Asian Market's Prime Picks Estimated Below Fair Value In May 2025

Reviewed by Simply Wall St

As global markets face volatility with U.S. stocks declining amid tariff threats and economic uncertainties, the Asian market offers a landscape of opportunities for discerning investors. In this environment, identifying stocks estimated to be below their fair value can provide potential avenues for growth, making them attractive considerations in an otherwise turbulent market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.23 | CN¥28.32 | 49.8% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥77.56 | CN¥153.79 | 49.6% |

| Fuji (TSE:6134) | ¥2247.00 | ¥4481.26 | 49.9% |

| H.U. Group Holdings (TSE:4544) | ¥3062.00 | ¥6058.85 | 49.5% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.28 | CN¥34.50 | 49.9% |

| Devsisters (KOSDAQ:A194480) | ₩38500.00 | ₩76148.72 | 49.4% |

| TLB (KOSDAQ:A356860) | ₩17600.00 | ₩34842.86 | 49.5% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.58 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1162.00 | ¥2310.67 | 49.7% |

| J&T Global Express (SEHK:1519) | HK$6.65 | HK$13.21 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

J&T Global Express (SEHK:1519)

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries, including China and various regions in Asia, the Middle East, and the Americas, with a market cap of HK$59.21 billion.

Operations: The company generates revenue from its transportation services, specifically air freight, totaling $10.26 billion.

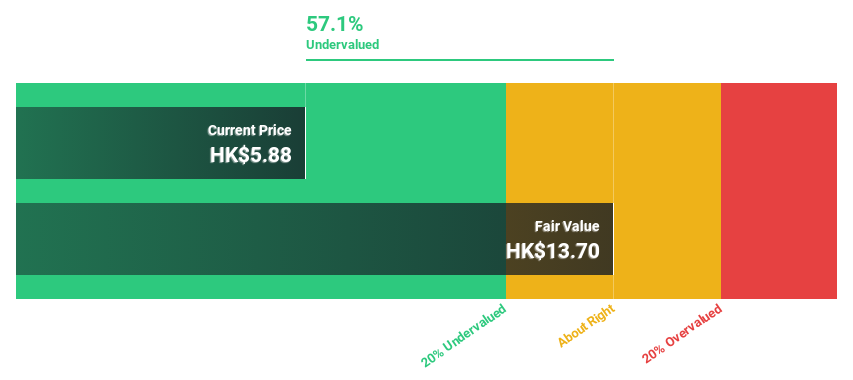

Estimated Discount To Fair Value: 49.7%

J&T Global Express is trading at HK$6.65, significantly below its fair value estimate of HK$13.21, presenting a strong undervaluation based on discounted cash flows. The company has transitioned to profitability with net income reaching US$113.7 million in 2024 from a prior loss, and earnings are projected to grow at 32.4% annually over the next three years, outpacing the Hong Kong market's growth rate of 10.5%.

- Insights from our recent growth report point to a promising forecast for J&T Global Express' business outlook.

- Get an in-depth perspective on J&T Global Express' balance sheet by reading our health report here.

DIP (TSE:2379)

Overview: DIP Corporation, with a market cap of ¥120.38 billion, is a labor force solution company offering personnel recruiting services in Japan.

Operations: The company's revenue is derived from two main segments: the DX Business, contributing ¥6.72 billion, and the Personnel Recruiting Services Business, which generates ¥49.66 billion.

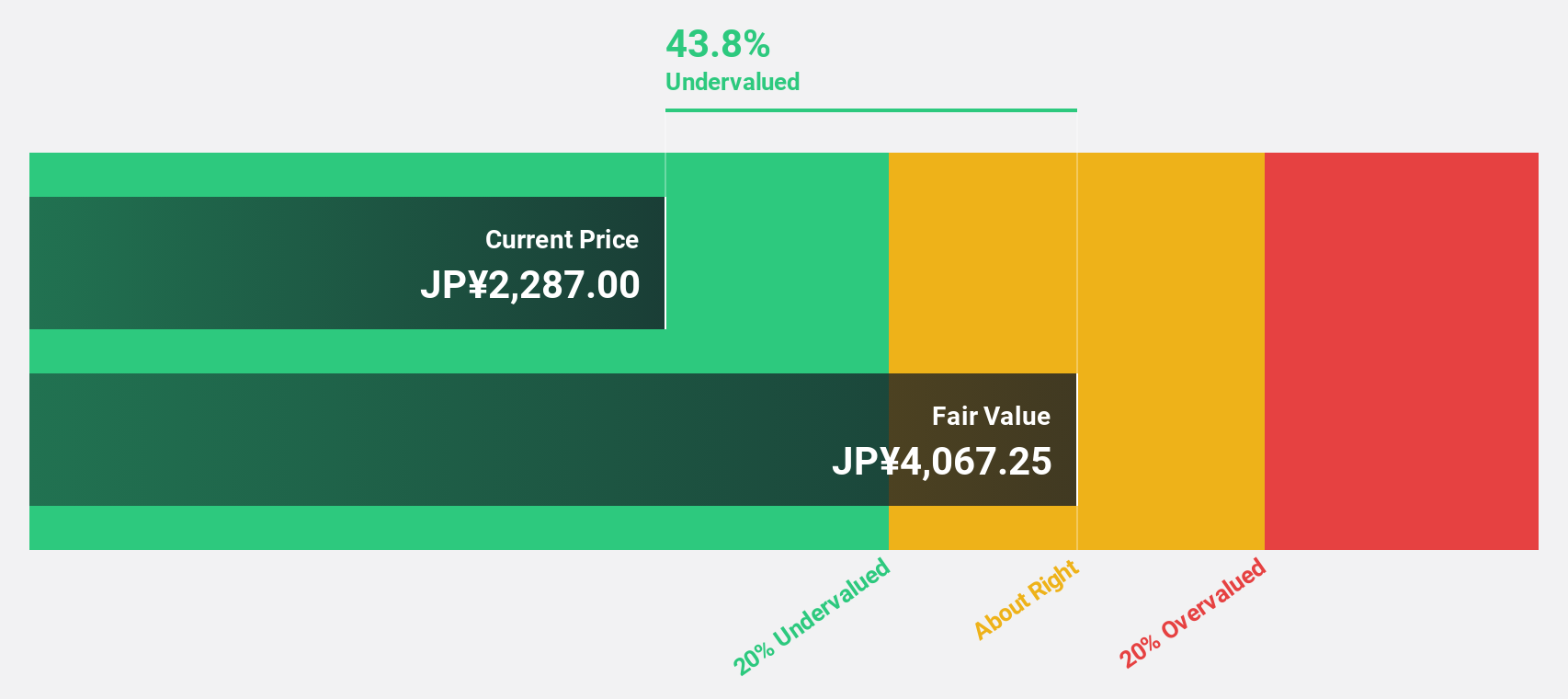

Estimated Discount To Fair Value: 42.1%

DIP Corporation is trading at ¥2,301, significantly below its fair value estimate of ¥3,971.88, indicating strong undervaluation based on discounted cash flows. Revenue is projected to grow 5.2% annually, surpassing the Japanese market's 3.7%, while earnings are expected to increase by 10.3% per year, exceeding the market's 7.6%. Despite an unstable dividend history and modest growth forecasts compared to peers, DIP offers a compelling opportunity for value-focused investors in Asia.

- In light of our recent growth report, it seems possible that DIP's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of DIP stock in this financial health report.

giftee (TSE:4449)

Overview: giftee Inc. operates in the Internet service sector in Japan with a market capitalization of ¥54.74 billion.

Operations: The company's revenue primarily comes from its E-Gift Platform Business, which generated ¥10.98 billion.

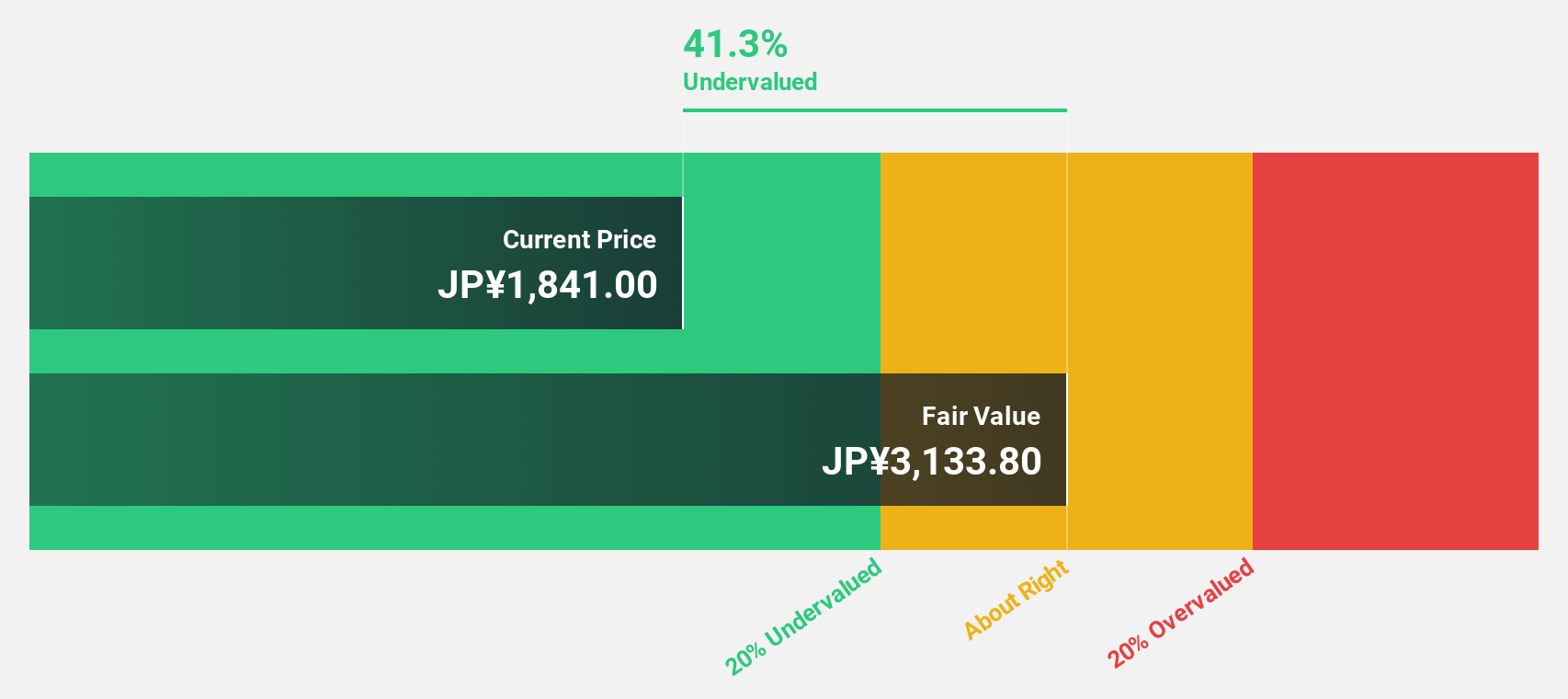

Estimated Discount To Fair Value: 41.9%

giftee Inc. is trading at ¥1,847, significantly below its estimated fair value of ¥3,180.9, suggesting considerable undervaluation based on discounted cash flows. The company forecasts a 65.46% annual earnings growth and expects to become profitable within three years, outpacing average market growth rates. Despite recent share price volatility and slower revenue growth projections than some peers, analysts anticipate a 37.2% stock price increase due to strong underlying fundamentals and improved financial guidance for 2025.

- Our growth report here indicates giftee may be poised for an improving outlook.

- Click here to discover the nuances of giftee with our detailed financial health report.

Where To Now?

- Dive into all 307 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1519

J&T Global Express

An investment holding company, offers integrated express delivery services in the People’s Republic of China, Indonesia, the Philippines, Malaysia, Thailand, Vietnam, Saudi Arabia, the United Arab Emirates, Mexico, Brazil, and Egypt.

Reasonable growth potential with adequate balance sheet.