- China

- /

- Communications

- /

- SHSE:603496

3 Growth Companies With High Insider Ownership And 33% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a complex landscape marked by tariff uncertainties and mixed economic signals, with U.S. stocks experiencing slight declines amid trade tensions and labor market adjustments. Despite these challenges, many companies continue to report robust earnings growth, underscoring the resilience of certain sectors even as broader concerns persist. In this environment, growth companies with high insider ownership can be particularly attractive due to their potential for alignment between management interests and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Here we highlight a subset of our preferred stocks from the screener.

Bangkok Life Assurance (SET:BLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bangkok Life Assurance Public Company Limited offers life insurance services to individuals and corporates in Thailand, with a market cap of THB33.13 billion.

Operations: The company generates revenue of THB45.65 billion from its life insurance business in Thailand.

Insider Ownership: 12.2%

Earnings Growth Forecast: 20.5% p.a.

Bangkok Life Assurance shows promising growth prospects with earnings expected to grow significantly at 20.5% per year, outpacing the Thai market's 16.6%. Despite a forecasted low return on equity of 8.7% in three years, the company trades at a discount of 16.1% below its estimated fair value, indicating potential undervaluation. Revenue growth is modest at 3.1%, yet it surpasses the market average, and no substantial insider trading has been reported recently.

- Click here to discover the nuances of Bangkok Life Assurance with our detailed analytical future growth report.

- The analysis detailed in our Bangkok Life Assurance valuation report hints at an deflated share price compared to its estimated value.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China, with a market cap of CN¥8.98 billion.

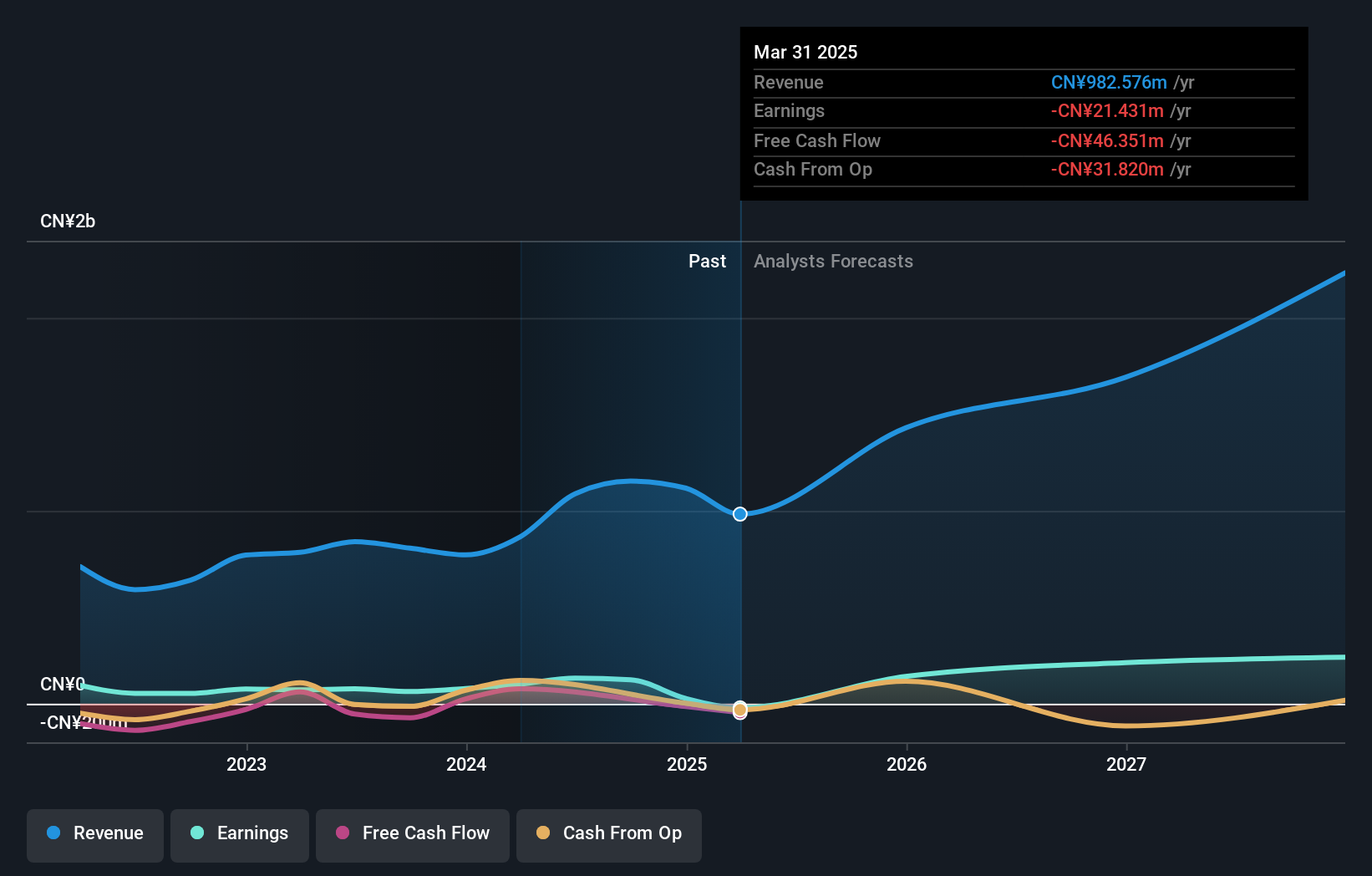

Operations: The company's revenue from the Computer, Communication and Other Electronic Equipment Manufacturing segment is CN¥1.15 billion.

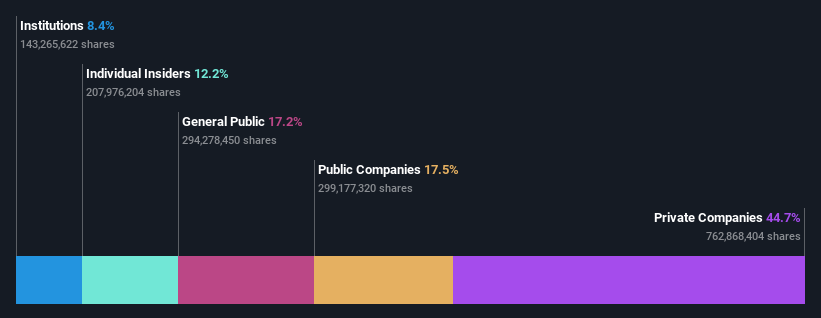

Insider Ownership: 32.1%

Earnings Growth Forecast: 33.9% p.a.

EmbedWay Technologies (Shanghai) is poised for substantial growth, with earnings projected to increase by 33.9% annually, surpassing the CN market's 25.4%. Despite a high price-to-earnings ratio of 72.4x, slightly below the industry average, the company's revenue is expected to grow at 18.3% per year. Although return on equity is forecasted to be low at 13.9%, recent performance shows significant profit growth of 96.7%, and no substantial insider trading activity has been reported recently.

- Take a closer look at EmbedWay Technologies (Shanghai)'s potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of EmbedWay Technologies (Shanghai) shares in the market.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥294.73 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which generated ¥66.61 billion, and its Incubation segment, which contributed ¥2.10 billion.

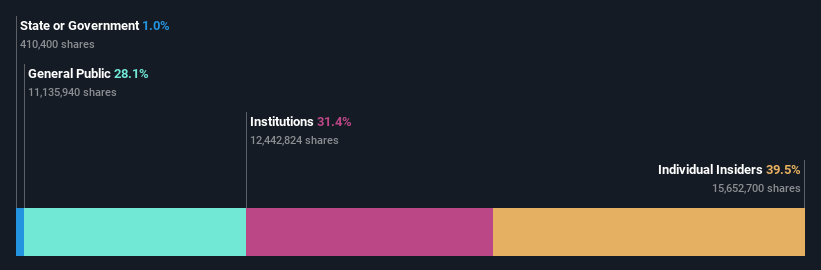

Insider Ownership: 39.2%

Earnings Growth Forecast: 13.8% p.a.

Visional's revenue is projected to grow at 12.2% annually, outpacing the JP market's 4.3%. Earnings are anticipated to rise by 13.85% per year, exceeding the market average of 7.7%. The stock trades at a significant discount, valued at 50.4% below fair value estimates, with analysts predicting a potential price increase of 23.5%. Recent earnings growth was strong at 24.5%, and no substantial insider trading activity has been noted recently.

- Navigate through the intricacies of Visional with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Visional's share price might be on the cheaper side.

Make It Happen

- Delve into our full catalog of 1453 Fast Growing Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EmbedWay Technologies (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603496

EmbedWay Technologies (Shanghai)

Operates as a network visibility infrastructure and intelligent system platform vendor in China.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives