As global markets navigate a landscape of economic uncertainties and mixed data, Asian markets continue to capture investor interest with their unique blend of growth potential and stability. In this context, dividend stocks in Asia offer an attractive proposition for investors seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.83% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.75% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.73% | ★★★★★★ |

Click here to see the full list of 1131 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

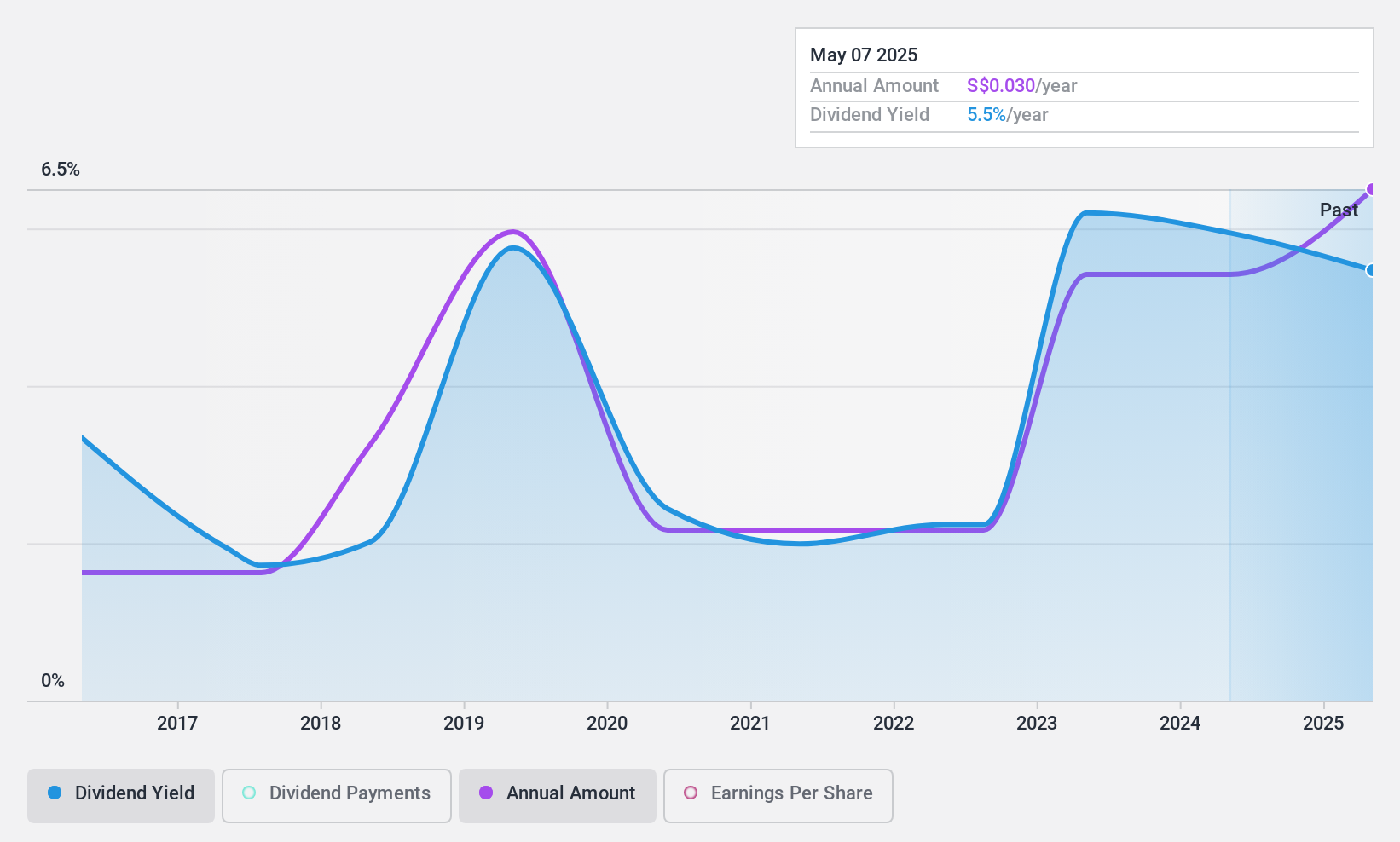

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across China, the rest of Asia, the United States, Europe, and internationally, with a market cap of SGD500.53 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily from its Rubber Chemicals segment, which accounts for CN¥4.38 billion, along with contributions from Heating Power at CN¥196.10 million and Waste Treatment at CN¥23.40 million.

Dividend Yield: 5.7%

China Sunsine Chemical Holdings has a low payout ratio of 24.1%, indicating that its dividends are well covered by earnings, and a cash payout ratio of 33.5% suggests strong coverage by cash flows. Despite this, the company's dividend payments have been volatile over the past decade, reflecting an unstable track record. Recent earnings show growth with net income rising to CNY 423.9 million in 2024 from CNY 372.4 million in the previous year, supporting dividend sustainability despite historical volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of China Sunsine Chemical Holdings.

- Our expertly prepared valuation report China Sunsine Chemical Holdings implies its share price may be lower than expected.

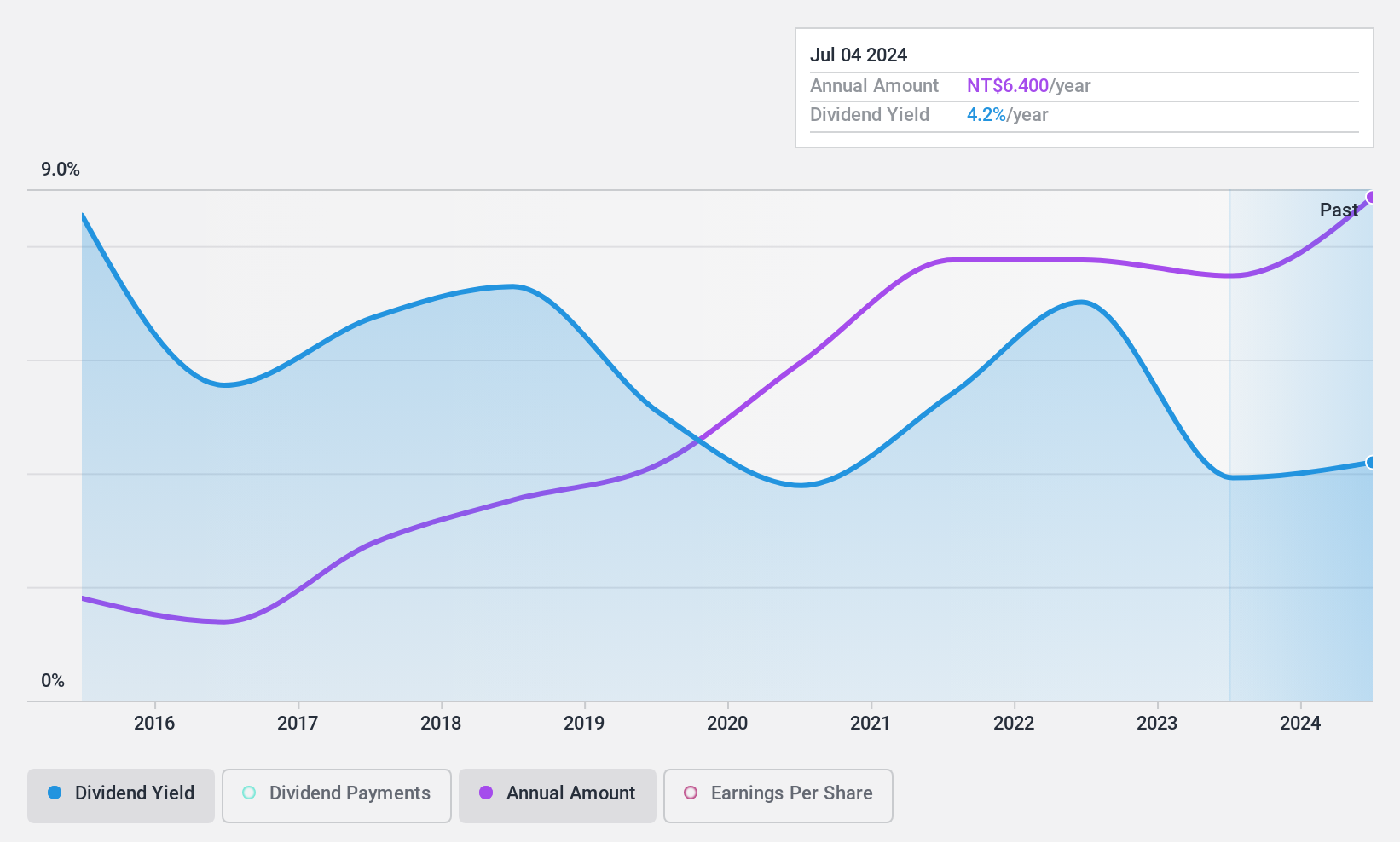

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. manufactures and sells electronic components and connectors across Asia, the United States, and internationally, with a market cap of NT$14.91 billion.

Operations: Argosy Research Inc.'s revenue primarily comes from the manufacturing and sales of electronic component products, amounting to NT$3.32 billion.

Dividend Yield: 3.9%

Argosy Research's dividend sustainability is backed by a payout ratio of 62.3% and a cash payout ratio of 77.1%, indicating coverage by earnings and cash flows. However, its dividend history is unstable, with past volatility despite recent increases over the last decade. The proposed TWD 8.80 per share dividend for 2024 highlights commitment to shareholder returns, though its yield remains lower than top-tier payers in Taiwan's market at 3.87%.

- Dive into the specifics of Argosy Research here with our thorough dividend report.

- Our valuation report unveils the possibility Argosy Research's shares may be trading at a discount.

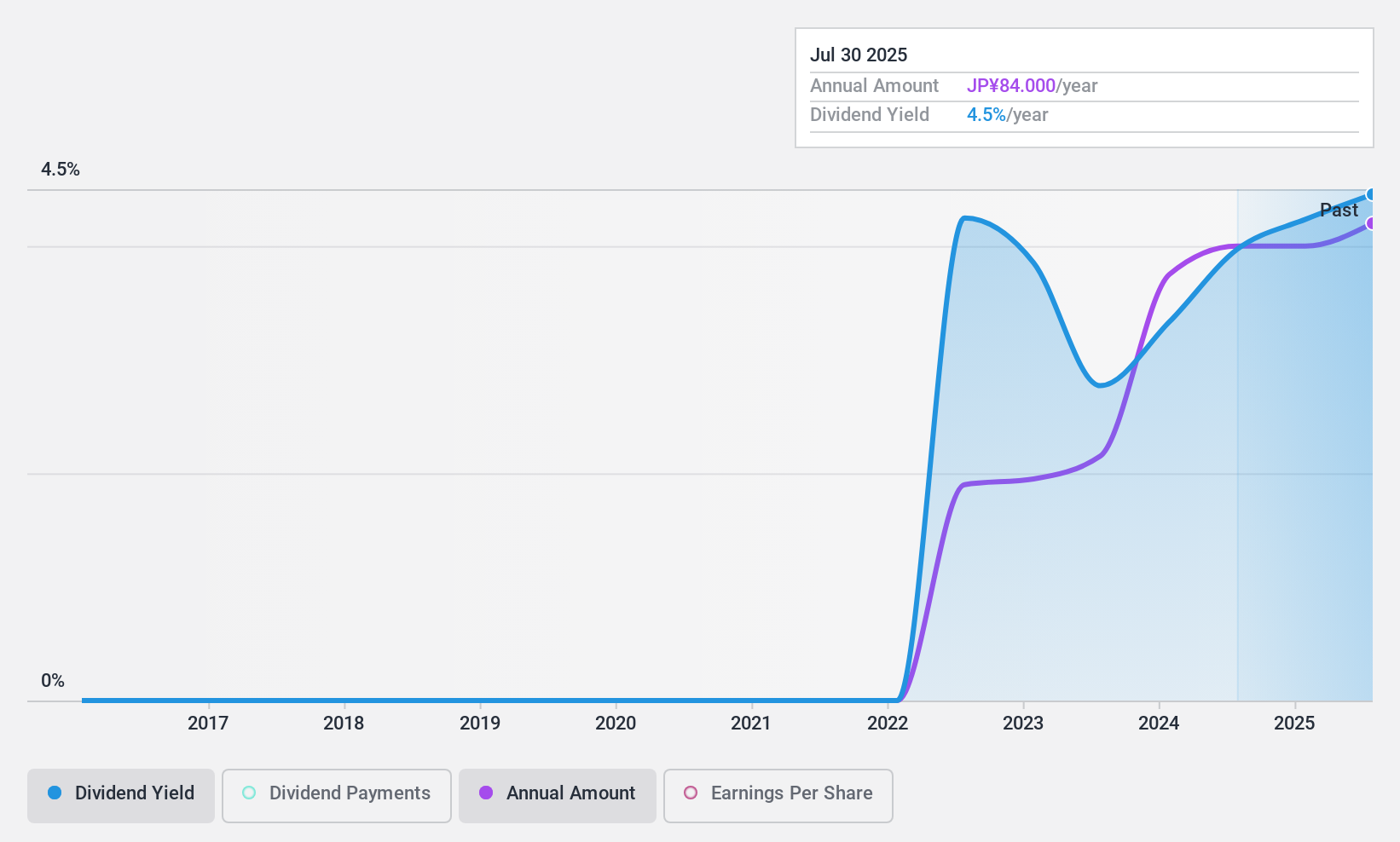

ArtnerLtd (TSE:2163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Artner Co., Ltd. specializes in worker dispatching and employment placement services both in Japan and internationally, with a market cap of ¥20.20 billion.

Operations: Artner Co., Ltd. generates revenue primarily from providing worker dispatching and employment placement services across domestic and international markets.

Dividend Yield: 4.4%

Artner Ltd.'s dividend sustainability is supported by a payout ratio of 69.1% and cash payout ratio of 79.2%, ensuring coverage by earnings and cash flows. The company increased its dividend to JPY 42 per share for the fiscal year ended January 2025, with plans to maintain this amount in the upcoming fiscal year, reflecting stability despite only three years of payments. Trading at a discount to fair value enhances its appeal among top-tier Japanese dividend payers.

- Unlock comprehensive insights into our analysis of ArtnerLtd stock in this dividend report.

- The analysis detailed in our ArtnerLtd valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Navigate through the entire inventory of 1131 Top Asian Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives