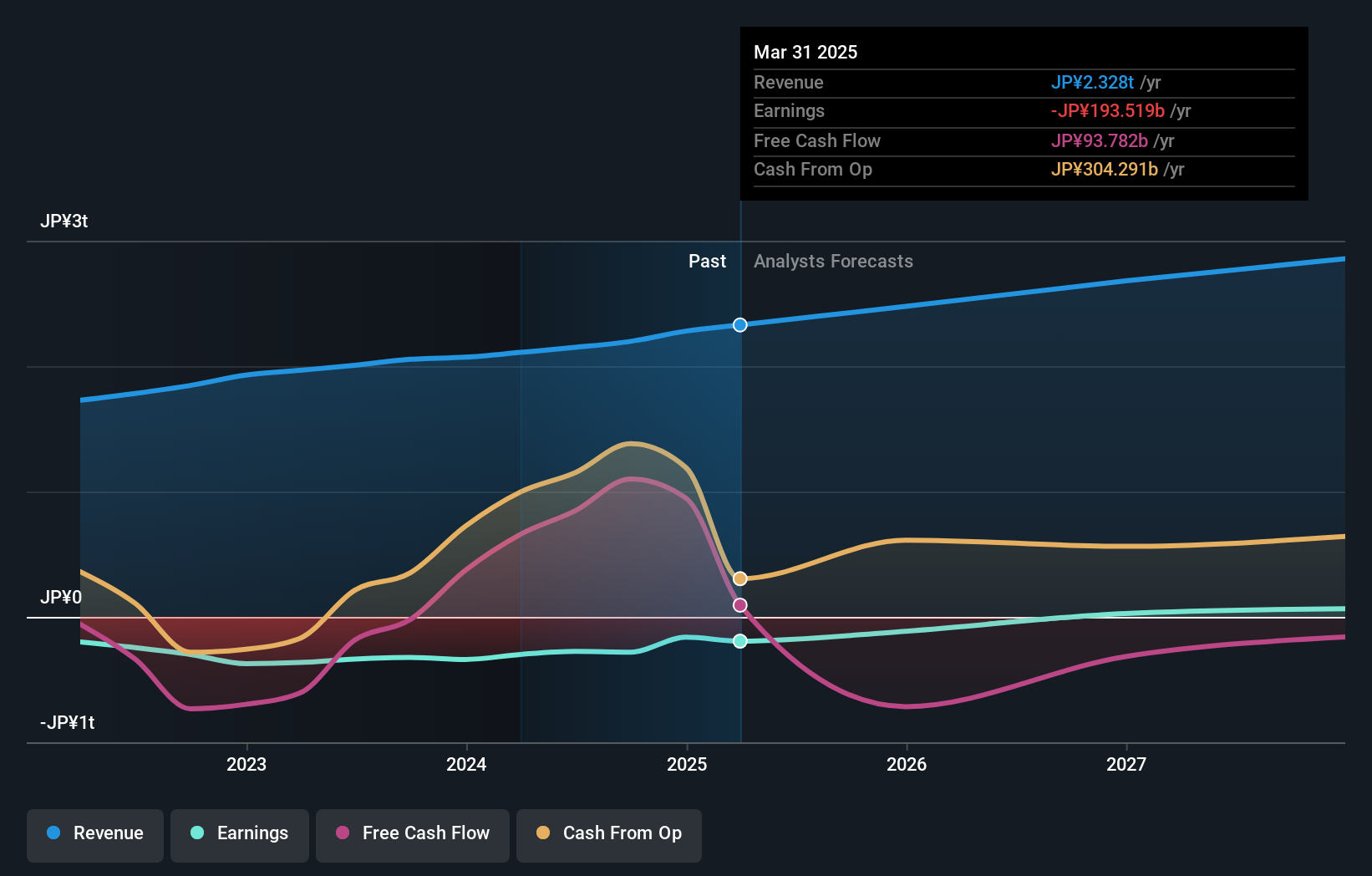

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors globally, with a market capitalization of approximately ¥1.93 trillion.

Operations: The company generates revenue through its diverse operations in e-commerce, fintech, digital content, and communications sectors worldwide.

Insider Ownership: 17.3%

Rakuten Group, set to achieve profitability within three years, is navigating a complex growth trajectory. While its annual revenue growth of 7.8% surpasses the Japanese market's 4.3%, its forecasted Return on Equity remains modest at 8.9%. The company recently projected double-digit growth in operating results for 2024, excluding its securities segment affected by market volatility. Despite trading significantly below fair value, Rakuten's financial outlook is bolstered by robust earnings growth expectations of 83.11% annually.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Rakuten Group's current price could be quite moderate.

Make It Happen

- Reveal the 100 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3994

Money Forward

Provides financial solutions for individuals, financial institutions, and corporations primarily in Japan.

Exceptional growth potential with adequate balance sheet.