- Japan

- /

- Professional Services

- /

- TSE:2475

3 Prominent Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are closely monitoring the performance of major indices, which have shown moderate gains despite recent setbacks. In this environment, dividend stocks stand out as a potential source of steady income and stability, offering investors an opportunity to benefit from regular payouts amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Lion Rock Group (SEHK:1127)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Rock Group Limited is an investment holding company that offers printing services to international book publishers and media companies, with a market cap of HK$985.60 million.

Operations: Lion Rock Group Limited generates revenue primarily through its Printing segment, which accounts for HK$1.84 billion, and its Publishing segment, contributing HK$931.82 million.

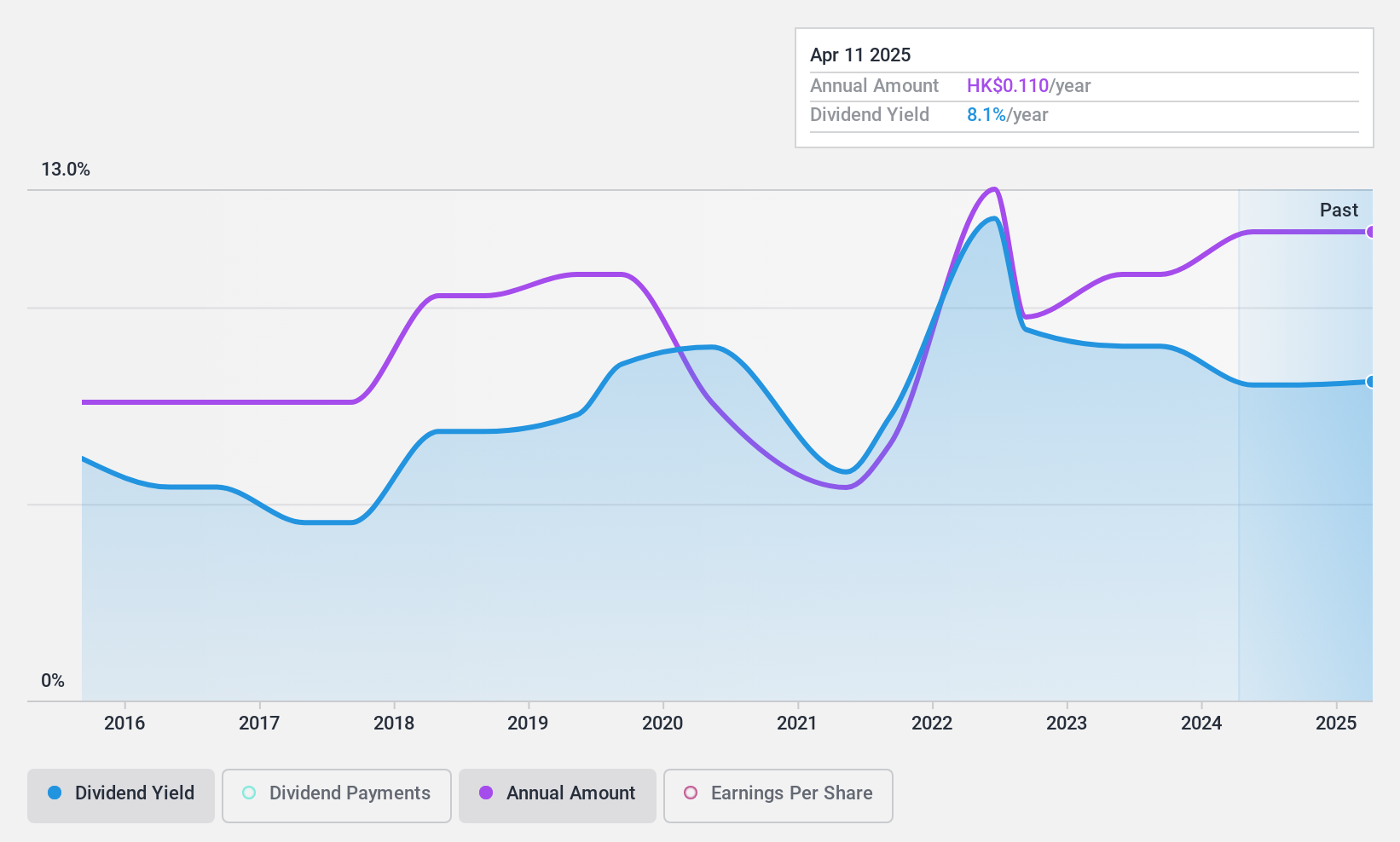

Dividend Yield: 8.6%

Lion Rock Group's dividend payments are supported by a low payout ratio of 42.5% from earnings and 38.7% from cash flows, indicating sustainability. However, the dividends have been volatile over the past decade, with an unreliable track record despite recent growth in earnings of 28.2%. The dividend yield stands at 8.59%, placing it in the top quartile of Hong Kong's market payers but stability remains a concern for investors seeking consistent income streams.

- Navigate through the intricacies of Lion Rock Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Lion Rock Group's share price might be on the cheaper side.

WDB Holdings (TSE:2475)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WDB Holdings Co., Ltd. operates in Japan, focusing on human resources, CRO, and platform businesses, with a market cap of approximately ¥32.64 billion.

Operations: WDB Holdings Co., Ltd. generates revenue from its CRO Business at ¥7.80 billion and Human Resource Services Business at ¥42.52 billion.

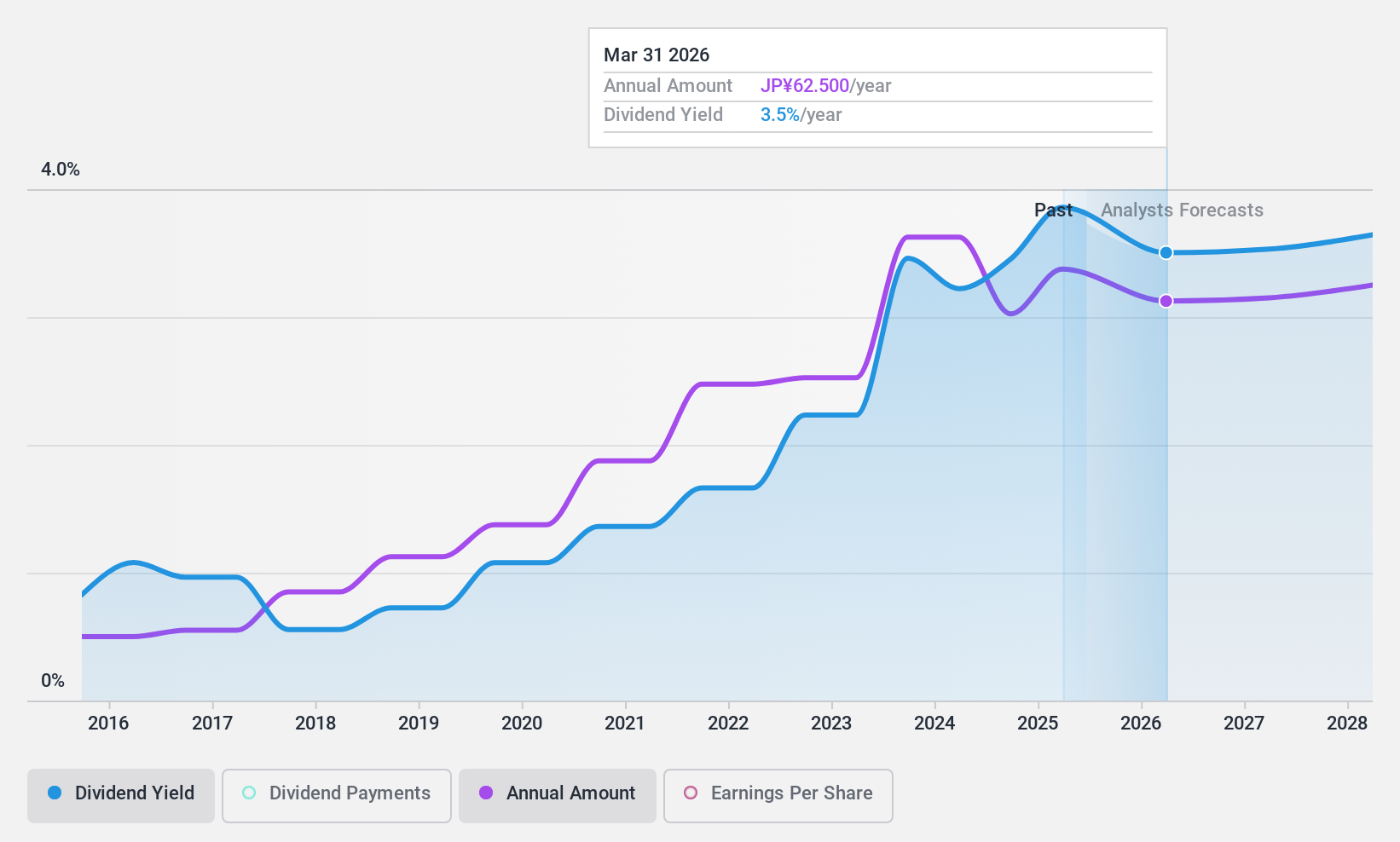

Dividend Yield: 4.1%

WDB Holdings has a history of volatile dividend payments, recently reducing its dividend to JPY 24.00 per share from JPY 29.00. Despite this, the company maintains a low payout ratio of 39.1% and covers dividends with cash flows at 61.8%. Trading below fair value and offering a yield in the top quartile of Japan's market, it presents good relative value but lacks stability for consistent income-seeking investors.

- Click here to discover the nuances of WDB Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, WDB Holdings' share price might be too pessimistic.

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan with a market cap of ¥36.74 billion.

Operations: FTGroup Co., Ltd.'s revenue is derived from its Network Infrastructure Business, generating ¥20.29 billion, and its Corporate Solutions Business, contributing ¥16.24 billion.

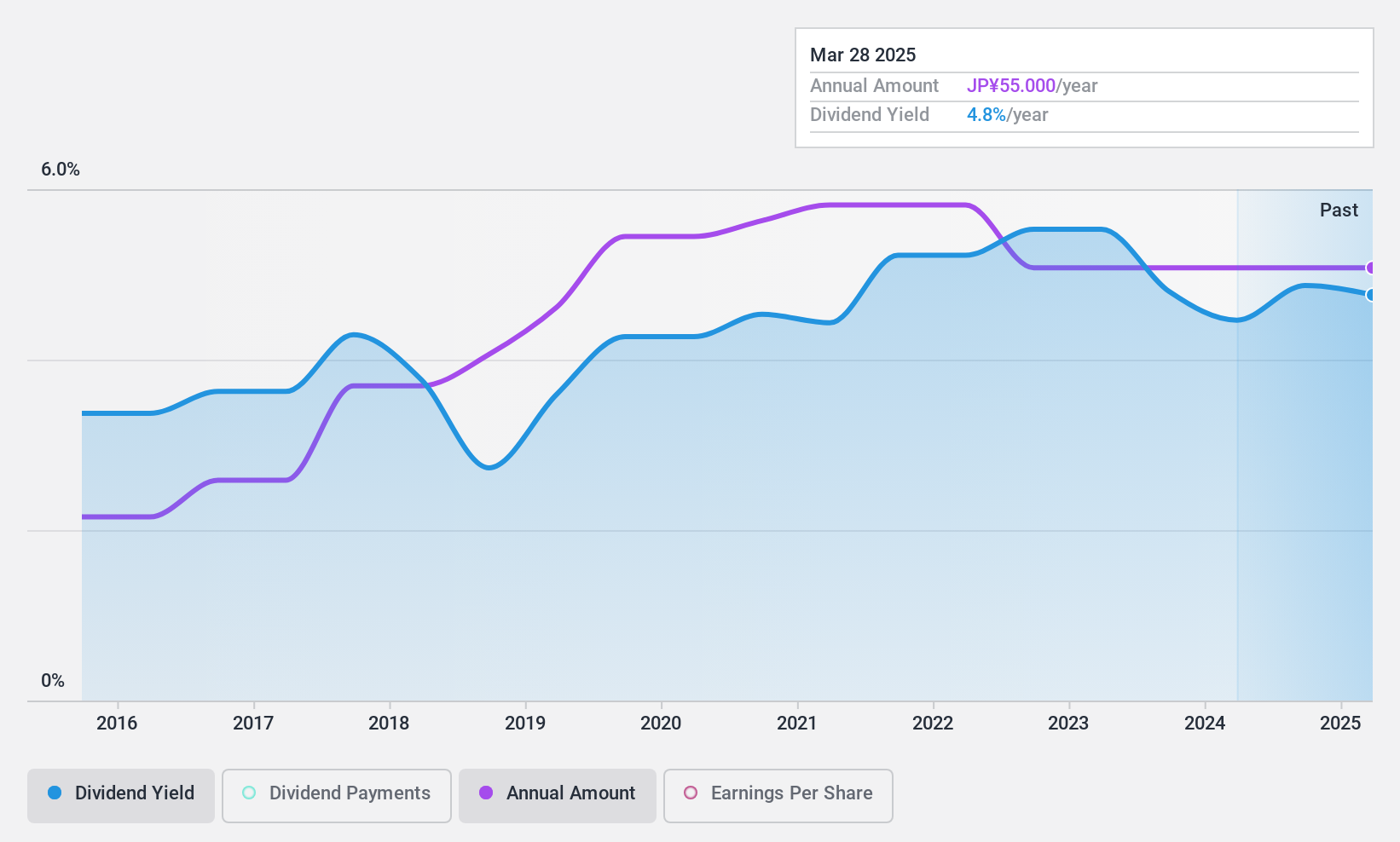

Dividend Yield: 4.5%

FTGroup offers a high and reliable dividend yield of 4.5%, ranking in the top 25% of Japanese dividend payers. Its dividends are well-covered by both earnings and cash flows, with payout ratios around 25%. Over the past decade, FTGroup's dividends have been stable and growing. Additionally, the company recently completed a share buyback worth ¥52.24 million, potentially enhancing shareholder value while trading slightly below its estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of FTGroup.

- In light of our recent valuation report, it seems possible that FTGroup is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1940 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WDB Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2475

WDB Holdings

Operates human resource, CRO, and platform and other business in Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives