As global markets experience a surge in optimism fueled by hopes for softer tariffs and advancements in artificial intelligence, major indices like the S&P 500 continue to climb toward record highs. In this environment of heightened market activity, dividend stocks can offer investors a blend of income and potential growth, making them an attractive consideration for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.41% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★☆ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

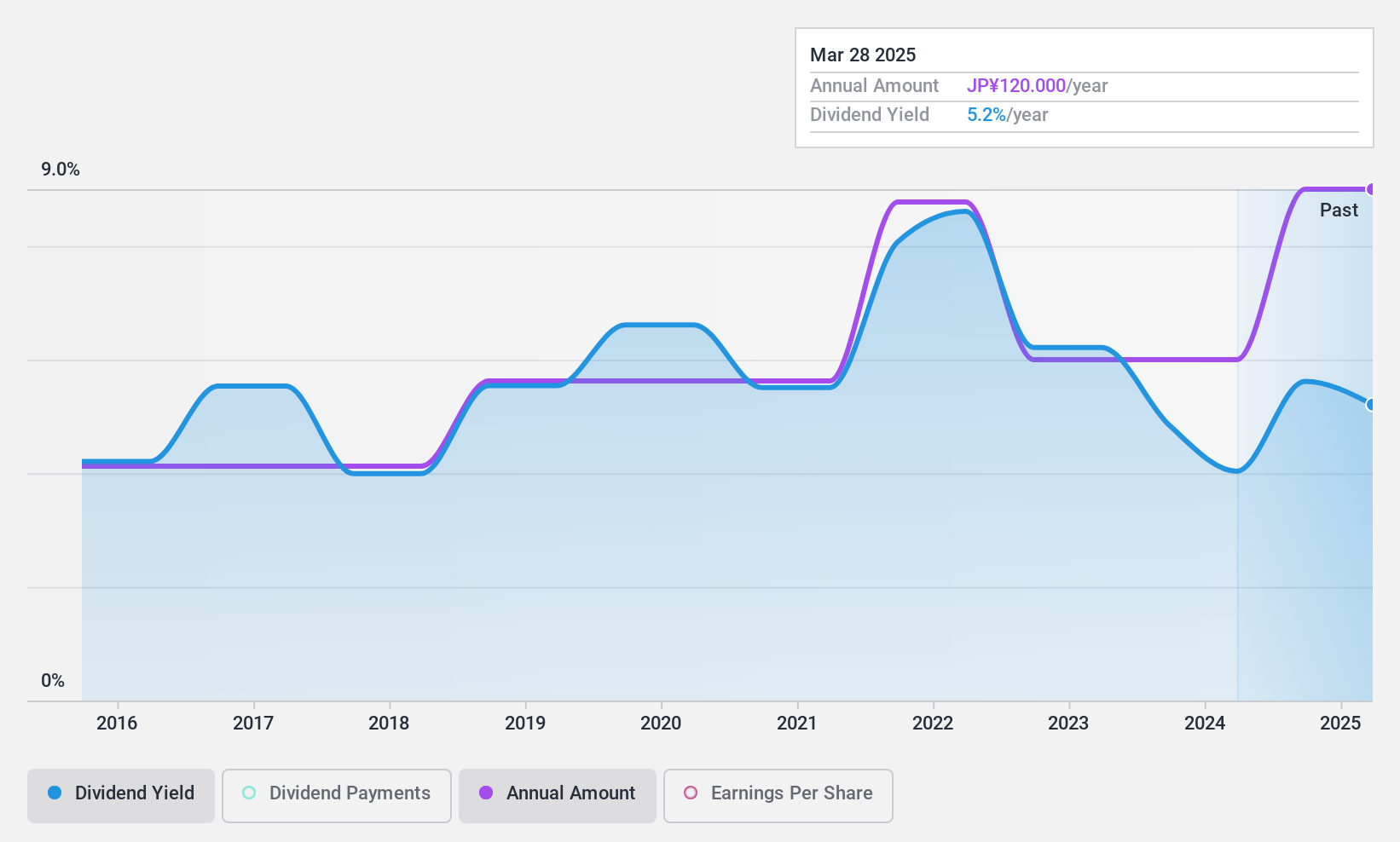

WDB Holdings (TSE:2475)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WDB Holdings Co., Ltd. operates in Japan, focusing on human resource services, contract research organization (CRO) activities, and platform businesses, with a market cap of ¥34.37 billion.

Operations: WDB Holdings Co., Ltd. generates revenue from its CRO Business with ¥7.80 billion and Human Resource Services Business with ¥42.52 billion in Japan.

Dividend Yield: 3.9%

WDB Holdings' dividend reliability is questionable due to a volatile track record, including a recent decrease from JPY 29.00 to JPY 24.00 per share. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 39.1% and 61.8%, respectively. Earnings have grown modestly at 2.6% annually over five years, supporting dividend sustainability, though past volatility remains a concern for investors seeking consistent income streams in the JP market's top tier yield segment.

- Click here and access our complete dividend analysis report to understand the dynamics of WDB Holdings.

- Our valuation report unveils the possibility WDB Holdings' shares may be trading at a discount.

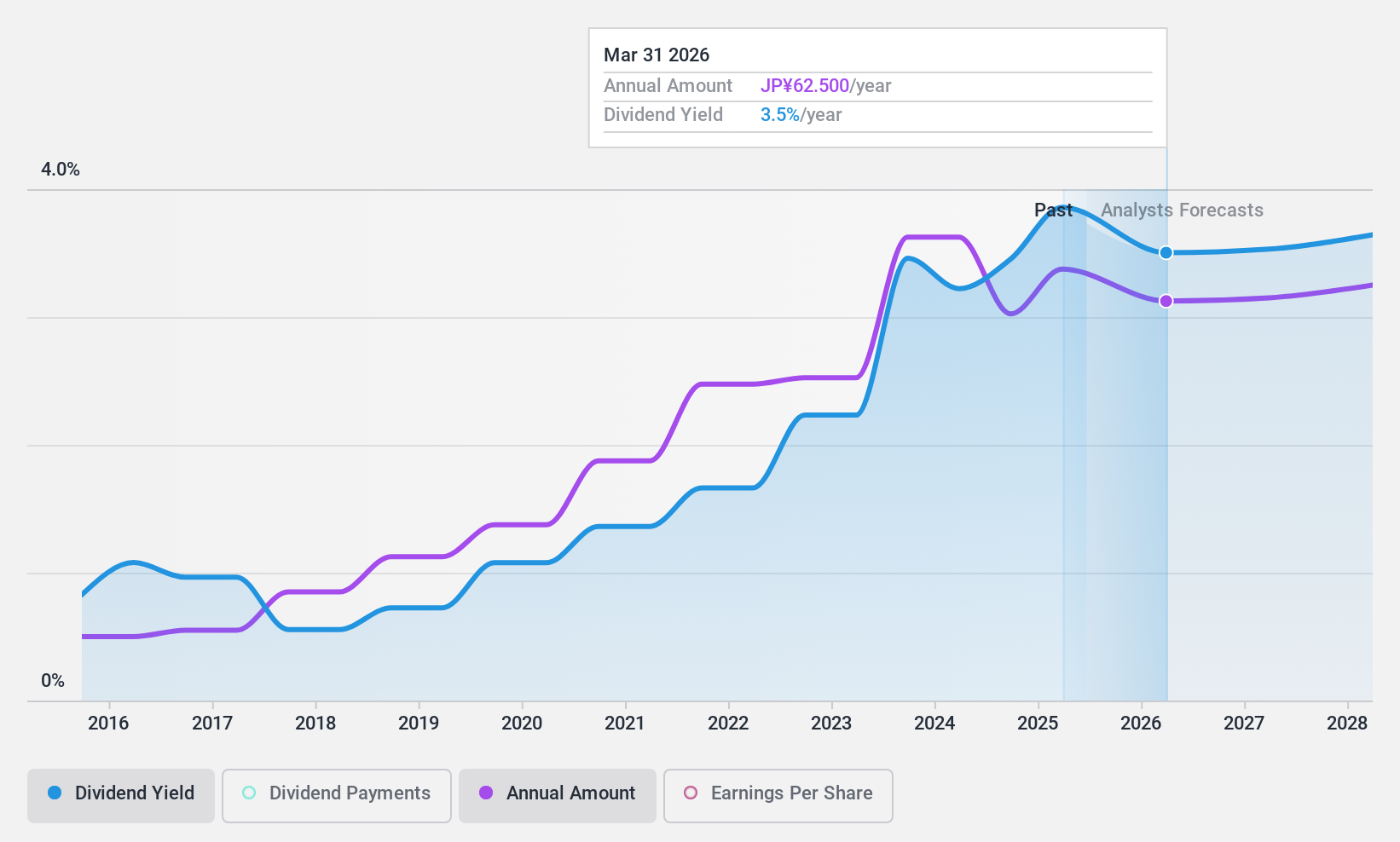

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc. and its subsidiaries offer financial services utilizing information technology in Japan, with a market capitalization of ¥58.75 billion.

Operations: IwaiCosmo Holdings, Inc. generates revenue primarily through Iwai Cosmo Securities Ltd., contributing ¥25.23 billion, and Iwai Cosmo Holdings Ltd., adding ¥2.88 billion.

Dividend Yield: 4.8%

IwaiCosmo Holdings offers a dividend yield of 4.8%, placing it among the top 25% in Japan, yet its reliability is questionable due to past volatility. Despite a low payout ratio of 45.2%, indicating coverage by earnings, cash flow coverage is inadequate with a high cash payout ratio of 113.2%. While earnings have surged by JPY 1 billion last year, forecasted growth remains modest at 1.58% annually, raising concerns about future dividend sustainability amidst its current valuation advantage.

- Take a closer look at IwaiCosmo Holdings' potential here in our dividend report.

- Our valuation report here indicates IwaiCosmo Holdings may be undervalued.

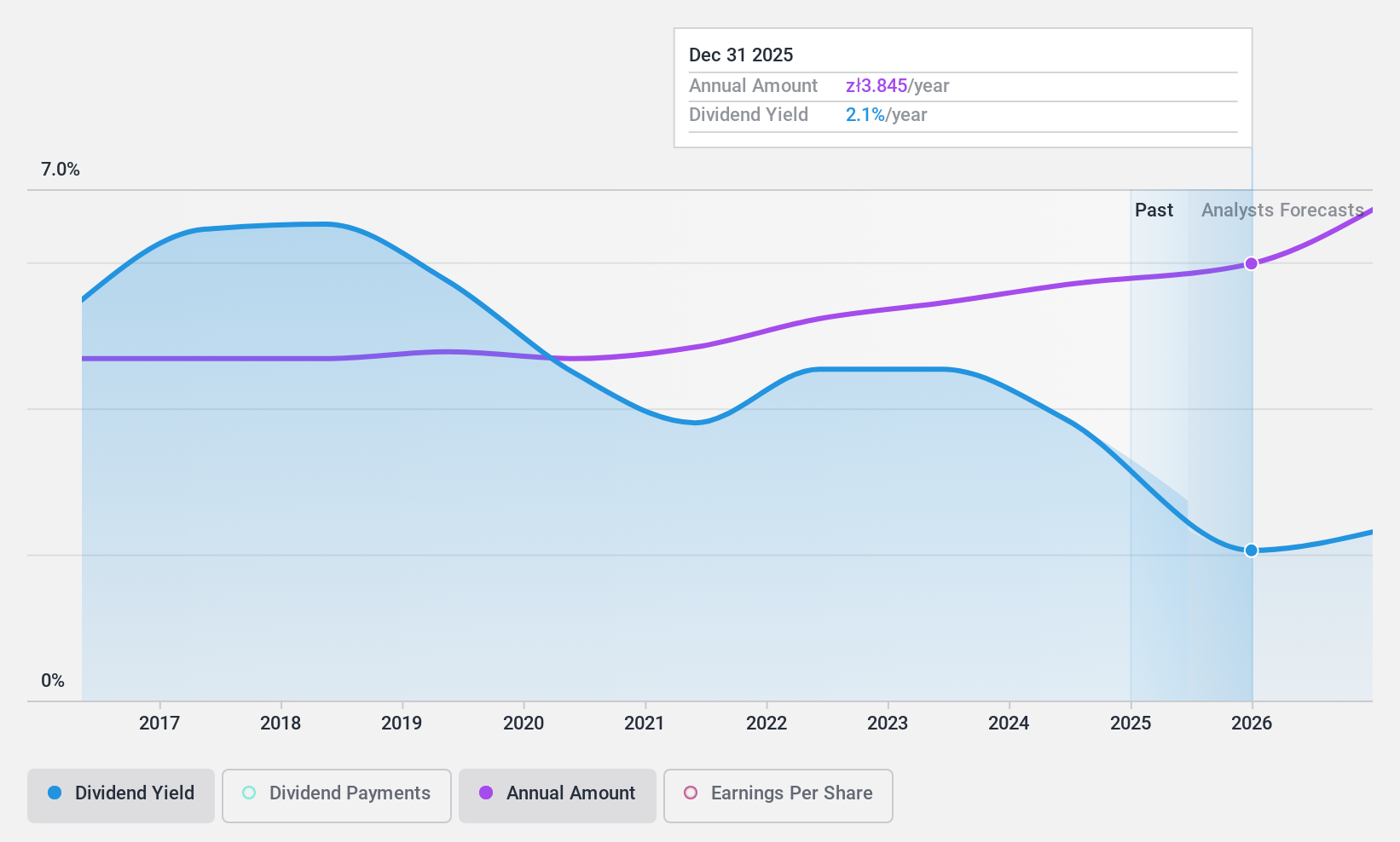

Asseco Poland (WSE:ACP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco Poland S.A. develops and sells software products across Poland, Europe, the United States, Israel, Africa, and internationally with a market cap of PLN7.25 billion.

Operations: Asseco Poland S.A. generates revenue from its segments with Asseco Poland contributing PLN2.04 billion, Formula Systems providing PLN10.75 billion, and Asseco International adding PLN4.12 billion.

Dividend Yield: 3.4%

Asseco Poland's dividend is reliable, having grown steadily over the past decade with a stable payout ratio of 49.1% and a low cash payout ratio of 12%, ensuring strong coverage by earnings and cash flows. Although its 3.44% yield is below the top quartile in Poland, it trades at good value relative to peers. Recent earnings growth, evidenced by increased net income and EPS for Q3 2024, supports its dividend sustainability.

- Dive into the specifics of Asseco Poland here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Asseco Poland shares in the market.

Next Steps

- Discover the full array of 1948 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ACP

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives