- Japan

- /

- Professional Services

- /

- TSE:296A

Reiwa Accounting Holdings (TSE:296A) Margin Jump Reinforces Bullish Narratives Despite Dividend Sustainability Concerns

Reviewed by Simply Wall St

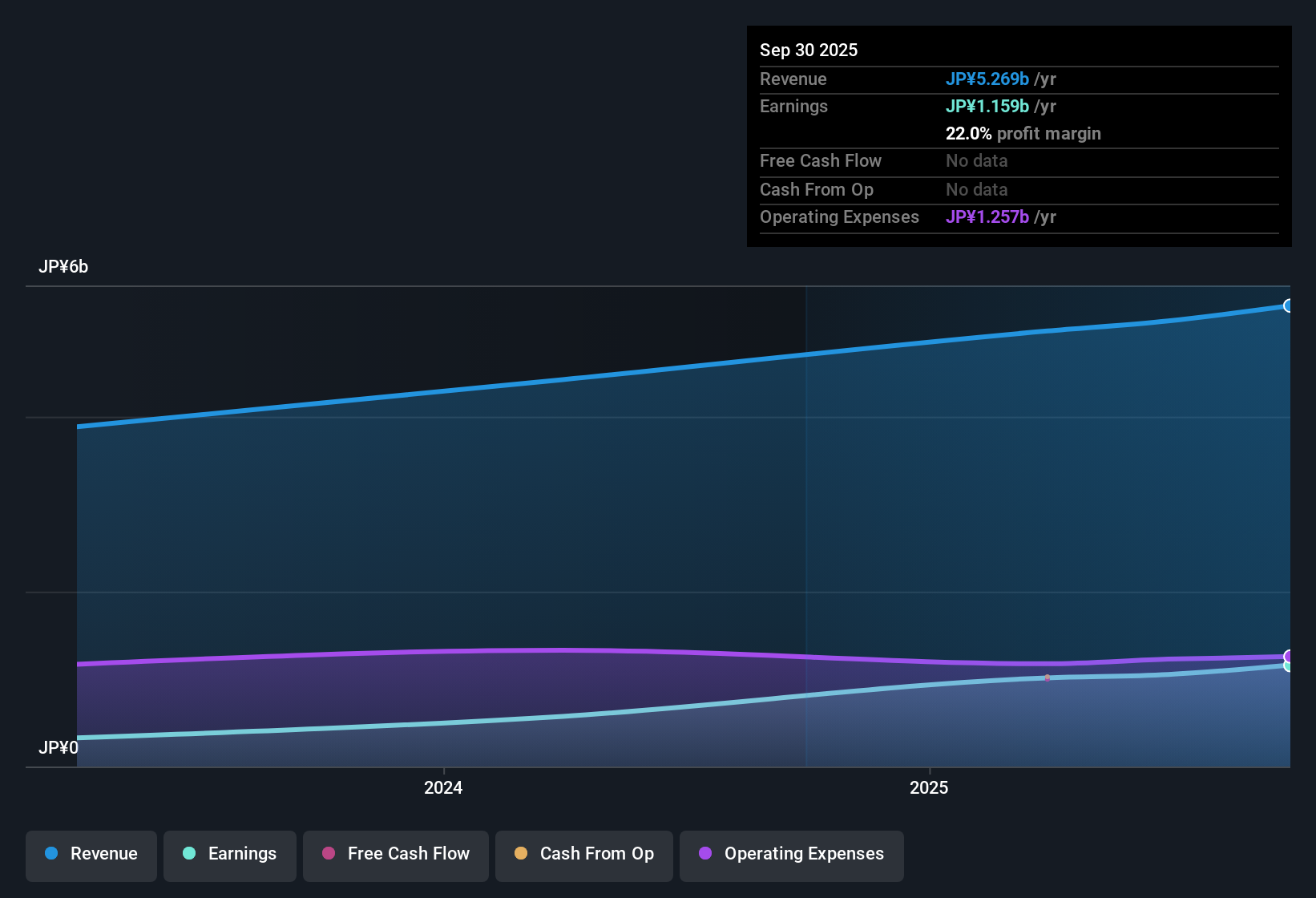

Reiwa Accounting Holdings (TSE:296A) reported a net profit margin of 20.7%, up from 15% last year, signaling a notable boost in profitability. Shares are currently trading at ¥660, putting the Price-To-Earnings ratio at 23.8x, well above the Professional Services industry average. With the stock priced below its estimated fair value and earnings quality strong, investors may see both a valuation gap and evidence of sustainable profit growth, even as questions around dividend sustainability linger in the background.

See our full analysis for Reiwa Accounting Holdings.Now, let’s see how these fresh earnings line up with the most widely held narratives for Reiwa Accounting Holdings. Here, the numbers confirm expectations in some areas, while in others they may surprise the market.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Jumps to 20.7% as Profit Quality Remains High

- The net profit margin increased to 20.7% from 15% last year, driven by operational improvements and solid cost control.

- This strongly supports the bullish case for business strength, with margin improvement signaling higher earnings power and potential for reinvestment.

- The jump in margin demonstrates the company's execution in boosting profitability faster than typical sector peers.

- With peer net profit margins running lower and industry margin averages sitting beneath Reiwa's result, investors get quantitative confirmation that the quality of current profits is not just sustainable but possibly above average.

Premium Valuation Versus Peers and Industry

- At a Price-To-Earnings ratio of 23.8x, shares trade materially above the Japanese Professional Services industry average (15.8x) and peer group average (18.8x).

- What is especially notable is that while the market assigns a premium based on performance and anticipated growth, the current share price of ¥660 still sits below a DCF fair value of ¥703.89.

- This suggests investors are paying up for perceived safety and growth, but there is still an implied valuation gap that could attract buyers looking for a mispriced opportunity, which is a classic trait in outperforming firms.

- The tension between a stretched P/E ratio and undervalued DCF signals both existing optimism and untapped upside if profit trends continue.

Dividend Sustainability Is the Main Watchpoint

- While profit and value metrics impress, the main highlighted risk is whether Reiwa can maintain dividends at current levels in light of recent growth.

- Bears raise caution that with a premium valuation, any stumble in dividend policy could dampen sentiment and cut into the share’s defensive appeal.

- The company’s high profit margin and value signals are only part of the story if investors begin to worry that shareholder returns are not as durable as the headline figures suggest.

- Dividend watchpoints can quickly become price drivers in the sector, especially when combined with a valuation premium relative to peers.

Reiwa’s numbers attract attention for value and profit growth, but dividend sustainability remains key to the investment story and future performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Reiwa Accounting Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust profits and valuation signals, ongoing uncertainty around Reiwa’s ability to maintain its dividend raises concerns about the sustainability of shareholder returns.

If stable and reliable income streams matter most to you, check out these 1987 dividend stocks with yields > 3% to discover companies consistently delivering strong dividend yields from a more secure base.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:296A

Flawless balance sheet with proven track record.

Market Insights

Community Narratives